In a decisive turn of legal proceedings, the UK High Court has concluded the case involving Dr. Craig Steven Wright and the Crypto Open Patent Alliance (COPA). Dr. Wright, who has long claimed to be Satoshi Nakamoto, the enigmatic creator of Bitcoin, has been facing allegations challenging the authenticity of his claims. Mr Justice Mellor presided over the joint trial, which has culminated in a series of definitive declarations.

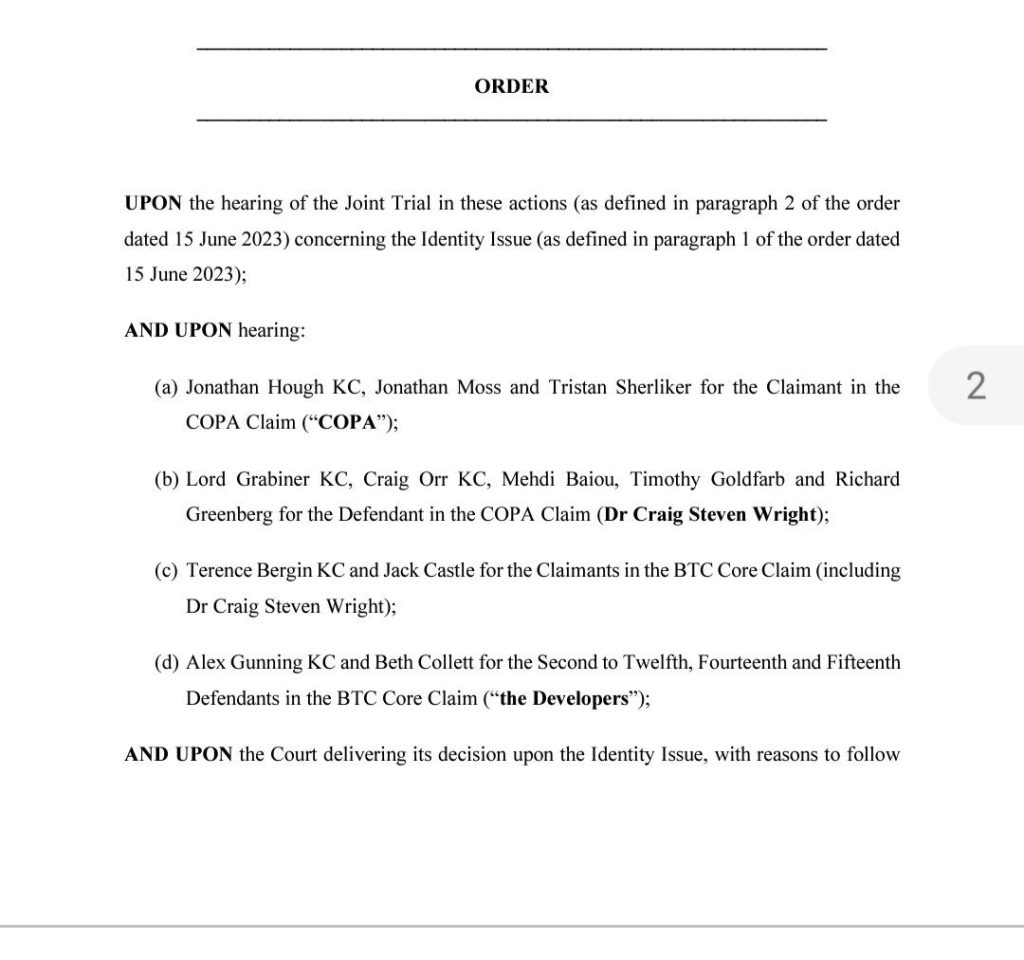

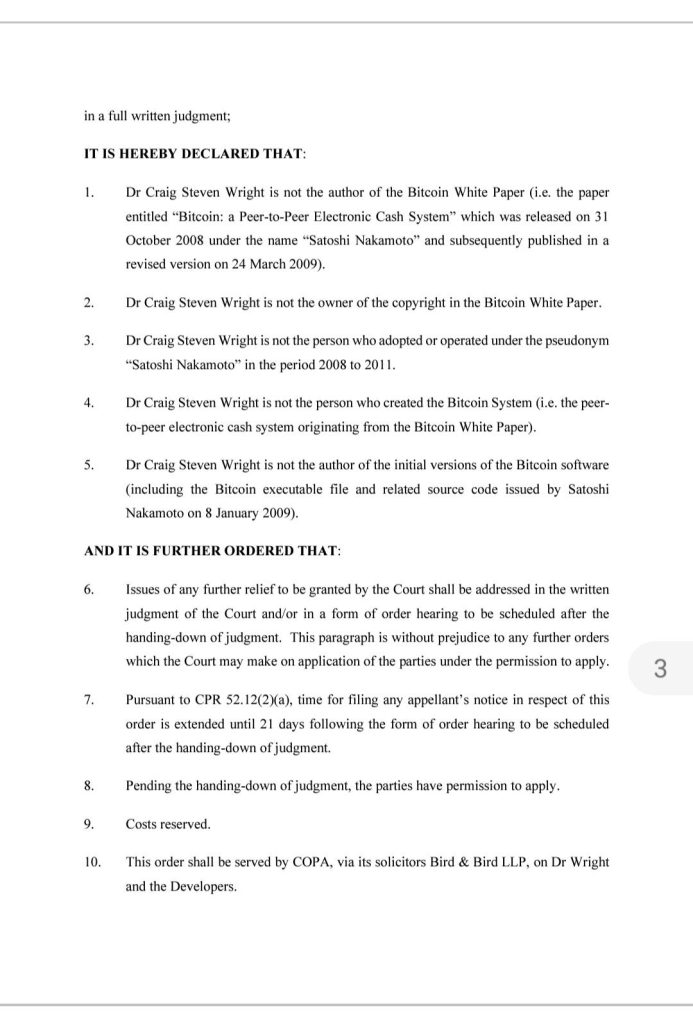

The court ruled unequivocally that Dr. Craig Steven Wright is not the author of the Bitcoin White Paper, nor is he the owner of the copyright in the document. Furthermore, the court found that Dr. Wright is not the person who adopted or operated under the pseudonym “Satoshi Nakamoto” from 2008 to 2011, and he did not create the peer-to-peer electronic cash system originating from the Bitcoin White Paper. Additionally, Dr. Wright was not identified as the author of the initial versions of the Bitcoin software, including the Bitcoin executable file and related source code issued by Satoshi Nakamoto on 8 January 2009.

