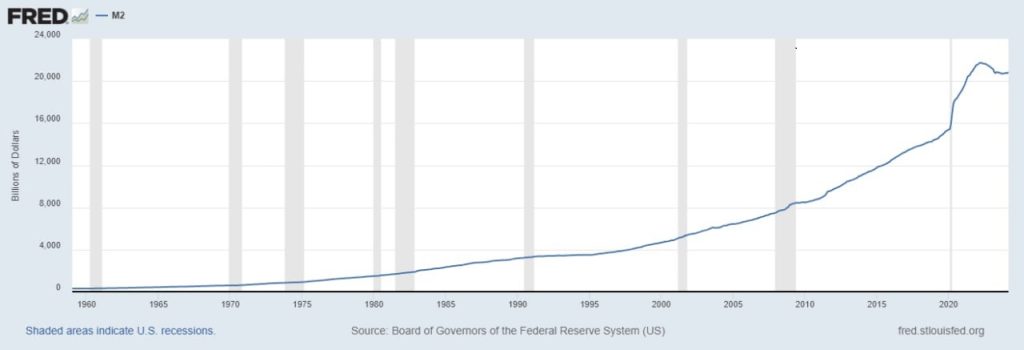

George Tzegas, known as CryptoCapitalist, is a prominent figure in the cryptocurrency investment world. He writes: “The market can stay irrational longer than you can stay solvent,” said John Maynard Keynes. This sentiment echoes the current economic climate, where despite significant disruptions, markets seem irrationally buoyant. From bank collapses to pandemics and wars, we’ve experienced it all. Central banks have injected liquidity to stabilize economies, benefiting financial institutions and large corporations first.

This influx increases debt and inflates market levels, leading to inflation that erodes consumer purchasing power. Thus, while the economy appears strong, the average person struggles financially.

The liquidity funneled through bailouts and bond buybacks primarily benefits banks, states, and large companies. The increase in money circulation leads to inflation, diminishing everyone’s purchasing power. Therefore, despite appearances, we are collectively shouldering the burden. The relationship between economy, prosperity, and markets isn’t linear and is influenced by various external factors. Economic strength doesn’t always translate to public well-being, as financial markets often react positively to negative economic news and vice versa.

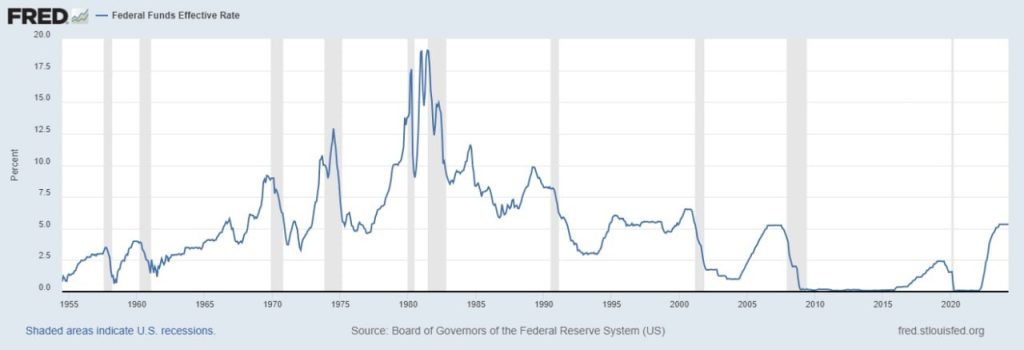

Currently, central banks like the Federal Reserve and ECB are tackling inflation by raising interest rates and reducing liquidity. This approach aims to reduce spending and investment, theoretically lowering prices and inflation. High interest rates, unseen in the past two decades, are part of this strategy. The FED’s goal is to pressure the economy just enough to lower inflation without causing a recession, a delicate balance that’s challenging to maintain.

Markets seek liquidity and low-interest rates. Therefore, signs of economic strain may prompt the FED to lower rates. However, as long as the economy seems robust and unemployment remains low, the FED is likely to maintain high rates, negatively impacting the stock markets.

For the average consumer, high inflation reduces purchasing power, making it hard to make ends meet. To combat this, one must understand the situation and seek ways to preserve value, such as investing in hard assets like real estate, gold, or Bitcoin. These assets tend to retain or even increase in value despite economic fluctuations. Bitcoin is particularly accessible, allowing investments as small as a few euros without geographical or political restrictions.

As Robert Kiyosaki suggests, economic downturns can be opportunities for wealth if one is prepared. Acknowledging and adapting to economic realities is crucial for financial resilience.

Originally posted on Euro2day.gr

About

George Tzegas is the founder of The Crypto Capitalist, a platform that offers investment insights and strategies tailored to the evolving landscape of digital assets. Tzegas focuses on applying value-based investment principles influenced by Austrian School economics to the realm of cryptocurrencies. His work emphasizes navigating the complexities of macroeconomic forces, regulatory developments, and technological innovations in the crypto space.

Tzegas has garnered attention for his forward-thinking approach to cryptocurrency investments, particularly through his analyses and newsletters that provide in-depth research and portfolio updates. He is known for predicting major trends in crypto stocks and offering guidance on managing wealth in a rapidly changing economic environment. His platform, The Crypto Capitalist, also provides educational resources, market commentary, and consultations to help investors capitalize on opportunities within the crypto economy.

Author Profile

- Lucy Walker covers finance, health and beauty since 2014. She has been writing for various online publications.

Latest entries

- April 25, 2025Global EconomicsWhistleblowers Unmask Schwab’s Toxic WEF Secrets

- April 9, 2025Global EconomicsTariff Tensions Drive Market Volatility

- March 18, 2025Global EconomicsRed in Name Only: Labour’s War on the UK Working Class

- March 7, 2025SatoshiCraig Wright Banned from UK Courts with Civil Restraint Order