Riot Platforms, Inc., a prominent name in cryptocurrency mining, has embarked on a groundbreaking project to construct the world’s largest Bitcoin mine in Texas. This venture, known as the Corsicana Facility, represents a significant leap in the scale and capability of Bitcoin mining operations.

Capacity and Development

The planned one gigawatt (GW) of electricity capacity is not just a number; it represents a quantum leap from the energy consumption of existing mining facilities. To put this into perspective, one GW is enough to power around 110 million LED lights or approximately 700,000 homes. This ambitious capacity is a reflection of the significant growth trajectory of Bitcoin mining as an industry.

The scale of operations has been rapidly increasing, driven by the advancement in mining technologies and the growing demand for Bitcoin and other cryptocurrencies. The Corsicana Facility’s planned one GW of power underscores the industry’s move towards building mega-facilities that can host a vast number of high-performance mining rigs.

The development strategy for the Corsicana Facility is methodical and measured, beginning with an initial phase that contributes 400 megawatts (MW) of the total capacity. This first phase alone is substantial, it could power a small city, and it’s just the starting point. The phased approach allows for careful expansion, testing, and scaling up operations to ensure that every stage of the mine’s development is sustainable and efficient.

This phased development is not just about installing hardware; it’s also an intricate process of securing a stable and cost-effective energy supply, developing cooling technologies to manage the immense heat produced by mining activities, and ensuring compliance with local and federal regulations. The 400 MW initial phase likely involves the deployment of state-of-the-art mining rigs, possibly utilizing advanced cooling solutions such as liquid immersion to enhance efficiency and reduce thermal output.

Moreover, the construction and operational planning of such a large facility must consider the impact on the local grid and the broader implications for energy markets. Riot Blockchain, Inc., the company behind the Corsicana Facility, may be entering into partnerships with power suppliers, possibly tapping into renewable energy sources to mitigate the environmental impact of their operations.

Location & Significance

Situated in Corsicana, Navarro County, Texas, this facility benefits from the state’s supportive regulatory environment and abundant energy resources. Texas has become a hub for cryptocurrency mining, attracting companies due to its relatively cheap and plentiful electricity, often derived from renewable sources.

Financial Aspects

The project is a significant financial undertaking, with an estimated cost of $333 million. This investment reflects confidence in the long-term viability of cryptocurrency mining and its potential profitability.

The Corsicana Facility’s massive capacity also indicates a strategic bet on the long-term profitability of Bitcoin mining, despite the cryptocurrency’s price volatility and the increasing complexity of mining new coins. As the facility reaches its one GW capacity, it will undoubtedly play a significant role in the Bitcoin network, contributing a considerable hash rate that can affect global mining dynamics.

Technological Innovation

The Corsicana Facility is expected to utilize advanced mining technologies, possibly including immersion-cooled mining solutions. Such technologies enhance the efficiency and sustainability of mining operations, reducing the environmental impact.

Market Impact

This development is likely to have a substantial impact on the global Bitcoin mining landscape. The increased capacity could lead to changes in the distribution of mining power, potentially affecting the dynamics of the Bitcoin network.