The findings of the court have significant implications for the cryptocurrency community and the ongoing debate about the origins and authorship of Bitcoin. The judgment further details that Dr. Wright has engaged in the forgery of documents and has been dishonest in his testimony, casting serious doubt on his previous assertions and damaging his credibility.

As the community digests the outcomes of this trial, the overarching message from the UK High Court is a reaffirmation of the importance of veracity and integrity within the realms of intellectual property and technological innovation. With the final judgment pending, the crypto world awaits further details, which could potentially shed more light on the events that led to this historic legal conclusion and the consequences for the parties involved.

Frozen Assets

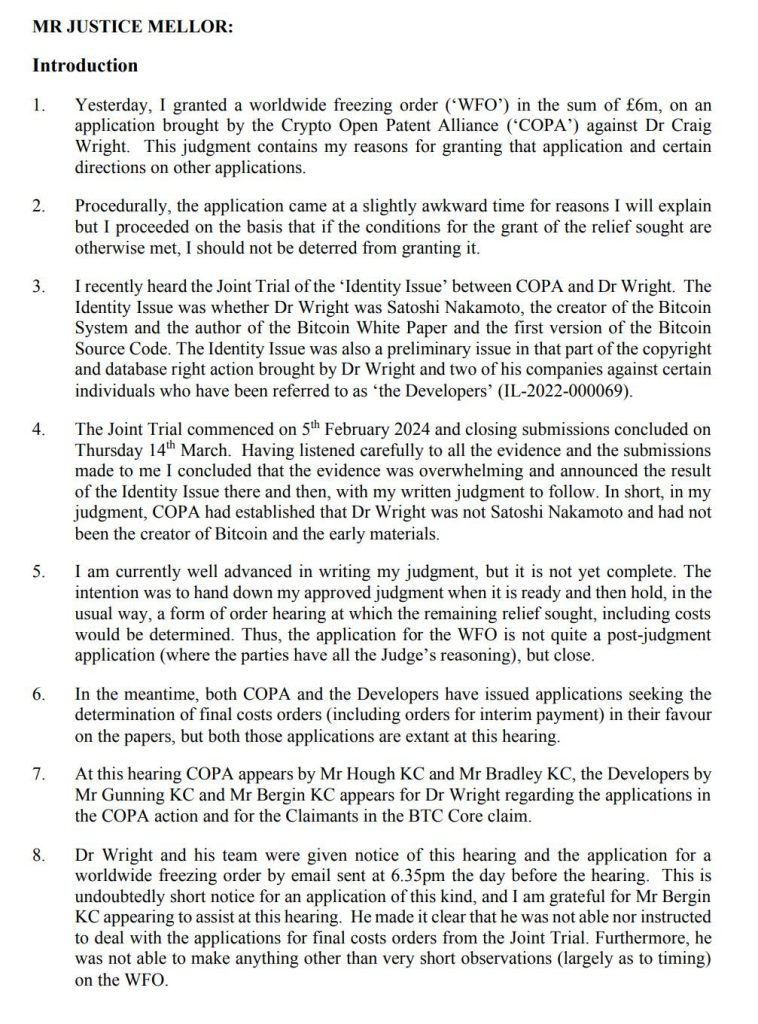

The court has issued a worldwide freezing order (‘WFO’) against Dr. Wright for the sum of £6 million. The order was granted on the application of the Crypto Open Patent Alliance (‘COPA’), which pursued legal action against Dr. Wright over his assertions of being the creator of Bitcoin and the author of the Bitcoin White Paper.

