In a significant move reflecting the growing institutional interest in Bitcoin, U.S. Exchange-Traded Funds (ETFs) have collectively purchased 5,240 BTC, valued at approximately $295 million. This strategic acquisition underscores a robust demand for Bitcoin despite recent market volatility.

Major Players in the Bitcoin ETF Market

Here’s a breakdown of the major players and their recent Bitcoin acquisitions:

- BlackRock: 3,320 BTC

- Fidelity: 1,100 BTC

- Grayscale: 450 BTC

- Bitwise: 195 BTC

Nate Geraci, a well-known financial analyst, highlighted the substantial inflow into Bitcoin ETFs, amounting to $438 million over the past two days. Geraci’s observation counters the narrative that Bitcoin ETFs are predominantly held by retail investors who might flee during downturns. Instead, the significant purchases by established financial institutions suggest a long-term bullish sentiment towards Bitcoin.

German Government’s Bitcoin Holdings

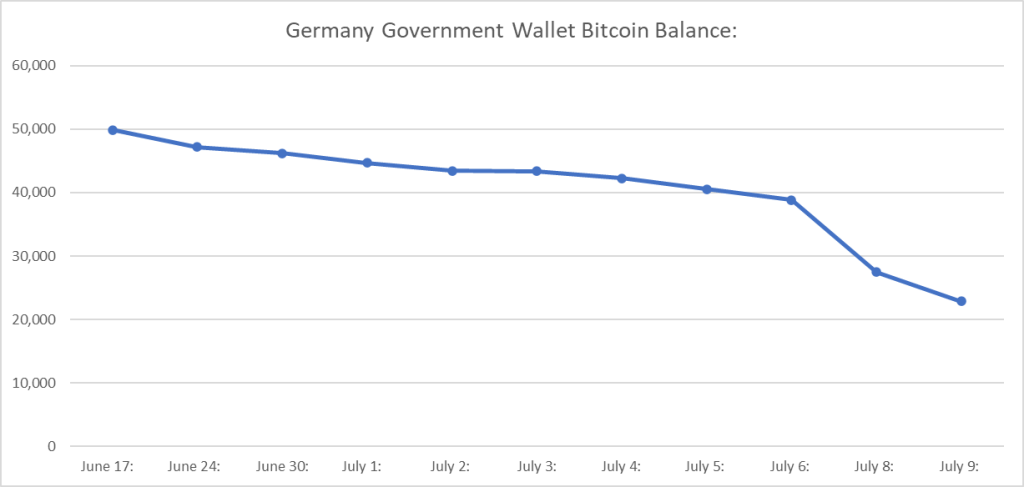

Meanwhile, the German government has reduced its Bitcoin reserves to 22,800 BTC, less than half of its original holdings. This reduction has coincided with the increased acquisitions by U.S. ETFs, indicating a potential transfer of Bitcoin wealth across national boundaries. Carl B Menger, an economic commentator, described this as an “intergenerational transfer of wealth between nations,” emphasizing the important moment in the global financial landscape.

Bitcoin vs. Euro: A Tale of Diverging Fortunes

Few comparisons are as striking as that between Bitcoin and the Euro in finance right now. Daniel Sempere Pico, known as @BTCGandalf on Twitter, recently made a thought-provoking statement: “Imagine selling bitcoin to buy euros.” This sentiment encapsulates the contrasting trajectories of these two forms of currency over the past two decades.

From 2000 to 2020, the purchasing power of one Euro has seen a significant decline. Starting from a value close to 1.4€, it has steadily decreased to just above 1€ in 2020. This decline represents the euro’s diminished ability to purchase goods and services over time, a reflection of inflation and other economic factors affecting the Eurozone. As the purchasing power of the euro has eroded, it highlights the challenges faced by traditional fiat currencies in maintaining value over extended periods.

