In the intricate world of financial investments, few figures loomed as large as Sam Bankman-Fried. Renowned for his “astute “perceived” acumen, Bankman-Fried’s ventures resonated deeply within the investment community, that was not aware of what was going on behind the scenes.

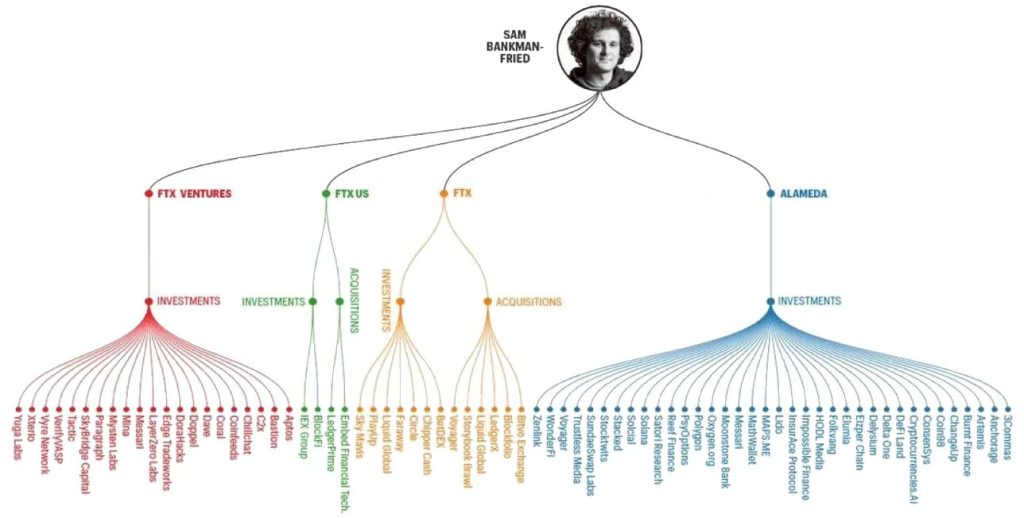

The recent graphic revelations about the companies he chose to invest in using FTX customer funds delineate an impressively expansive financial tapestry. And a great appetite to spend money he did not have. Let us dive deep into this fascinating web of investments to understand more.

The Core Entities

The graphic is distinctly divided into central entities that have been the prime movers for the numerous investments. From what we know now, all these entities moved money from deposits that customers made on the FTX platform.

- FTX Ventures: Previously an arm of the FTX empire, this division seemed particularly focused on cultivating emerging businesses, offering a plethora of opportunities for those seeking investment.

- FTX US: Catering specifically to the United States market, this segment seemed to blend both the worlds of direct investments and acquisitions.

- FTX: As the principal entity, it served as a conduit for both investments and acquisitions, with a leaning more towards acquisitions. And this is where the majority of the fraud happened.

- Alameda: Representing the largest segment of investments in the graphic, Alameda’s vast influence within the Bankman-Fried investment sphere was undeniable. It was eventually revealed that Alameda assisted heavily in the fraud by borrowing heavily with great exposure to risk.

Diversification – A Key Strategy

Bankman-Fried’s fraudulent investment strategy, as depicted, showcases a form of diversification, whilst others could see it as indiscriminate spending. This is evident from the varied companies under each entity:

- FTX Ventures had a notable investment in entities like ‘Yuga Labs‘, ‘DeFi Technologies, and ‘Emerald Capital’, to name just a few.

- FTX US, apart from investments in ‘Eventus’, ‘Blok Sports’, and ‘Copper’, also leaned towards acquisitions like ‘LedgerX’ and ‘TrueDigital’.

- FTX’s range included acquisitions such as ‘LayerZero’, ‘Blockfolio’, and ‘Liquidity Cannon’, juxtaposed with investments like ‘Splyt’ and ‘StakeFish’.

- Alameda’s wide spectrum included ‘Nexus Mutual’, ‘KyberSwap’, and ‘3Commas’, underscoring its pivotal role in this investment web.

Implications for Investors

For seasoned and prospective investors alike, this graphic representation offers crucial insights into how large sums of money which Sam Bankman-Fried did not have, were funneled into a variety of organizations earning him favor and recognition.

The recent allegations against Sam Bankman-Fried have cast a long shadow over what was once seen as a tale of innovative growth strategy in the rapidly evolving cryptocurrency domain. Initially, Bankman-Fried’s ventures, notably FTX and Alameda Research, showcased a forward-thinking approach, capturing emergent market trends and positioning themselves at the forefront of the crypto trading industry.

However, the high-risk nature of the cryptocurrency market, compounded by the allegations of fraud and other criminal charges, reflects a stark miscalculation in risk diversification, which is an essential aspect of sustainable growth in volatile markets.

This scenario not only led to a personal financial debacle for Bankman-Fried but also a significant loss of market presence and credibility for his ventures in a fiercely competitive and regulation-encumbered market environment.

The confluence of aggressive growth aspirations, inadequate risk management measures, and the subsequent legal entanglements serve as a stringent reminder of the precarious balance between innovation, risk management, and adherence to legal and ethical standards in the pursuit of market dominance and financial prosperity.

Author Profile

- Lucy Walker covers finance, health and beauty since 2014. She has been writing for various online publications.

Latest entries

- April 25, 2025Global EconomicsWhistleblowers Unmask Schwab’s Toxic WEF Secrets

- April 9, 2025Global EconomicsTariff Tensions Drive Market Volatility

- March 18, 2025Global EconomicsRed in Name Only: Labour’s War on the UK Working Class

- March 7, 2025SatoshiCraig Wright Banned from UK Courts with Civil Restraint Order