The world of cryptocurrency has seen significant growth, with Bitcoin leading the charge. Among the major players in this field are the top five publicly traded Bitcoin holders, each with their unique strategies, 5-year charts and impact on the market.

1. Grayscale: Leading the Pack with Bitcoin Trust ETF

Grayscale, the largest publicly traded holder of Bitcoin, manages the Grayscale Bitcoin Trust ETF (GBTC), offering investors exposure to Bitcoin through a regulated investment product. This trust allows investors to invest in Bitcoin without the complexities of setting up a cryptocurrency exchange account.

As of January 2024, Grayscale underwent a significant shift, transitioning from the OTCQX Market to being listed on NYSE Arca as a spot Bitcoin ETF. The trust aims to reflect the value of Bitcoin it holds, minus expenses and liabilities. Notably, Grayscale experienced a notable outflow of Bitcoin, shedding over 13,700 BTC in a single day amid rising competition in the Bitcoin ETF space.

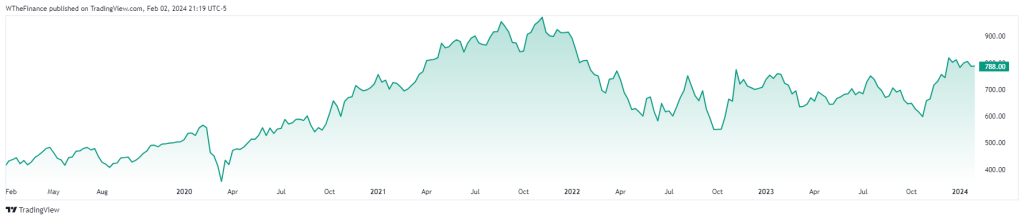

Stock price is up 860% in the last 5 years.

2. MicroStrategy: A Bold Player in the Bitcoin Arena

MicroStrategy, a business intelligence company, has been at the forefront of corporate investment in Bitcoin, particularly under the leadership of CEO Michael Saylor. The company’s strategy has been characterized by a significant shift from traditional asset management to a focus on Bitcoin as a primary treasury reserve asset. This move is not just an investment but a strategic realignment of the company’s financial approach, reflecting a deep-seated belief in the long-term potential and value of Bitcoin.

MicroStrategy has utilized its balance sheet to purchase substantial amounts of Bitcoin. This involves using company funds and sometimes even raising debt to finance additional Bitcoin purchases. he company treats Bitcoin not merely as an investment but as a principal holding. This approach is akin to how a nation treats its gold reserves, indicating a level of trust in the digital asset’s enduring value.

MicroStrategy’s significant Bitcoin acquisitions reflect its leadership’s belief in the long-term appreciation of the cryptocurrency. This perspective views Bitcoin as a hedge against inflation and a potential standard in the evolving digital economy.

MicroStrategy’s investment in Bitcoin has been a catalyst in the corporate world, influencing other companies to consider cryptocurrencies as a part of their treasury management. It represents a significant endorsement of Bitcoin’s legitimacy as an investment asset and could lead to broader institutional adoption.

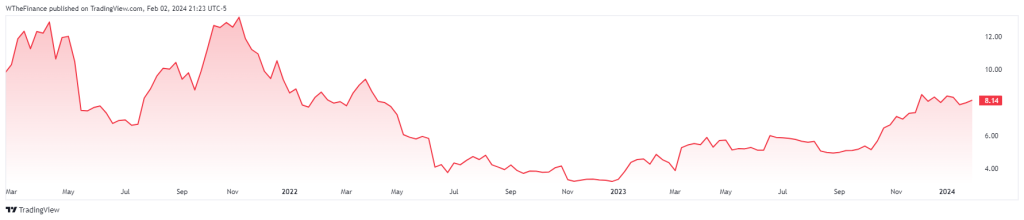

Stock price is up 293% in the last 5 years.

3. BlackRock: Diversifying into Digital Assets

BlackRock’s foray into Bitcoin represents a significant moment in the financial world, as it reflects a shift in perspective towards digital assets among traditional financial institutions. As one of the world’s largest investment management firms, BlackRock’s entry into the cryptocurrency space signals a growing acceptance and interest in digital currencies within the mainstream financial sector.

BlackRock’s investment in Bitcoin is a strong indicator of the increasing acceptance of cryptocurrencies by traditional financial entities. This move can be seen as a validation of the legitimacy and potential of digital assets as a part of diversified investment portfolios. The decision to invest in Bitcoin likely involves a strategic approach to asset diversification. By including Bitcoin in their investment offerings, BlackRock is acknowledging the potential of digital assets to provide hedging opportunities against inflation and market volatility.

BlackRock’s involvement in the cryptocurrency market could lead to increased market stability and maturity. As institutional investors like BlackRock enter the space, there is potential for higher liquidity and reduced volatility, making the market more appealing to a broader range of investors.