In stark contrast, Bitcoin’s journey has been one of exponential growth. From virtually negligible value in its early days, Bitcoin has soared to impressive heights, reaching over $57,000 as of the latest data. This dramatic increase underscores Bitcoin’s appeal as a store of value and investment vehicle, especially in an era where traditional currencies are struggling with inflation and depreciating purchasing power.

The contrasting fortunes of the Euro and Bitcoin raise important questions about the future of money and investment. Bitcoin, with its decentralized nature and finite supply, offers a compelling alternative to traditional fiat currencies. It provides a hedge against inflation and a potential refuge for those seeking to preserve their wealth in uncertain economic times.

Daniel Sempere Pico’s remark, “Imagine selling bitcoin to buy euros,” resonates deeply with those who have witnessed Bitcoin’s rise. Trading a rapidly appreciating asset like Bitcoin for a depreciating fiat currency seems counterintuitive. This perspective is further reinforced by the market dynamics and investor behavior observed in recent years.

Market Reactions and Analysis

Last week was challenging for Bitcoin bulls, but the market’s resilience is noteworthy. Observers noted a higher Relative Strength Index (RSI) bottom amid the decline, signaling a positive divergence. This pattern suggests potential bullish momentum, contrasting with the negative divergence that marked the market’s peak in March.

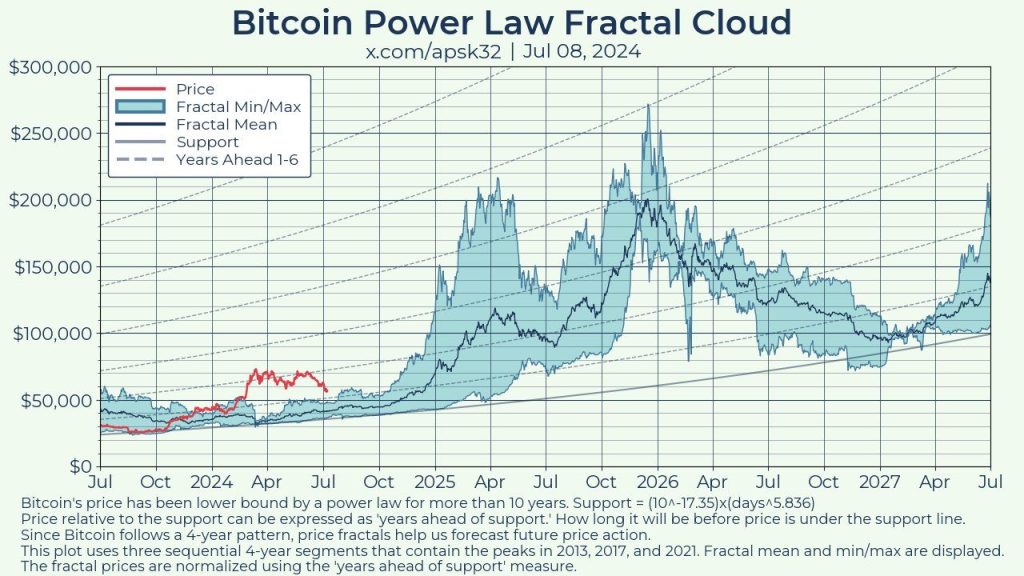

Bitcoin supporter and engineer @apsk32 discusses the cyclical patterns of Bitcoin prices, suggesting that prices should remain within or near a specific “fractal cloud” representing these cycles. He attributes recent deviations, such as the price surge due to ETF announcements, to temporary anomalies. He forecasts that Bitcoin may see a significant price increase, potentially up to four times its current value by the end of 2025, based on historical patterns.

@apsk32 delves into the concept of Bitcoin ‘cycles’ and how historical price data can be used to predict future prices through fractals. He explains the challenges of selecting the start date and scaling prices for these fractals. He prefers using a simple four-year cycle for these predictions, believing that the cycles are more psychological than driven by actual decreases in Bitcoin issuance. He also criticizes the use of percentage gain scaling, advocating instead for a time-based metric derived from Bitcoin’s power law support.

