Diageo, the renowned owner of popular liquor brands like Johnnie Walker whisky and Smirnoff vodka, has recently encountered a significant setback. The company’s shares took a nosedive following an announcement that sales and profits for the first half of its fiscal year are expected to be weaker than previously anticipated. This news has sent ripples through the market, reflecting the broader challenges faced by global consumer goods companies in the current economic climate.

A Tough Market in Latin America and the Caribbean

The primary cause of Diageo’s woes can be traced to a deteriorating macroeconomic environment in Latin America and the Caribbean. This region, which accounts for approximately 11% of Diageo’s revenue, has seen a notable decline in consumer spending on alcoholic beverages. The company highlighted that consumers in these areas are not only drinking less but are also increasingly opting for cheaper brands, a trend that significantly impacts Diageo’s premium product portfolio.

Diageo’s forecast for the region is grim, with expectations of organic net sales plummeting by over 20% year-on-year in the first half, ending December 31. This stark decline is a clear indicator of the challenges faced by the company in maintaining its market position amidst changing consumer behaviors and economic pressures.

Share Prices Reflect Investor Concerns

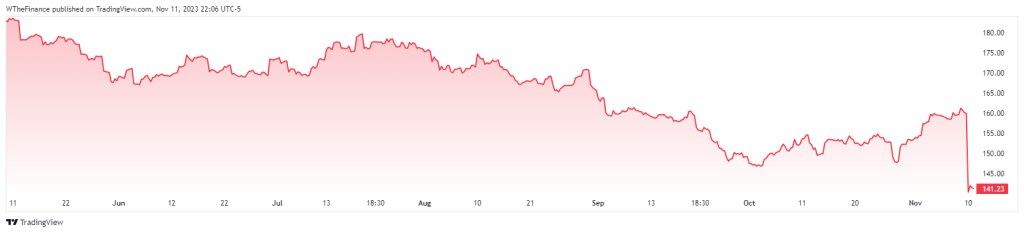

The market’s reaction to Diageo’s announcement was swift and severe. On the London Stock Exchange, Diageo PLC (UK:DGE) saw its share price fall by 395.00 GBp, a substantial drop of 12.17%. Similarly, in the United States, Diageo’s ADR (DEO) listed on the NYSE experienced a decline of $18.75, translating to a 11.72% decrease. These figures underscore the investor concerns about the company’s near-term profitability and growth prospects.

DEO NYSE Price Chart

Broader Implications for the Alcoholic Beverage Industry

Diageo’s struggles are emblematic of the broader challenges facing the alcoholic beverage industry. The shift in consumer preferences towards lower-priced alternatives, coupled with economic headwinds, poses a significant challenge to companies that have traditionally relied on premium branding and pricing strategies. This trend may prompt a strategic reevaluation within the industry, as companies like Diageo may need to adapt their product offerings and marketing strategies to align with the evolving consumer landscape.

What is Next?

As Diageo navigates through these turbulent times, the company’s response to these challenges will be closely watched. Adapting to changing market conditions, reevaluating pricing strategies, and possibly diversifying product lines to include more affordable options could be on the horizon for Diageo. The company’s ability to weather this storm will not only be crucial for its own future but could also set a precedent for how premium brands in the alcoholic beverage industry respond to economic downturns and shifting consumer preferences.

Diageo’s current predicament serves as a stark reminder of the volatility and unpredictability of global markets. As the company grapples with these challenges, its actions in the coming months will be critical in determining its path forward in an increasingly competitive and economically sensitive industry.

Author Profile

- Lucy Walker covers finance, health and beauty since 2014. She has been writing for various online publications.

Latest entries

- June 30, 2025NewsWireBank Savings at Risk: The Dark Side of EU’s Savings Standard

- April 25, 2025Global EconomicsWhistleblowers Unmask Schwab’s Toxic WEF Secrets

- April 9, 2025Global EconomicsTariff Tensions Drive Market Volatility

- March 18, 2025Global EconomicsRed in Name Only: Labour’s War on the UK Working Class