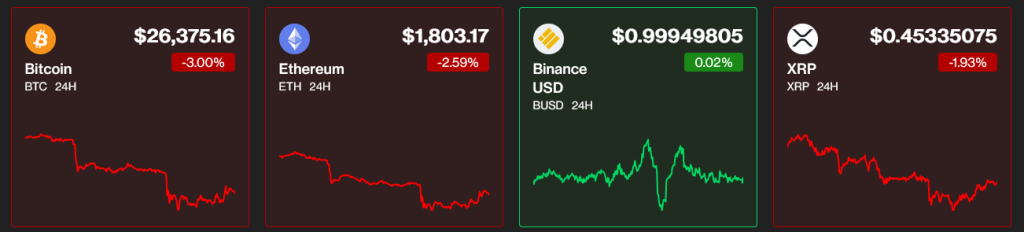

- Bitcoin ($BTC) has stalled its rapid ascent from the beginning of the year hovering between $26,000-$31,000. It closed 3% down yesterday at ~$26.4k and 3.4% down compared to seven days earlier. The world’s most popular cryptocurrency has failed to maintain its price above the $30k barrier on a couple of occasions this year. Historically stalling leads to the price falling (a buy opportunity) or rising significantly beyond the $35k mark.

- Ethereum ($ETH) is resisting fluctuation better than Bitcoin at the moment, with the second most popular cryptocurrency up 01% last night and only 1.2% compared to last week. This newfound resilience by Ethereum might signal a stronger performance in the coming months. The fact that the fork did not bring disaster has added confidence among investors and longtime fans of the ecosystem to keep defending the price and going long with ETH.

- With the Binance stablecoin (BUSD) as the third most-traded cryptocurrency the market signals its vote of confidence toward the cryptocurrency giant once more. Despite all the legal woes that Binance is about to face, the global crypto community is still trusting CZ to turn things around for the company. The price of BNB has also been resilient keeping 3rd place in market capitalization after BTC and ETH.

- The crypto lending space scandals, the banking crisis, interest rates rising and the cost of living have all challenged cryptocurrency prices in the last 2 years. Bitcoin and the other cryptocurrencies have failed to recover the highs of November 2021 but in a highly cyclical and especially volatile crypto market, nothing is impossible. Let’s not forget that the next Bitcoin halving is coming in April 2024 and that has historically affected the price in a significant way.

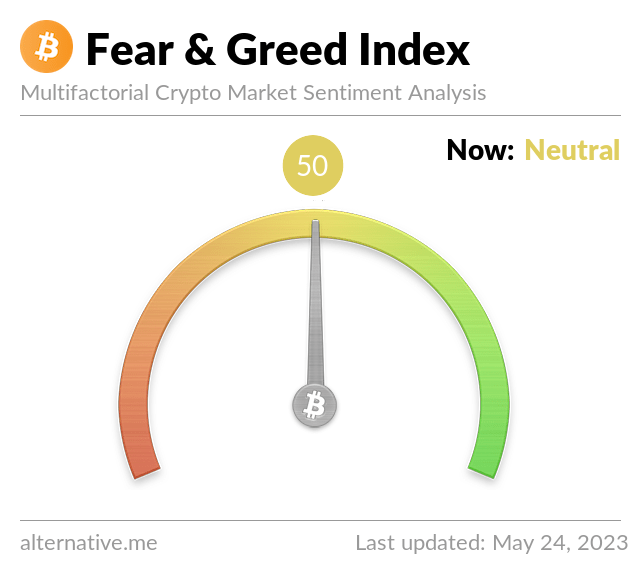

- The Fear and Greed index is stuck at 50 with the sentiment hang between fear and greed perfectly in the middle. This confirms the prediction that a price movement is about to happen, and whilst analysts are split, many are expecting a major upward action.

Author Profile

- Lucy Walker covers finance, health and beauty since 2014. She has been writing for various online publications.

Latest entries

- June 30, 2025NewsWireBank Savings at Risk: The Dark Side of EU’s Savings Standard

- April 25, 2025Global EconomicsWhistleblowers Unmask Schwab’s Toxic WEF Secrets

- April 9, 2025Global EconomicsTariff Tensions Drive Market Volatility

- March 18, 2025Global EconomicsRed in Name Only: Labour’s War on the UK Working Class