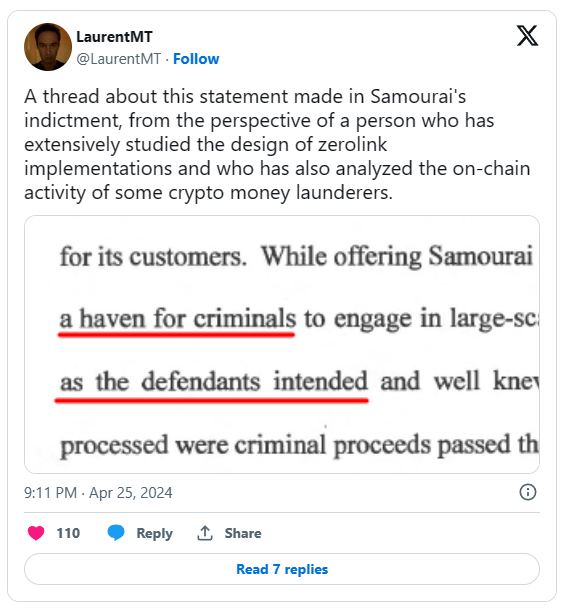

The recent indictment involving the Samourai wallet has brought on a heated debate and a hidden layer of privacy advocates on Bitcoin. A thread from Bitcoin developer Laurent MT, who has dedicated extensive research to the design of zerolink implementations and the on-chain activities of cryptocurrency money launderers, offers a counter-narrative to the indictment’s claim that Samourai is a “haven for criminals.”

Laurent MT’s analysis suggests a paradox in the behavior of these money launderers; they appear to neglect basic privacy practices, compromising not only their own anonymity but also that of others using mixing services. These actors inundate the mixers with disproportionately large inflows and exit swiftly, often leaving traces just a few transactions down the line. This strategy, Laurent MT posits, is akin to a “go-fast” approach where the intent is to move quickly through mixing systems, putting distance between the launderers and those tracking them, not to maintain long-term privacy.

Whirlpool, the mixing protocol used by Samourai, is designed on the principle of slow mixing over extended periods, advocating for the notion that the best privacy is achieved when funds are perpetually mixed within the system. This approach runs counter to the quick-fix anonymity solutions provided by many other Bitcoin mixers and, according to Laurent MT, makes Whirlpool less conducive to the tactics employed by money launderers.

The indication that only an alleged 5% of criminal funds may have traversed Whirlpool, a relatively low figure compared to other mixers, seems to support the argument that Whirlpool’s design inherently discourages the type of rapid, high-volume laundering typically seen in criminal activities.

Laurent MT’s thread, further amplified by cryptographer Zooko (lead developer of zCash) extensive commentary on the subject, challenges the narrative presented in the indictment. The analysis suggests that not only is the claim about Samurai’s complicity in criminal activities possibly overstated, but also that the design of Whirlpool may inherently be at odds with the strategies employed by crypto money launderers. This invites a broader conversation about the balance between privacy, innovation, and regulation in the crypto space, and whether current legal approaches adequately reflect the nuances of technology they seek to govern.

Community Reaction

A tweet from Seth For Privacy (Editor of Freedom.Tech) raises critical questions about the implications of recent public service announcements (PSAs) concerning cryptocurrency Money Services Businesses (MSBs) and privacy-focused wallet users. Seth underscores the confusion surrounding the definition of an MSB and expresses concern over why an ordinary person seeking financial privacy should be alarmed by a PSA, which many may not fully understand. The tweet reflects a broader sentiment among cryptocurrency users who value privacy and are unsettled by the potential implications of being associated with money services business without clear reasons.

This unease is compounded by the suggestion that wallets like Samourai, which prioritize user privacy, could be misunderstood as MSBs. Seth’s tweet voices the concern that there is “zero reason” for a privacy-focused wallet user to have previously considered the need to identify a wallet like Samourai as an MSB. The tweet also hints at a perceived underlying threat in these announcements, as they could signal a shift in regulatory scrutiny towards individual users under the banner of anti-money laundering efforts, with far-reaching implications for privacy and personal freedom in the digital space.

That Is Not A Grouch (Bitcoin Magazine Editor) takes a firm stance against the Department of Justice’s classification of Samourai Wallet as a money transmission business. This position is echoed in the user’s vehement argument that self-custodial tools do not fall under the regulatory umbrella of money transmitters, a categorization they see as a severe and unwarranted overreach. The conviction here is clear: such an interpretation by the DOJ could have widespread and profound consequences for all self-custodial tools within the cryptocurrency space, potentially redefining user autonomy and the very nature of individual asset management. The sentiment captures a broader anxiety within the crypto community regarding the ramifications of regulatory actions that may inadvertently conflate privacy preservation with illicit activities.

Sparrow Wallet Removes Whirlpool

Sparrow Wallet has issued an update as a reaction to the above. Version 1.9.0 of the wallet removes the Whirlpool client and other features related to Soroban, signaling Sparrow’s commitment to compliance and its proactive response to the heightened scrutiny of privacy tools within the crypto space. Despite these removals, the developers assure users that all wallets and accounts remain accessible, maintaining the integrity of user assets while navigating the complex regulatory environment. This update underscores the delicate balance crypto-based platforms must strike between offering privacy-enhancing technologies and adhering to new legal frameworks.

Author Profile

- Lucy Walker covers finance, health and beauty since 2014. She has been writing for various online publications.

Latest entries

- June 30, 2025NewsWireBank Savings at Risk: The Dark Side of EU’s Savings Standard

- April 25, 2025Global EconomicsWhistleblowers Unmask Schwab’s Toxic WEF Secrets

- April 9, 2025Global EconomicsTariff Tensions Drive Market Volatility

- March 18, 2025Global EconomicsRed in Name Only: Labour’s War on the UK Working Class