Understanding how much Bitcoin one can accumulate over time with a fixed investment strategy could be very useful, albeit sombering. Ashwin Sridhar, a PhD in Computational Dynamics, has delved into this by applying mathematical principles to determine the maximum amount of Bitcoin one could own using a dollar-cost averaging (DCA) strategy.

The Concept of Dollar-Cost Averaging

Dollar-cost averaging (DCA) is an investment strategy where an investor divides the total amount to be invested across periodic purchases of a target asset, aiming to reduce the impact of volatility on the overall purchase. This strategy is particularly popular in volatile markets like cryptocurrency.

Assumptions and Model

Sridhar’s analysis is based on two key assumptions:

- Fixed Monthly Investment: The investor allocates a fixed amount of money each month indefinitely.

- Bitcoin Price Dynamics: The price of Bitcoin follows a mean-reverting power law with an exponent of 5.7. This implies that Bitcoin prices will revert to a long-term growth trend.

Using these assumptions, Sridhar presents a model that shows the theoretical maximum amount of Bitcoin one could accumulate over time. The formula provided for this calculation is:

[ \text{Maximum Bitcoin} = a \times 0.0006631 ]

where (a) is the dollar amount invested per month.

The maximum #bitcoin you will ever own.

— Ashwin Sridhar (@math_sci_tech) July 8, 2024

Assumptions:

– You only perform DCA with a fixed amount per month in perpetuity.

– Bitcoin price follows (i.e. mean reverts to) a power law with exponent 5.7

In this case, there is a theoretical maximum amount of bitcoin you will ever… pic.twitter.com/p5ba0keDIY

Insights from the Model

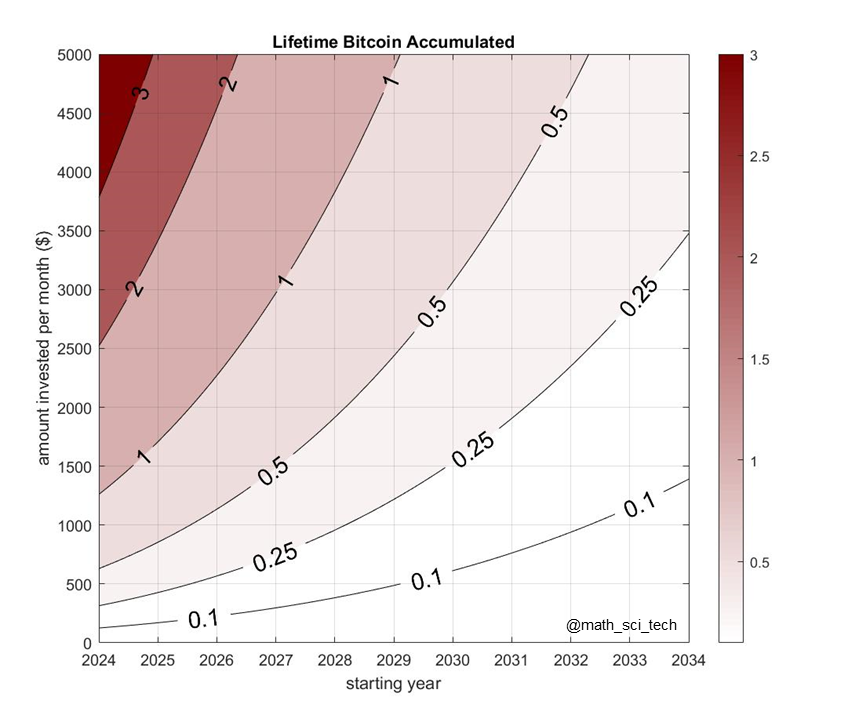

The graphical representation created by Sridhar highlights several important insights:

- Starting Early Matters: The earlier one starts investing, the greater the potential accumulation of Bitcoin. For instance, to achieve 1 Bitcoin by starting in 2024, an investor needs to invest at least $1,500 per month. By 2026, this amount increases to $2,300 per month, and by 2033, even a $10,000 monthly investment will not be sufficient to reach 1 Bitcoin.

- Investment Amount and Timing: The graph clearly indicates how the investment amount and starting time interplay to influence the total Bitcoin accumulation. The longer an investor waits to start, the more they need to invest monthly to reach the same amount of Bitcoin.

Practical Implications

While Sridhar’s analysis provides a theoretical framework, it emphasizes the importance of starting early and maintaining consistent investments. Here are some key takeaways:

- Early Investment: Beginning investments earlier can significantly enhance the potential for accumulating Bitcoin, leveraging the benefits of compounding and price trends.

- Regular Contributions: Consistent, regular investments, regardless of market conditions, can smooth out the volatility and provide a clear path toward accumulation.

- Mathematical Insight: Understanding the underlying mathematical models can help investors make informed decisions about their investment strategies.

Community Reaction

The community’s reactions to Ashwin Sridhar’s analysis of the maximum Bitcoin accumulation using a dollar-cost averaging (DCA) strategy were varied and engaging, reflecting both admiration and curiosity.

Several users praised the analysis for its clarity and usefulness. For instance, @apsk32 commended the 2D contour visualization, noting it helps people determine how much they could reasonably save. Sridhar appreciated the compliment, acknowledging it as high praise.

