The block size debate in Bitcoin has been one of the most intense discussions within the community, encompassing both technical and philosophical standpoints on the direction of Bitcoin’s future. A debate that has been active since Bitcoin’s original launch in 2009 and which intensified between August 2015 to November 2017. At the heart of this debate lies the question: Should Bitcoin scale to accommodate more transactions per block at the cost of increased centralization risks, or should it maintain smaller blocks to ensure decentralization and security?

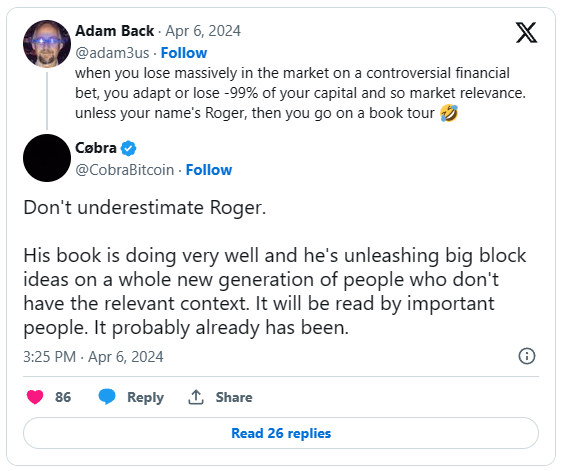

Today. the cryptocurrency community is witnessing another chapter unfold in the ongoing narrative of the Bitcoin Block Size Wars. In a recent social media exchange, Adam Back, CEO of Blockstream, took a swipe at Roger Ver over his market strategies and new literary venture. Ver, a leading advocate for Bitcoin Cash (BCH) and prominent critic of the small blocker faction, recently published “Hijacking Bitcoin,” a book that scrutinizes the actions and philosophy of small blockers in the Bitcoin community.

It’s not good for the soul to get trapped in a dead fork cult, sour on what could or should have been in a failed alternate history. move on!

Adam Back on Roger Ver

Back’s in a recent tweet points to the financial risks associated with taking a controversial stance in the market, often resulting in substantial losses. He sardonically notes that, for Roger Ver, such a loss seems to translate into an opportunity to embark on a book tour. This implies a skepticism of Ver’s approach to maintaining relevance in the crypto sphere following a market setback.

Adding to Back’s critique, Cobra, a notable figure within the Bitcoin community, accepts Ver as a threat. Cobra acknowledges the success of Ver’s book and its impact on introducing big block ideologies to a new, possibly uninformed audience. He suggests that the book’s reach extends to influential individuals, implying it could shape the perceptions and future direction of the Bitcoin community.

Back retorts with skepticism about Ver’s efforts to spread his views, labeling it as ‘laughable’ and suggestive of being ensnared in what he describes as a “dead fork cult.” Back’s comments imply a belief that the ideal path for Ver, and perhaps for the greater good of the crypto community, would be a return to the original Bitcoin fold.

Twitter user subsidleland cast a speculative shadow on Roger Ver’s future in the crypto community by suggesting that he may share a fate akin to that of Craig Wright, whose claims were found to be false by a UK court.

The comment alludes to a downfall or discredit, drawing a parallel with Wright, a controversial figure who has claimed to be Satoshi Nakamoto, the pseudonymous creator of Bitcoin, and has been involved in numerous legal battles and disputes within the crypto community before finally losing the final one. This parallel brings into relief the unpredictable and often volatile nature of the crypto sphere, where reputations are heavily contested and the court of public opinion can be unforgiving.

Cobra, interjects with a contrary viewpoint, suggesting that the reason Roger Ver might be experiencing a resurgence in popularity is that some of his core arguments, specifically those aligned with the ‘big blocker’ perspective, may have been partly valid. The big blockers’ stance, which Ver has championed, posited that Bitcoin’s Lightning Network would lead to centralization, contrary to the decentralized ethos of cryptocurrency. According to Cobra, recent developments are proving these concerns to be somewhat prophetic.

Adam Back contests this view, arguing that the Lightning Network, contrary to leading to centralization and custodial control, actually offers routes around censorship and allows for unilateral withdrawal of funds. He emphasizes that the network is designed to navigate around any potential barriers, including high fees, by automatically finding the most cost-effective transaction pathways.

The discussions and comments from Bitcoiner Juan Galt on the Roger Ver interview reflect a mix of skepticism and technical analysis of Bitcoin’s operational mechanics, particularly regarding the Lightning Network and transaction malleability. Galt acknowledges Ver’s admission of being misled by an individual claiming to be Satoshi Nakamoto, but remains critical of Ver’s perspective on Bitcoin’s transaction speed and reliability.

