Update: Coinbase is yet experiencing problems again, just a few days later and as the price of Bitcoin this time is nearing $68,000. Read below on how the same thing happened only last week when Coinbase balances appeared as zero for most users. Not your keys, not your coins.

Coinbase is huffing and puffing again. 👇 pic.twitter.com/yQP3FeG2cv

— TheBitcoinVandal (@Bulldozer0) March 4, 2024

Coinbase, a leading cryptocurrency exchange, recently found itself at the center of a storm after a significant technical glitch led to many users seeing their account balances drop to $0. This unsettling incident, occurring amid a sharp increase in Bitcoin’s value, has raised questions about the platform’s ability to handle sudden market movements and maintain the trust of its vast user base.

As Bitcoin soared to heights not seen in recent months, surpassing the $64K mark, an unprecedented surge in trading activity followed. This surge seemingly overwhelmed Coinbase’s systems, leading to a display issue that presented users with a $0 balance, prompting widespread concern and confusion among the platform’s users. Reports from mainstream and crypto media detailed the events, with users taking to social media to voice their frustrations and seek reassurances about the safety of their investments.

Coinbase was quick to acknowledge the glitch, with media reporting that the company was investigating the issue affecting account balance displays. Through social media and official statements, Coinbase aimed to reassure its users that their funds were secure and that the glitch was purely a display issue, with no real impact on actual account balances.

Other sources highlighted the shock and panic that ensued, with customers expressing dismay upon finding their accounts seemingly wiped out. This reaction underscores the high stakes involved in cryptocurrency trading and the paramount importance of trust and reliability in the platforms facilitating these transactions.

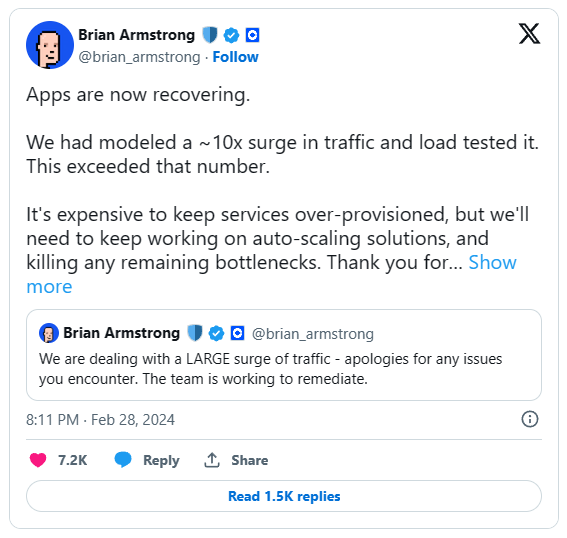

Bitcoin Magazine shed light on the potential cause of the glitch, attributing it to the large influx of traffic that followed Bitcoin’s price pump. Coinbase’s CEO later confirmed that the volume of activity had indeed put a strain on the platform’s systems, leading to the unfortunate glitch. His announcement was met with a lot of criticism, however. Firstly because this is not the first time such thing happens and secondly because Coinbase already knew that a bull run was coming.

Brian Armstrong deflected the blame on the high costs of over-provisioning (whatever that means) with many users prompting him to “pay the money”, alluding to costs connected with maintaining servers that are strong enough to anticipate an increase in demand. Like many other companies in the space, Coinbase was in the news for large firing rounds. And without the confidence within the company that the tide would turn, they ended up red-faced once again.

Binance was accused of breaking laws. At least they knew how to run a proper service and did not look for excuses when they messed up. Brian Armstrong is increasingly becoming a questionable figure, with the backstabbing moves in Congress and false promises to users and crypto believers without himself being heavily invested in cryptocurrency. It is a fiat world for Brian these days. He has shareholders to answer to. And despite Binance, FTX and every other major crypto player being hit, Coinbase is still struggling to cement its dominance, working against Bitcoin, and causing it to crash, because they could not keep their servers going. A little tragic.

Of course, this is not going to stop Bitcoin, but it will further hurt Coinbase’s position as a “leading” cryptocurrency exchange.

This incident serves as a poignant reminder of the challenges cryptocurrency exchanges face in managing the highly volatile and unpredictable nature of digital currency markets. The rapid increase in trading activity can strain systems, highlighting the need for robust infrastructure capable of handling sudden surges in demand.

Moreover, the event underscores the critical importance of communication and transparency in maintaining user trust. Coinbase’s prompt acknowledgement of the issue and reassurances about fund security were crucial steps in managing the situation. However, the incident is likely to prompt further scrutiny of Coinbase and other exchanges, with users demanding assurances that such glitches will not recur.

The cryptocurrency market is known for its rapid price movements, making it essential for trading platforms to offer reliable and uninterrupted services. As the market continues to grow, with more mainstream investors getting involved, the expectations for platform performance and reliability will only increase. This incident may catalyze Coinbase and other exchanges to bolster their systems, ensuring they can withstand the pressures of increased trading activity without compromising user experience.

In the wake of this glitch, the broader cryptocurrency community will be watching closely to see how Coinbase and other exchanges respond to the challenges presented by the incident. Enhancements to infrastructure, improvements in customer communication, and measures to enhance transparency and trust will be key areas of focus.

As the dust settles, the incident at Coinbase offers valuable lessons about the importance of scalability, reliability, and trust in the rapidly evolving world of cryptocurrency trading. How Coinbase and its peers address these challenges will be critical in shaping the future of digital currency exchanges and maintaining the confidence of the global trading community.

Author Profile

- Ex-community moderator of the Banano memecoin. I have since been involved with numerous cryptocurrencies, NFT projects and DeFi organizations. I write about crypto mainly.

Latest entries

- June 6, 2025NewsWireElon Musk to Decommission SpaceX Dragon after Trump Threat

- December 9, 2024Stock MarketMaster the Time Value of Money Financial Concept

- November 18, 2024Stock MarketFinancial Ratios Guide to Measuring Business Performance

- November 11, 2024NewsWireLabour’s UK Budget: A Fiscal Smirk of Contempt for Working People