In the realm of cryptocurrency investment, the strategy of focusing on well-positioned altcoins with solid entry points can be a prudent approach, particularly for those looking to capitalize on concentrated bets. This strategy involves identifying altcoins that exhibit strong potential for growth based on various factors such as technology, market position, community support, and development activity. Let’s break down this approach.

Identifying Well-Positioned Altcoins

- Technology and Innovation: Look for altcoins that bring unique solutions or improvements to existing blockchain technology. Innovations in scalability, security, or functionality can set an altcoin apart.

- Strong Use Case: Altcoins should have a clear and viable use case. This could be in areas like decentralized finance (DeFi), non-fungible tokens (NFTs), supply chain management, or data security.

- Community and Development Activity: A strong, active community and a committed development team can be indicators of an altcoin’s long-term viability. Regular updates and community engagement are positive signs.

- Market Position and Partnerships: Altcoins that have secured partnerships with reputable companies or are positioned well in a niche market can offer more stability and growth potential.

| Rank | Altcoin | Description |

|---|---|---|

| 1 | Ethereum (ETH) | The best altcoin to invest in 2023 |

| 2 | BNB (BNB) | The top challenger to Ethereum’s DeFi supremacy |

| 3 | Aptos (APT) | A cutting-edge layer 1 capable of reaching 160,000 TPS |

| 4 | Optimism (OP) | A leading layer 2 solution for Ethereum |

| 5 | Shiba Inu (SHIB) | One of the best memecoin projects |

| 6 | Polkadot (DOT) | The best parachain ecosystem |

| 7 | Mina Protocol (MINA) | The world’s lightest blockchain |

| 8 | Arweave (AR) | The most advanced distributed storage altcoin project |

| 9 | Celo (CELO) | The best mobile-first DeFi platform |

| 10 | Cosmos (ATOM) | Building the “Internet of Blockchains” powered by ATOM |

| 11 | Lido DAO Token (LDO) | The leading liquid staking protocol for Ethereum, Polygon, and others |

| 12 | Osmosis (OSMO) | An innovative DEX project with superfluid staking |

Solid Entry Points

Finding the right entry point is crucial for maximizing returns and minimizing risks. This involves:

- Technical Analysis: Use technical indicators to identify optimal entry points. Look for patterns, support/resistance levels, and trend lines.

- Fundamental Analysis: Assess the altcoin’s fundamentals, like tokenomics, demand drivers, and market conditions, to determine if it’s undervalued or has growth potential.

- Market Sentiment: Keep an eye on overall market sentiment. Sometimes, broader market trends can provide opportunities to enter at favorable prices.

Managing Risks with Underperforming Altcoins

While the focus on well-positioned altcoins is key, equally important is the willingness to cut off underperforming ones. This involves:

- Regular Portfolio Review: Monitor the performance of altcoins in your portfolio. Assess if they are meeting the expected milestones or if their market position has changed.

- Setting Stop Losses: Implement stop-loss orders to automatically sell off assets that reach a certain price point, limiting potential losses.

- Diversification: While having concentrated bets can be beneficial, ensure that your investment is not overly concentrated in a few assets. Diversification can help mitigate risks.

- Staying Informed: Keep up-to-date with the latest news and developments in the cryptocurrency world. Regulatory changes, technological advancements, or market shifts can impact altcoin performance.