Galt’s comments suggest that Ver may not have thoroughly engaged with the Lightning Network, a second-layer solution built on Bitcoin that aims to enable faster and more cost-effective transactions. He mentions his personal experience with the network, which contrasts with Ver’s assertions about Bitcoin’s performance. The Lightning Network facilitates immediate, secure, off-chain transfers, which, according to Galt, operate successfully without the need for complex channel management when using wallets like Phoenix

On the topic of Replace-by-Fee (RBF), a protocol that allows Bitcoin transactions with insufficient fees to be supplanted by a transaction with a higher fee, Galt argues that transaction malleability was an issue even before RBF’s implementation. This protocol is cited by Ver as a detrimental factor to Bitcoin’s user experience because it disrupts businesses relying on zero-confirmation transactions. Galt points out that RBF merely formalizes a behavior that already existed within the network, and businesses were previously managing the risk of such occurrences.

Galt also critiques the idea of on-chain scaling as a solution to congestion and high transaction fees, using Ethereum and Solana as examples where increased block throughput has not resolved these issues and has led to other problems. He insists that such approaches are ineffective and jeopardize the decentralized nature of the network by making it more difficult for individuals to run full nodes.

History Revisited

Archer Larsen, an early adopter, recently suggested that the best way to deal with the continuous strife is to block out the opposing voices and ignore the recurring arguments surrounding Bitcoin’s scaling issues. He advocates for putting an end to rehashing old discussions and conflicts that have long plagued the Bitcoin community.

However, this perspective was challenged by another crypto enthusiast known as Hodlonaut. Hodlonaut pointed out the flaw in Larsen’s approach, emphasizing that the majority of the current community members are new to the scene and weren’t present for the initial rounds of the scaling debate. He argues that it’s detrimental to the community to let new entrants be influenced by potentially one-sided narratives without exposure to counterarguments.

Hodlonaut further recalls a notable incident from the height of the Block Size Wars when Roger Ver, sometimes referred to as “Bitcoin Jesus” for his early advocacy and significant contributions to the Bitcoin movement, echoed the sentiments of Craig Wright. Ver had quoted Wright, aligning with the view that those opposing larger block sizes, the ‘small blockers’, were effectively attacking Bitcoin by delaying its scaling.

This recollection serves as a reminder of the intensity and the stakes of the Block Size Wars, a key period that saw the Bitcoin community grapple with its future direction. The debate was not merely technical but was laden with personal convictions and ideologies. On one side were those who believed in keeping blocks small to maintain decentralization and security. On the other were those who pushed for larger blocks to increase transaction throughput and reduce fees, which they believed was more in line with Satoshi Nakamoto’s original vision for peer-to-peer electronic cash.

The “Block Size Wars” led to significant forks in the Bitcoin blockchain, creating distinct cryptocurrencies, most notably Bitcoin Cash (BCH) led by Roger Ver. This move signified a tangible divide in the community, where both sides continued to vie for legitimacy and the right to claim the mantle of ‘true’ Bitcoin.

Bringing this history to the present, the dialogue between Larsen and Hodlonaut sheds light on the importance of historical context in the cryptocurrency world. For veterans, the Block Size Wars are a concluded chapter, though its consequences reverberate to this day. For the uninitiated, understanding this history is crucial for informed participation in the community.

As Bitcoin continues to evolve and attract new adopters, the discussions around its past, present, and future are bound to be revisited. The challenge for the community is to navigate these debates constructively, ensuring that historical lessons inform current decisions, and that all voices, old and new, are part of shaping the ongoing narrative of Bitcoin. This is not just a matter of preserving the legacy but is essential for the decentralized ethos of cryptocurrency to continue to thrive in an environment informed by its own complex history.

Big Blockers

Colin Talks Crypto, a podcast host and crypto commentator, has raised a counter argument that challenges a deeply ingrained narrative in the Bitcoin community. According to him, the widespread belief that Bitcoin cannot scale without sacrificing decentralization is not just a misconception but a deliberate falsehood propagated by certain actors within the cryptocurrency sphere.

Colin posits that this narrative was carefully engineered by developers funded by major banks aiming to suppress Bitcoin’s potential. He likens this to tactics seen in broader social media discourse around world politics and health, suggesting that it’s part of a concerted effort of social media engineering.