To support his predictions, @apsk32 introduces the concept of ‘years ahead of support’ as a stable metric for measuring Bitcoin’s price relative to its minimum expected value based on the power law. He uses this metric to create a fractal cloud from three past four-year cycles, providing a visual representation of where Bitcoin prices might head. He acknowledges that deviations can occur, as seen with the recent ETF-driven price surge, but suggests that the long-term patterns remain robust. He plans to share additional resources to help explain these concepts further.

Mt. Gox Bitcoin Distribution

Mt. Gox, launched in 2010, was a pioneering Bitcoin exchange based in Shibuya, Tokyo, Japan. By early 2014, it handled over 70% of all Bitcoin transactions worldwide, making it a dominant force in the cryptocurrency market. However, its success was abruptly halted in 2014 due to severe security breaches.

The first major hack occurred in June 2011, when hackers compromised an auditor’s computer, manipulating the price of Bitcoin to just 1 cent and exploiting this to acquire about 2,000 Bitcoins at this artificial price. Despite efforts to bolster security, Mt. Gox was hit again in 2014 by a catastrophic hack, leading to the theft of 744,408 Bitcoins. The company initially failed to detect the theft, mistakenly believing the stolen Bitcoins were being transferred to secure accounts.

Following the 2014 hack, Mt. Gox ceased operations, filed for bankruptcy, and later discovered 200,000 Bitcoins in old accounts. These Bitcoins have been held in a protected status for creditors. In November 2021, the trustee overseeing the bankruptcy announced a court-approved plan to reimburse creditors, with payouts scheduled between July and October 2024. Mt. Gox announced it would begin distributing 141,868 BTC, worth $9 billion, which were stolen from its customers in 2014 (BTC price was $360).

The potential for a massive sell-off by creditors receiving their funds has generated significant FUD (fear, uncertainty, and doubt) in the market, influencing Bitcoin’s price movements and market sentiment. This development underscores the ongoing impact of Mt. Gox on the cryptocurrency ecosystem, even years after its downfall.

The Future is Orange

The recent influx of institutional investments into Bitcoin ETFs, despite market downturns, signals strong confidence in Bitcoin’s long-term value proposition. This strategic accumulation by financial giants like BlackRock and Fidelity, juxtaposed with Germany’s selling and Mt. Gox’s asset distribution, highlights the dynamic and evolving nature of the Bitcoin market. As the landscape continues to shift, market participants remain bullish, anticipating further developments in this intriguing interplay of global financial forces.

As we move forward, the juxtaposition of Bitcoin’s growth and the Euro’s decline serves as a powerful reminder of the evolving landscape of finance. Investors and individuals are increasingly looking towards alternatives like Bitcoin to safeguard their financial future. The data and trends depicted in the graphs tell a story of a digital currency that has not only survived but thrived, offering a glimpse into the potential future of global finance.

Together, these insights underscore the profound shifts occurring in the financial world. The robust institutional backing of Bitcoin, even during periods of volatility, underscores a growing trust in its resilience and long-term potential. Meanwhile, the diminishing purchasing power of the Euro further amplifies Bitcoin’s appeal as a stable and appreciating asset. As institutional and individual investors alike navigate this transforming financial terrain, Bitcoin’s role appears increasingly pivotal, heralding a new era in global finance.

Author Profile

- Lucy Walker covers finance, health and beauty since 2014. She has been writing for various online publications.

Latest entries

- April 25, 2025Global EconomicsWhistleblowers Unmask Schwab’s Toxic WEF Secrets

- April 9, 2025Global EconomicsTariff Tensions Drive Market Volatility

- March 18, 2025Global EconomicsRed in Name Only: Labour’s War on the UK Working Class

- March 7, 2025SatoshiCraig Wright Banned from UK Courts with Civil Restraint Order