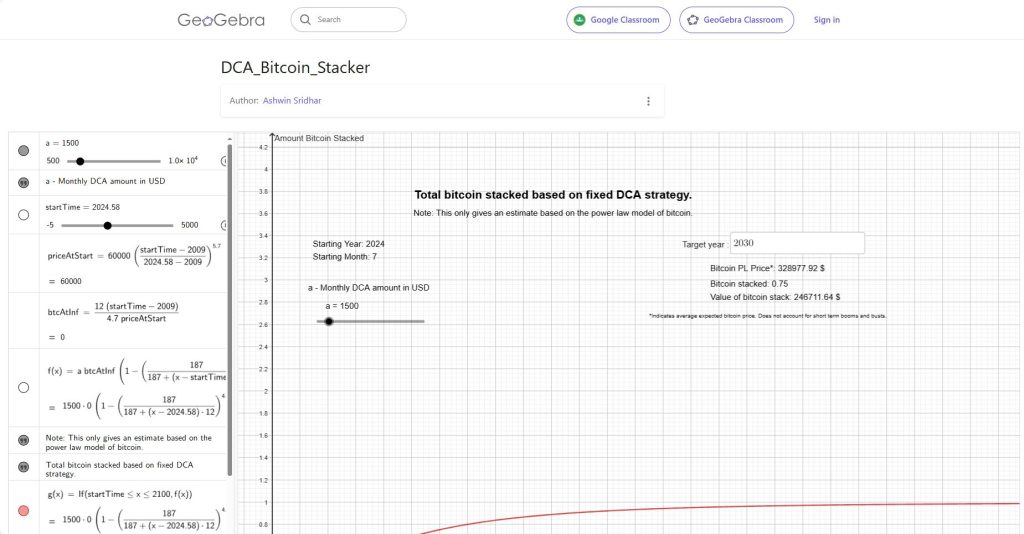

On the other hand, some users sought further clarification. @ALSollozzo questioned the practical application of the model, asking when one would achieve one whole Bitcoin if starting with a $1500 monthly investment today. Sridhar responded that technically, achieving one Bitcoin would take an infinite amount of time, but the model shows how close one can get to that goal in a finite period.

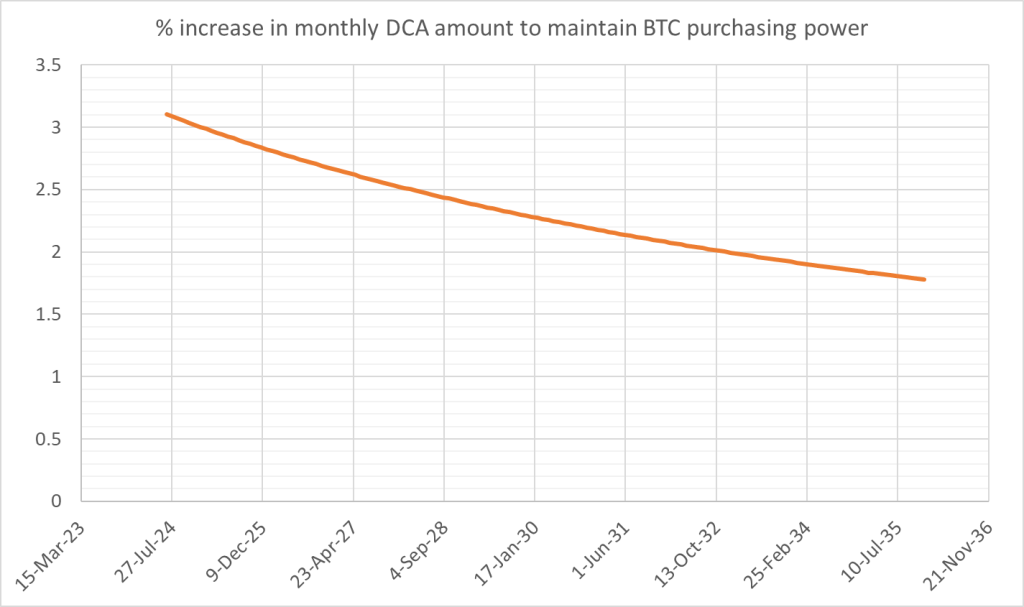

The discussion also delved into more complex scenarios. @BhavikBitcoin asked about increasing the DCA amount by 5% every month. Sridhar explained that while this approach would allow indefinite growth of the Bitcoin stack, it’s not optimal due to the difficulty of matching DCA increases with Bitcoin growth rates.

Some users like @TheWise57752887 inquired about the underlying assumptions of the model. Sridhar reiterated that the model is based on a power law reflecting how large networks grow, which has historically been accurate in predicting Bitcoin’s overall trend.

Finally, @CBRobber highlighted the extreme view by humorously suggesting selling everything to buy Bitcoin, citing a personal anecdote of substantial gains from such an approach, while acknowledging the inherent risk and impracticality.

Computational Dynamics

Ashwin Sridhar’s analysis using computational dynamics offers valuable insights into the potential for accumulating Bitcoin through a disciplined DCA strategy. By applying a power law model, Sridhar demonstrates that starting early and maintaining regular investments is crucial for maximizing Bitcoin holdings over time. Check out the app he built to make this calculation possible: DCA_Bitcoin_Stacker – GeoGebra

As with any investment strategy, it’s essential to consider the assumptions and be prepared for market volatility. However, the mathematical principles presented provide a robust framework for understanding long-term investment outcomes in the dynamic world of cryptocurrency.

Author Profile

- Lucy Walker covers finance, health and beauty since 2014. She has been writing for various online publications.

Latest entries

- April 25, 2025Global EconomicsWhistleblowers Unmask Schwab’s Toxic WEF Secrets

- April 9, 2025Global EconomicsTariff Tensions Drive Market Volatility

- March 18, 2025Global EconomicsRed in Name Only: Labour’s War on the UK Working Class

- March 7, 2025SatoshiCraig Wright Banned from UK Courts with Civil Restraint Order