Countering the scaling skepticism, Colin argues that Bitcoin is inherently capable of scaling without losing its decentralized essence. He points out that there are numerous optimization strategies and technologies which can be leveraged to maintain, or even improve, Bitcoin’s efficiency and functionality while retaining the decentralization that is fundamental to its appeal. These include pruning, SPV wallets, compression techniques, and block propagation technologies like “small blocks”, “thin blocks”, and “xthin blocks”.

Furthermore, Colin highlights the exponential growth in technology over the past decade and a half, citing advancements in bandwidth, storage, and computing power that can support Bitcoin’s scaling. He suggests that naysayers are often those lacking in creativity, technical understanding, or the drive to innovate, echoing sentiments or doctrines set out by certain developers without questioning their validity or motives.

In Colin’s view, the essence of decentralization is not to serve as an end in itself but as a means to achieve censorship resistance. Therefore, if Bitcoin can scale to the point where it remains resistant to censorship, it fulfills its primary objective. He challenges the community to adopt a proactive approach, to ask “how can we make this work?” rather than accepting defeatist attitudes about Bitcoin’s scalability.

What did Satoshi Think?

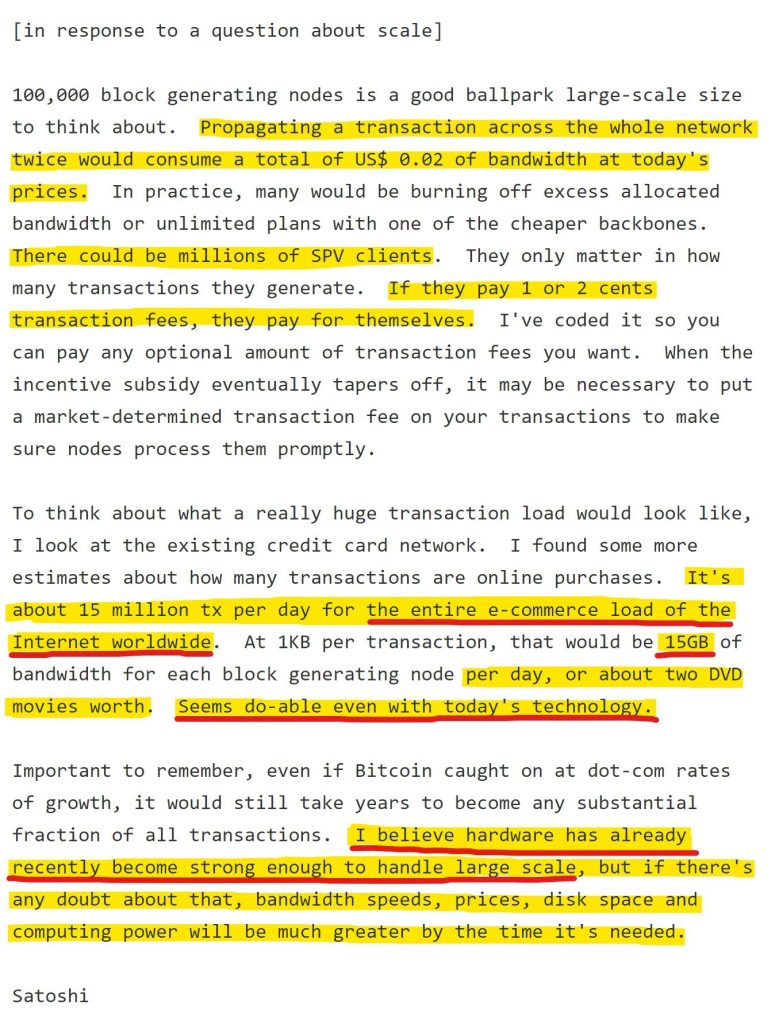

Recent revelations from an email penned by Satoshi Nakamoto, the enigmatic creator of Bitcoin, and revealed in court, have ignited discussions of scaling once again, providing evidence of Satoshi’s stance on the matter.

The content of the email showcases Satoshi discussing the scale at which Bitcoin could operate. He outlines a vision for 100,000 block-generating nodes as a “good ballpark large-scale size” to consider, highlighting the feasibility of propagating transactions across the network at a low bandwidth cost. Satoshi rationalized that the transmission of transactions could be highly affordable, even speculating that in practice, excess bandwidth could accommodate the network’s needs without financial strain.

What stands out in this communication is Satoshi’s anticipation of Bitcoin’s potential growth. He calculated that the system could efficiently handle e-commerce’s demands, estimating a comparison to the global volume of online credit card transactions, and deemed the required data transfer as “do-able” with the technology of his time.