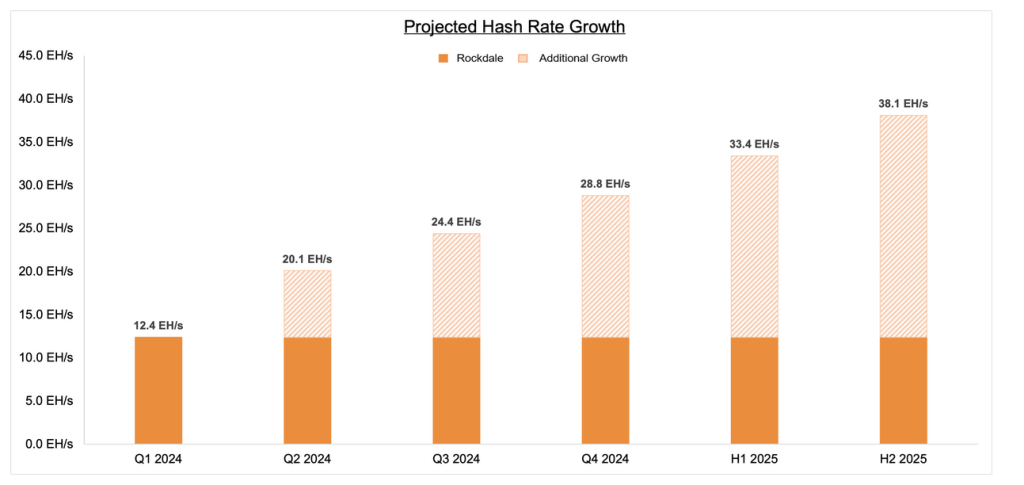

The Corsicana Facility by Riot is set to reach a total capacity of 1 gigawatt once it’s fully developed. Riot aims for a self-mining hash rate capacity of 29 exahashes per second (EH/s) by the end of 2024. They have made significant strides in this direction through a long-term purchase agreement with MicroBT, placing an initial order for 33,280 Bitcoin miners in June 2023 and a subsequent order for an additional 66,560 miners effective December 2023, both primarily for the Corsicana Facility.

These orders collectively are expected to contribute 26 EH/s to Riot’s capacity. The deployment of these miners will start in the first quarter of 2024 and is scheduled to be completed by the second half of 2025, at which point Riot’s self-mining hash rate capacity is projected to increase to 38 EH/s.

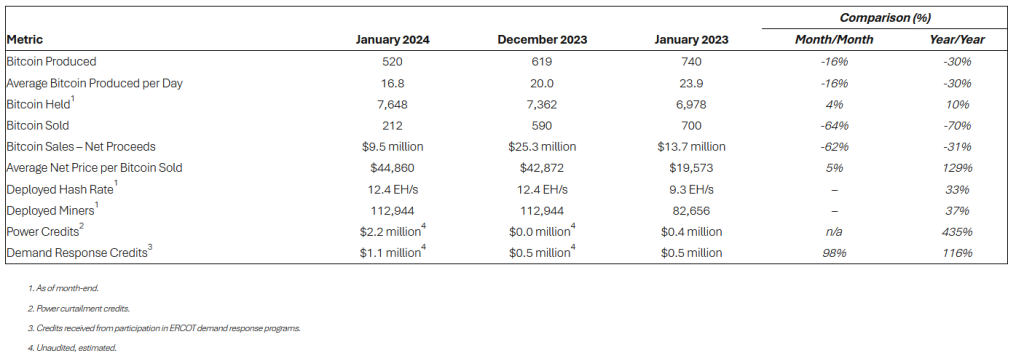

Bitcoin Production Update for January 2024

Challenges and Controversies

Large-scale mining operations like the Corsicana Facility often face challenges and controversies, particularly concerning energy consumption and environmental impact. The project will likely need to address these concerns, emphasizing sustainable practices and energy efficiency.

Riot Platforms Inc.

Riot Platforms, Inc., previously known as Riot Blockchain Inc, is a company that has been involved in the blockchain sector for several years. Initially, the company was known for its involvement in the biotech industry, but it pivoted to blockchain technology and cryptocurrency mining around 2017. The shift to blockchain was part of a broader trend at the time, where many companies were looking to capitalize on the burgeoning interest in cryptocurrencies.

Financially, Riot has seen various changes in its market capitalization over the years, with significant fluctuations that often mirror the volatile nature of the cryptocurrency market itself. The company’s financial performance has been closely tied to the price of Bitcoin, given that a large portion of its business is focused on Bitcoin mining.

In periods when Bitcoin has surged in value, Riot’s financials have typically seen a boost, whereas downturns in the cryptocurrency market have often hurt the company’s performance. Riot has aimed to expand its operations and increase its mining capacity, which has involved large capital expenditures but also positioned the company as one of the leading entities in the cryptocurrency mining sector.

RIOT Share Price – Riot Platforms, Inc.

The development of the Corsicana Facility is a pioneering move in the cryptocurrency mining sector, demonstrating the industry’s push towards larger, more powerful, and more efficient mining operations. The phased roll-out of its 400 MW initial capacity is just the first step in achieving a milestone in the scale of Bitcoin mining, paving the way for a future where such mega-mining operations may become the standard.

Author Profile

- Ex-community moderator of the Banano memecoin. I have since been involved with numerous cryptocurrencies, NFT projects and DeFi organizations. I write about crypto mainly.

Latest entries

- June 6, 2025NewsWireElon Musk to Decommission SpaceX Dragon after Trump Threat

- December 9, 2024Stock MarketMaster the Time Value of Money Financial Concept

- November 18, 2024Stock MarketFinancial Ratios Guide to Measuring Business Performance

- November 11, 2024NewsWireLabour’s UK Budget: A Fiscal Smirk of Contempt for Working People