In the tumultuous world of cryptocurrency, the shifting sands of Bitcoin’s (BTC) value often capture the headlines. Recently, a narrative has taken shape, dichotomizing investors into two camps: the ‘dumb money’ worried about Bitcoin’s price decline following the approval of Exchange Traded Funds (ETFs), and the ‘smart money’ focusing on a less visible, yet potentially transformative trend.

It’s the silent migration of BTC out of liquid supply and into the vaults of institutional giants that might be setting the stage for a seismic shift in the crypto economy.

The Unwavering 8%

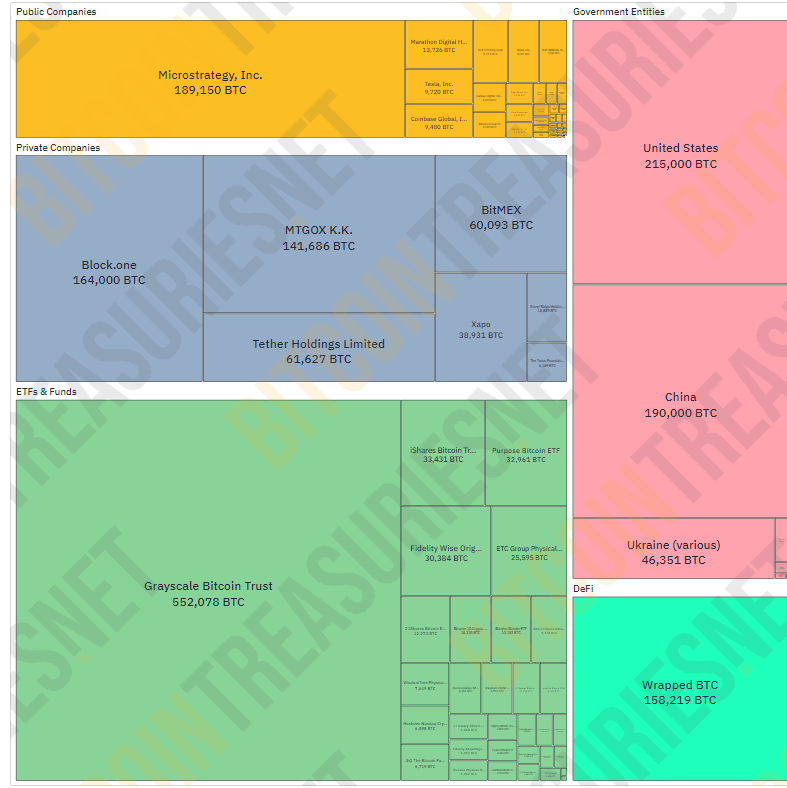

For over two years, a consistent 8% of Bitcoin’s total supply has been nestled in the balance sheets of corporate treasuries, a fact that can be corroborated by regular visits to BitcoinTreasuries.net. This may seem like a static figure, a small piece of a larger pie, but the entities behind these numbers are far from insignificant. They include:

- Public Companies: Microstrategy, Tesla, and Coinbase are among the firms making large-scale Bitcoin investments.

- Private Companies: SpaceX and Block Inc. have also diversified their assets with substantial BTC holdings.

- Mining Companies: Marathon, Hut 8, and Riot reflect the investment of cryptocurrency miners in holding their products.

- Governments and ETFs: China, the USA, Ukraine, and other nations, alongside all 11 US ETFs, are stakeholders in Bitcoin’s institutional allure.

Each of these entities, in their way, has acknowledged the potential of Bitcoin not just as a transactional currency but as a reserve asset, a digital gold of the 21st century.

The ETF Effect and the Vertical Ascent

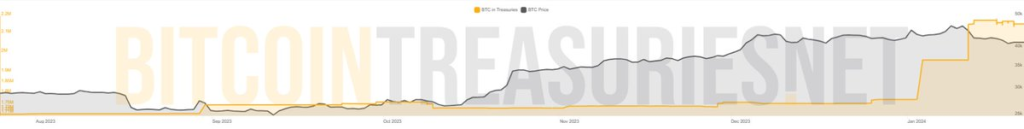

With the entrance of ETFs in the trading arena, there has been a significant uptick in the institutional accumulation of Bitcoin. In the days following ETF trading, the Bitcoin Treasuries chart did not just inch upward, it soared. The percentage of BTC held by institutional entities leapt over 20%, from a steady 8% to an impressive 10.3%.

This jump represents a staggering influx of capital into Bitcoin, and more importantly, a withdrawal of a 2.3% supply from the circulating market. These Bitcoins are being “locked away”, perhaps indefinitely, in the digital vaults of institutions betting on long-term value. The immediate result? Less BTC is available for trading and purchasing, a classic precursor to a supply shock in market economics.

What This Means for Bitcoin

It’s essential to dissect the implications of such a market movement. With a significant portion of Bitcoin being squirrelled away by entities with no immediate intention to sell, the market could be on the verge of experiencing a supply shock. In simple terms, as demand continues to grow or even remain constant, the decreased supply could lead to an increase in Bitcoin’s price.

This trend underscores a fundamental shift in the perception of Bitcoin, from a speculative instrument to a store of value. The ‘smart money’, it seems, is betting on Bitcoin’s scarcity value. As more institutions adopt this approach, we could witness a self-reinforcing cycle that drives Bitcoin’s value upwards, assuming the demand persists.

Keeping an Eye on the Future

This phenomenon merits close attention. A supply shock, should it occur, could have far-reaching consequences, not only for investors but for the broader financial landscape. If Bitcoin’s supply continues to be absorbed by institutional behemoths, the impact on price, volatility, and market dynamics could be profound.

While the ‘dumb money’ frets over daily price fluctuations, the ‘smart money’ may be quietly laying the groundwork for a Bitcoin renaissance. The question for investors, traders, and observers is not if, but when, and how this will reshape the market we thought we knew.

Author Profile

- Lucy Walker covers finance, health and beauty since 2014. She has been writing for various online publications.

Latest entries

- June 30, 2025NewsWireBank Savings at Risk: The Dark Side of EU’s Savings Standard

- April 25, 2025Global EconomicsWhistleblowers Unmask Schwab’s Toxic WEF Secrets

- April 9, 2025Global EconomicsTariff Tensions Drive Market Volatility

- March 18, 2025Global EconomicsRed in Name Only: Labour’s War on the UK Working Class