Satoshi’s comments reflect a belief in Bitcoin’s ability to scale massively without compromising its operational integrity. He also foresaw the role of transaction fees in sustaining the network once the block subsidy reduces, suggesting a self-sufficient model where the costs are balanced by the fees generated from transactions.

Furthermore, Satoshi expressed confidence in the existing hardware’s capacity to support Bitcoin’s growth and optimistically projected that technological advancements would continue to outpace the network’s demands. His forward-looking comments suggest that concerns over scalability should not hinder Bitcoin’s development, as he believed future technological improvements would address these issues as they arise.

This unearthed email serves as a critical piece of historical context for the ongoing scalability debate. It highlights Satoshi’s original perspective, providing proponents of significant on-chain scaling with a canonical reference for their arguments. It also reassures the community that Bitcoin was conceived with an inherent belief in its ability to adapt and expand in tandem with technological progress. For many, this is a call to action to continue seeking innovative solutions that align with this vision, ensuring Bitcoin remains a robust and versatile financial system for the future.

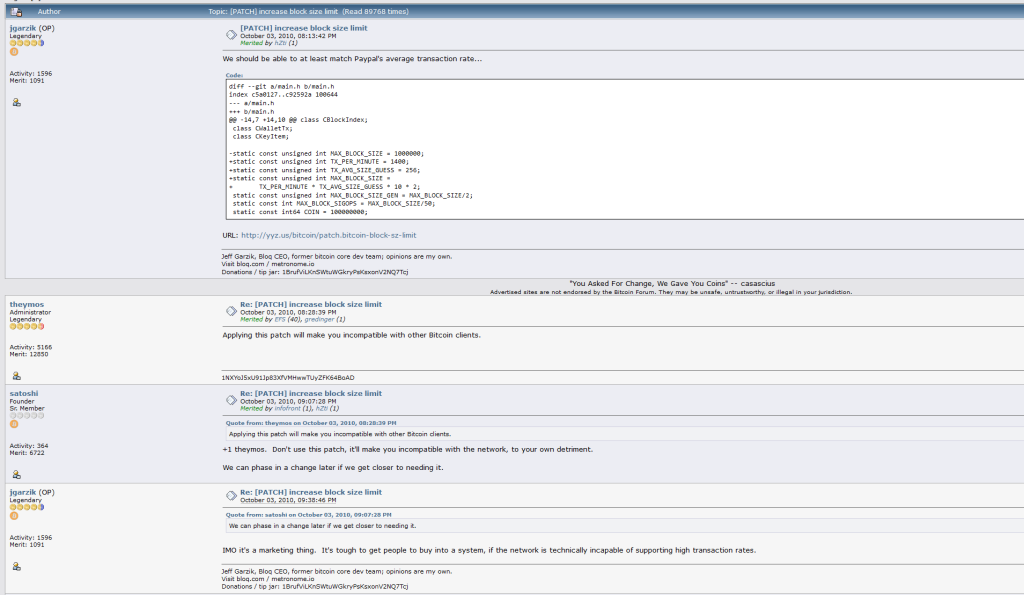

From the above screenshot from the bitcoin.org forum, it is clear that the discussion about block size stretches back to at least October 2010. A substantial discussion took place when a proposed code change was made, aimed to dramatically increase the block size, which proponents argued would allow Bitcoin to process transactions at rates comparable to traditional electronic payment systems like PayPal. This patch, however, was met with skepticism by core contributors including Theymos and even Satoshi himself.

Theymos, a figure with a long-standing presence in the Bitcoin community, warned in 2010 that such a change would lead to incompatibility issues with other Bitcoin clients, effectively bifurcating the network and potentially isolating users who adopt the patch. The cautionary stance was echoed by Satoshi, who acknowledged the patch’s contentious nature and suggested a more conservative approach, focusing on the long-term scalability rather than a quick fix that could jeopardize the network’s unified integrity.

The person that recommended this patch in 2010 was Jeff Garzik, ex-Bitcoin Core dev and Red Hat veteran, who later co-founded Bloq for multi-chain blockchain solutions. His Linux work is in all Androids and many data centers. He’s an advisor to several crypto firms and notably gave away 15,678 BTC in early Bitcoin bounties.

Jeff defended the marketing perspective of the patch, pointing to the necessity for Bitcoin to meet mainstream transaction demands to gain widespread adoption. However, Satoshi advised against using the patch due to its network-incompatible risks, highlighting the importance of consensus and the peril of hasty unilateral actions.