Stock price is up 89% in the last 5 years.

4. Fidelity: Embracing Bitcoin for Diversification

Fidelity Investments, renowned for its diverse financial services, has taken a notable leap into the world of digital assets, particularly Bitcoin, reflecting a broader trend among traditional investment firms. Their involvement with Bitcoin spans several innovative initiatives and products, marking a significant embrace of cryptocurrencies for portfolio diversification and signaling confidence in the potential of digital assets.

In January 2024, Fidelity launched the Fidelity® Wise Origin® Bitcoin Fund (FBTC), one of the industry’s first spot bitcoin exchange-traded products (ETPs). This ETP, designed to track the performance of Bitcoin, provides financial advisors and individual investors with a more accessible way to invest in Bitcoin without buying it directly. Available through Fidelity’s online platforms, FBTC is competitively priced with an expense ratio of 25 basis points, which is waived for the first six months. This launch indicates Fidelity’s commitment to expanding digital assets offerings and facilitating secure access to markets for investors.

The introduction of FBTC by Fidelity is part of a broader movement within the financial industry towards the acceptance and integration of digital assets. Fidelity’s decision to offer a spot-priced exchange-traded product aligns with their long-held belief in the efficiency of such instruments for gaining exposure to Bitcoin. The firm’s years of engagement and expertise in the digital assets space have culminated in the creation of this innovative product, reflecting their deep understanding of the digital assets ecosystem.

The Fidelity Wise Origin Bitcoin Fund’s underlying Bitcoin is custodied by Fidelity Digital Assets℠, regulated by the New York Department of Financial Services since 2019. Fidelity Digital Assets offers institutional-grade security for digital assets, which is a crucial aspect of the fund. This move by Fidelity is indicative of the increasing institutional interest in Bitcoin and the growing recognition of its potential as an alternative investment class. Fidelity’s involvement in Bitcoin, through FBTC and other initiatives, underscores the company’s forward-thinking approach and its commitment to providing investors with diverse and innovative investment options.

As the landscape of investment continues to evolve with emerging technologies like blockchain and cryptocurrencies, Fidelity’s strategic steps towards incorporating Bitcoin into its portfolio offerings demonstrate both a recognition of the asset’s potential and a response to the growing investor interest in digital assets.

Stock price is up 45% in the last 5 years.

5. Purpose: Canada’s Foray into Bitcoin

Purpose Investments, a renowned Canadian investment firm, has emerged as a key player in the cryptocurrency arena, holding a substantial amount of Bitcoin. This strategic move by Purpose Investments is a testament to the burgeoning global interest in digital currencies, signifying a major shift in investment trends. By allocating a significant portion of its portfolio to Bitcoin, Purpose is not only diversifying its investment strategy but also embracing the potential of digital assets.

This decision reflects a broader understanding of the evolving financial landscape where traditional investment paradigms are being reshaped by the advent of blockchain technology and cryptocurrencies. Purpose’s involvement in Bitcoin is indicative of the firm’s forward-thinking approach, recognizing the long-term value and impact of this digital asset.

As Canada’s representative among the top holders of Bitcoin, Purpose Investments’ venture into the cryptocurrency space underscores the international appeal and acceptance of Bitcoin as a viable investment asset. This move is particularly significant, considering the cautious approach traditionally adopted by institutional investors towards digital currencies. It exemplifies a growing confidence among major financial players in the stability and future potential of Bitcoin.

Purpose’s investment in Bitcoin not only fortifies its portfolio but also sends a strong signal to the global investment community about the legitimacy and maturing nature of cryptocurrency markets. Such recognition from a leading investment firm paves the way for more institutional investors worldwide to consider incorporating cryptocurrencies like Bitcoin into their investment strategies, further establishing digital assets as a fundamental component of modern financial portfolios.

The Story Goes On

The top five publicly traded Bitcoin holders – Grayscale, MicroStrategy, BlackRock, Fidelity, and Purpose – each play a pivotal role in shaping the cryptocurrency landscape. Their investments in Bitcoin not only signify trust in its value as an asset but also pave the way for more mainstream acceptance of cryptocurrencies.

As the market evolves, these entities will likely continue to influence the trajectory of Bitcoin and the broader digital asset space.

Author Profile

- Ex-community moderator of the Banano memecoin. I have since been involved with numerous cryptocurrencies, NFT projects and DeFi organizations. I write about crypto mainly.

Latest entries

- June 6, 2025NewsWireElon Musk to Decommission SpaceX Dragon after Trump Threat

- December 9, 2024Stock MarketMaster the Time Value of Money Financial Concept

- November 18, 2024Stock MarketFinancial Ratios Guide to Measuring Business Performance

- November 11, 2024NewsWireLabour’s UK Budget: A Fiscal Smirk of Contempt for Working People