Positive news for Solana from China and Asia in general where a web3 phone has been tested. In a separate report, Asia is seen as a key growth area for altcoins.

New Phone

A report indicates that the inaugural testing of Solana’s mobile phone, Saga, has been successfully completed in China. The evaluation primarily focused on the cornerstone features of the product, specifically the seed vault and the dApp application store.

Upon its activation, the Saga Web3 phone encourages users to establish or connect a Solana wallet and securely stores the mnemonic locally. The introduction of Solana’s Saga phone signifies a pivotal progression in the ecosystem. The unveiling and distribution of the phone, coupled with subsequent community reviews, are instrumental in fostering the Web3 phone’s acceptance and practicality among users.

This initial review of the Saga mobile from China represents yet another milestone for the Web3 phone, promoting its ongoing adoption. The review reveals that while Web3 applications possess several user-friendly capabilities, certain user experience issues remain.

The review regards Saga as a commendable initial endeavour by Solana in crafting a Web3 phone.

Solana Today

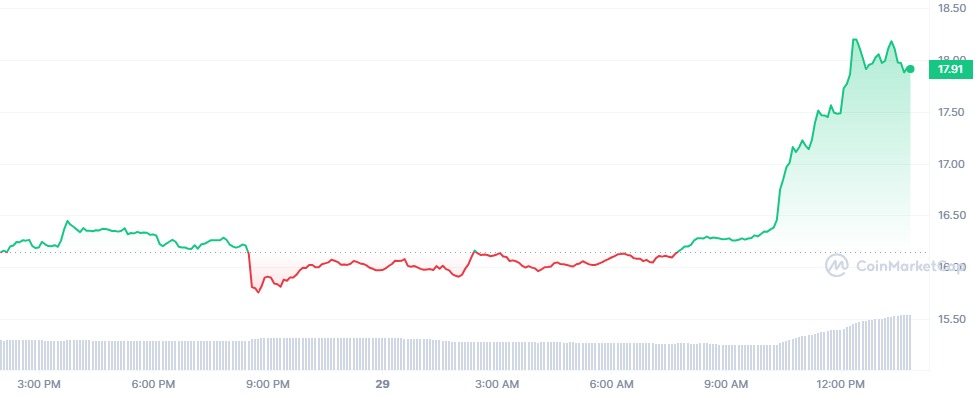

Today’s real-time price of Solana is $17.93 USD, with a trading volume over the last 24 hours amounting to $587,590,256 USD. There has been a rise in the value of Solana by 10.77% within the past 24 hours. Currently, Solana holds the 9th position on CoinMarketCap’s ranking. The live market capitalization stands at $7,172,837,855 USD, and there are 400,053,555 SOL coins in circulation.

New Survey Shows Investors Bullish for Crypto

A recent survey conducted by a subsidiary of the prominent banking institution Nomura, reveals that an overwhelming 96% of professional investors managing nearly $5 trillion are interested in venturing into cryptocurrency investments. “Our extensive study uncovers that the majority of institutional investors we surveyed perceive a definitive role for digital assets within the investment management landscape and acknowledge their potential benefits, such as portfolio diversification,” states the report.

The survey included 303 professional investors who collectively handle $4.95 trillion in assets. It indicated that 82% of these investors have a positive view on both Bitcoin and Ethereum, with 88% stating that they or their clients are contemplating investing in cryptocurrencies.

In related news, last week, BlackRock sought approval from the U.S. Securities and Exchange Commission (SEC) for a spot Bitcoin ETF, with Coinbase as its custodial partner. This comes at a time when the SEC is intensifying its scrutiny of the crypto industry.

Author Profile

- Ex-community moderator of the Banano memecoin. I have since been involved with numerous cryptocurrencies, NFT projects and DeFi organizations. I write about crypto mainly.

Latest entries

- June 6, 2025NewsWireElon Musk to Decommission SpaceX Dragon after Trump Threat

- December 9, 2024Stock MarketMaster the Time Value of Money Financial Concept

- November 18, 2024Stock MarketFinancial Ratios Guide to Measuring Business Performance

- November 11, 2024NewsWireLabour’s UK Budget: A Fiscal Smirk of Contempt for Working People