Satoshi has also discussed Layer 2 solutions so to say that he was a big blocker will not be factually correct based on the above. However it is clear that he did support scaling of Bitcoin as a P2P electronic cash system in a variety of ways that perhaps encapsulate both big and small blocker ideology. But even Satoshi perhaps could not have foreseen certain pitfalls and risks associated with scaling that would have influenced his decision on the matters covered here.

Roger Ver’s Stance & Past Actions

Roger Ver is a notable figure in crypto, and was very involved in the early days of Bitcoin, which made him famous for his videos and active promotion of the cryptocurrency. He was an early investor in Bitcoin startups and advocated for its adoption as a means of fostering economic freedom. Ver’s stance on increasing the block size to improve transaction efficiency led him to support Bitcoin Cash (BCH), a fork of Bitcoin, which he continues to promote as closer to the original vision of Satoshi Nakamoto, Bitcoin’s pseudonymous creator. His views and actions have made him a polarizing figure in the community, drawing both admiration and criticism.

As part of a string of controversies, his endorsement of Mt. Gox prior to its collapse in 2014 is well-documented. Ver made a video addressing the withdrawal issues of Mt. Gox, where he suggested that the traditional banking system, not Mt. Gox itself, was to blame for the exchange’s issues. This video was created months before the collapse of Mt. Gox, where it was later revealed that a significant amount of Bitcoin was missing from the exchange.

Moreover, Ver’s alignment with figures like Jihan Wu, as well as his partnerships with Craig Wright – where eventually claimed he was conned and apologized for – and Calvin Ayre, are often highlighted as part of his more infamous history within the industry. More recently, Ver has been back in the news due to allegations regarding an outstanding debt. CoinFLEX, a cryptocurrency exchange, has claimed that Ver owes them $47 million due to a defaulted contract, which has been publicly disputed by Ver himself.

The curiosity around this debate took a turn when Roger Ver made a substantial offer to Adam Back. Ver, not one to shy away from controversy, proposed the repeat of a public debate over the block size limit. As an incentive for Back to participate, Ver pledged a hefty sum of $100,000 USD to a charity of Back’s choice. Doubling down, Olivier Janssens announced that he had upped his offer to $250,000 USD, matched by Ver, bringing the total charitable donation to an impressive $500,000 USD should Back agree to the debate.

This proposition has caused some interest in the crypto community. With Laura Shin, a well-regarded journalist in the space, suggested as the moderator, the potential debate is set to capture the attention of crypto enthusiasts worldwide. As of yet, Back has not publicly responded to the challenge, leaving many in the community in suspense and eager for a fresh confrontation on an old debate.

The Background

The Block Size Wars, a significant period in Bitcoin’s history between 2015 and 2017, were marked by a contentious debate over the cryptocurrency’s scalability. The community was divided into two factions: those advocating for larger block sizes, known as ‘Big Blockers,’ who argued that it would lead to lower fees and faster confirmation times, and the ‘Small Blockers,’ who maintained that smaller blocks were crucial for preserving Bitcoin’s decentralization and security.

The ongoing disagreements resulted in several proposals to address the scalability issue. The Big Blockers, for instance, suggested changes like Bitcoin Unlimited, which would allow for larger blocks. Small Blockers, on the other hand, prioritized network security and the development of solutions like Segregated Witness (SegWit) and the Lightning Network, which aimed to enhance transaction capacity without compromising the network’s foundational principles.

SegWit, in particular, was a significant compromise that effectively increased the block size limit by changing how transaction data was stored and verified, and also enabled the development of the Lightning Network for off-chain transactions. This innovation alleviated some congestion on the primary Bitcoin network by enabling more efficient transaction processing.

Ultimately, the inability to reach a consensus led to the hard fork that created Bitcoin Cash (BCH), a variant of Bitcoin with a larger block size. Despite the fractious debates and the fork, Bitcoin (BTC) remained the dominant and most recognized version of the currency.

The Block Size Wars underscored the complex interplay between scalability, decentralization, and network security. These events also highlighted the resilience of Bitcoin’s governance model, where widespread consensus is necessary for significant changes to be adopted. The debates have cooled since the adoption of SegWit, but the discussion on how to best scale the network continues as Bitcoin evolves.

Author Profile

- Lucy Walker covers finance, health and beauty since 2014. She has been writing for various online publications.

Latest entries

- June 30, 2025NewsWireBank Savings at Risk: The Dark Side of EU’s Savings Standard

- April 25, 2025Global EconomicsWhistleblowers Unmask Schwab’s Toxic WEF Secrets

- April 9, 2025Global EconomicsTariff Tensions Drive Market Volatility

- March 18, 2025Global EconomicsRed in Name Only: Labour’s War on the UK Working Class