Top Gainers Altcoins 2023

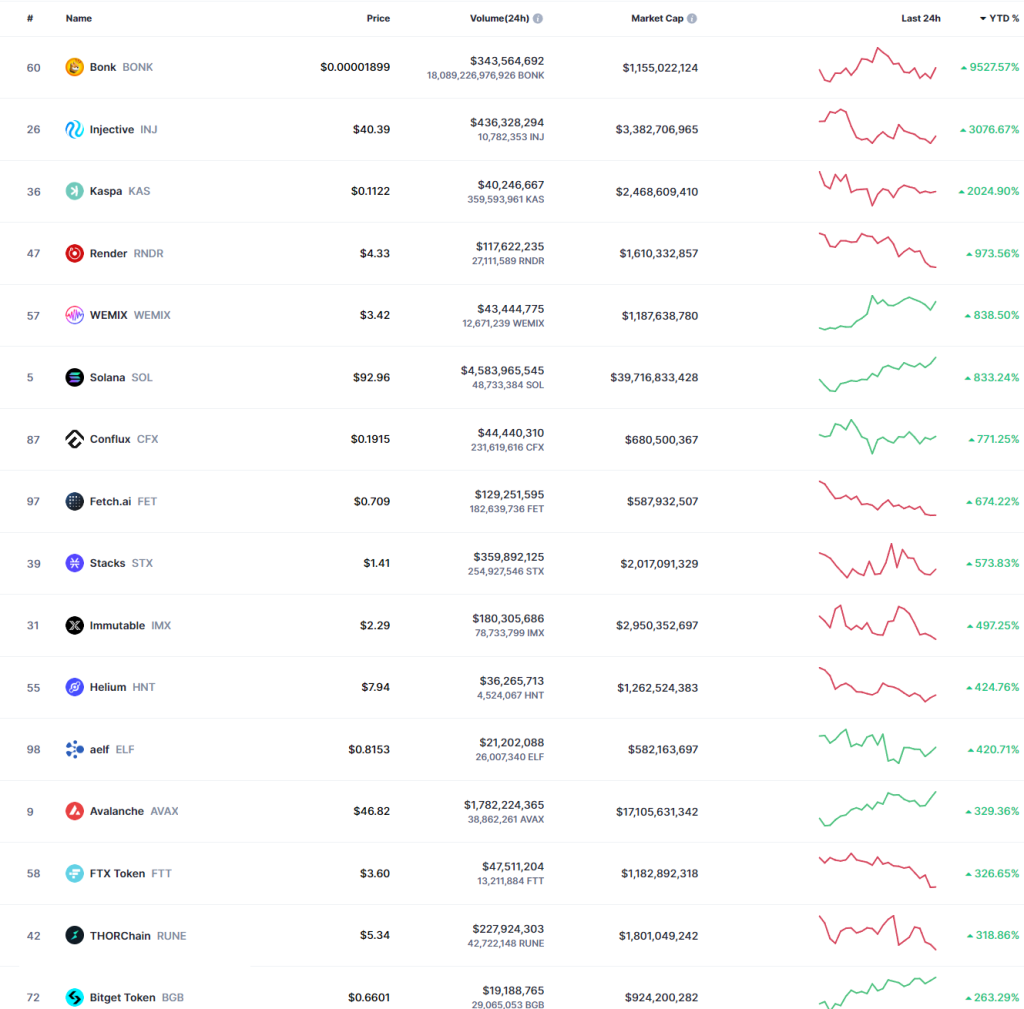

Below we showcase a selection of top gainer altcoins in 2023, each demonstrating significant year-to-date (YTD) returns. Featured prominently are:

- Bonk (BONK), with an astonishing YTD increase, highlighting a surge in popularity and investor interest.

- Injective (INJ), showing a notable gain, suggesting strong market confidence in its potential.

- Kaspa (KAS) and Render (RNDR), both with impressive growth, indicating robust market performance and possibly investor enthusiasm around their use cases or technological innovations.

- Solana (SOL), maintaining its position with solid gains, reflecting its enduring appeal as a high-throughput blockchain platform.

These coins, among others listed, point to a dynamic and rapidly evolving altcoin market where investors are actively seeking out opportunities with the potential for high returns. However, it’s important to note that such gains can be volatile and investing in cryptocurrencies carries risk. The data implies that despite market fluctuations, there remains a robust interest in emerging and established altcoins alike.

In summary, a strategy that involves investing in well-positioned altcoins with solid entry points, while being ready to cut losses on underperformers, requires a balanced approach of diligent research, continuous monitoring, and risk management. This approach aims to capitalize on the potential high returns of altcoins while maintaining a level of safety against the inherent volatility of the crypto market.

Author Profile

- Ex-community moderator of the Banano memecoin. I have since been involved with numerous cryptocurrencies, NFT projects and DeFi organizations. I write about crypto mainly.

Latest entries

- June 6, 2025NewsWireElon Musk to Decommission SpaceX Dragon after Trump Threat

- December 9, 2024Stock MarketMaster the Time Value of Money Financial Concept

- November 18, 2024Stock MarketFinancial Ratios Guide to Measuring Business Performance

- November 11, 2024NewsWireLabour’s UK Budget: A Fiscal Smirk of Contempt for Working People