During the Joint Trial of the ‘Identity Issue’ between COPA and Dr. Wright, the matter under contention was whether Dr. Wright was indeed Satoshi Nakamoto. The court concluded overwhelmingly against Dr. Wright’s claim, stating that COPA had established that he was not Satoshi Nakamoto and had not been the creator of Bitcoin and the early materials. The judgment, still in progress, is set to offer further details and reasoning behind the decision.

Mr Justice Mellor noted that Dr. Wright had engaged in the forgery of documents on a grand scale and that throughout his cross-examination, he lied extensively and repeatedly. This behavior was pointed out as consistent with the tendency observed in other legal proceedings involving Dr. Wright, where he also provided dishonest evidence under oath. The judgment paints a picture of a man who is considered to be well-versed in the art of evasion and who has showcased a propensity to mislead and manipulate legal structures.

In addition, the court remarked on Dr. Wright’s asset structures, noting his use of offshore structures combined with a narrative of being judgment-proof, further compounding the complexity of enforcing the WFO. These revelations contribute to a narrative of a man whose actions have not only challenged his own credibility but have also stirred the broader cryptocurrency community, raising serious questions about the integrity of claims within this innovative yet still maturing industry.

Community Reaction

The UK High Court’s decision against Dr. Craig Steven Wright has sparked a torrent of reactions from industry observers, many of whom have long questioned his claim to be Satoshi Nakamoto. Frank Rundatz, for instance, has emphasized the gravity of Wright’s alleged document forgery, branding BSV, the cryptocurrency associated with Wright, as the brainchild of a “fraudulent conman.”

Peter McCormack, a notable figure in the crypto space, expresses doubt about the recoverability of funds, suggesting that Wright’s assets may already be depleted. This sentiment echoes the concerns of many who feel impacted by the case, pondering the likelihood of recouping losses from Wright’s alleged misdeeds.

J Nicholas Gross offers a sarcastic retort to claims of Wright’s innocence, pointing out the irony in Wright allegedly owing COPA a hefty sum despite previous assertions of owing nothing. This highlights the disconnect between Wright’s past public stances and the realities imposed by the legal system.

Moreover, prominent figures such as Arthur van Pelt and Christen Ager-Hanssen have expressed satisfaction with the court’s judgment, underscoring that it validates their persistent skepticism regarding Wright’s claims. Ager-Hanssen, in particular, has taken to social media to express relief and joy at the court’s ruling, calling out backers like Calvin Ayre for their unwavering support of Wright, despite the overwhelming evidence presented against him.

I am going to assume he has close to zero assets remaining. Chances of getting our money back are very low.

Peter McCormack

Jimmy N. Lose didn’t hold back, describing the court’s freezing order as going beyond the term ‘rekt,’ underscoring the severity of the situation for Wright. He wryly noted that while Wright’s assets are frozen, others in the crypto space continue to freely transact, highlighting the irony of the situation for someone who once claimed to be a pioneer of the industry.

Hodlonaut, another vocal figure in the crypto space, commented on the damning nature of the court’s findings, pointing out Wright’s extensive and repeated lies during his cross-examination. The anticipation for a “brutal” final written judgment reflects the community’s expectation for a comprehensive and perhaps unsparing conclusion to this case.

Peter Faketoshi, a play on the Satoshi Nakamoto pseudonym, seized the moment to suggest that a criminal referral to the Crown Prosecution Service (CPS) is now more likely. This sentiment signals the gravity of the High Court’s findings and the potential for further legal ramifications.

In a climate rife with misrepresentation, the court’s order stands as a stark reminder of the need for integrity and veracity in the crypto industry. The observers’ comments reflect a shared sense among many in the community that the legal decision is a step toward upholding these values and protecting the community from potential deception.

The ramifications of the court’s findings against Craig Wright could resonate far beyond the courtroom, influencing how he continues to operate in the space, with the final ruling still hanging over his head.

Author Profile

- Lucy Walker covers finance, health and beauty since 2014. She has been writing for various online publications.

Latest entries

- June 30, 2025NewsWireBank Savings at Risk: The Dark Side of EU’s Savings Standard

- April 25, 2025Global EconomicsWhistleblowers Unmask Schwab’s Toxic WEF Secrets

- April 9, 2025Global EconomicsTariff Tensions Drive Market Volatility

- March 18, 2025Global EconomicsRed in Name Only: Labour’s War on the UK Working Class