In the midst of recent regulatory upheavals, a significant yet under-discussed financial crisis has emerged: the Synapse bankruptcy. This fintech meltdown has led to the freezing of up to $150 million in user funds, affecting numerous fintech apps and their customers. This crisis exposes the fragility of modern fintech ecosystems, which often rely on a complex web of intermediaries to manage user funds.

The Role of Fintech Apps and Synapse’s Collapse

Modern consumers increasingly use fintech applications to manage their finances. These apps typically provide a user-friendly frontend, while actual banking services, such as accounts and FDIC protection, are managed by partner banks. Synapse, a startup, acted as an intermediary, connecting around 100 fintech brands with approximately 20 banking vendors, including Evolve Bank & Trust. It served up to 10 million end users by facilitating transactions and account management.

However, in April, Synapse filed for bankruptcy, leading to chaos in the fintech landscape. By May 11, Synapse disabled access to its system, effectively freezing transactions and deposits for many end users. The fallout was swift and severe, with customers of various fintech apps suddenly unable to access their funds.

The Blame Game and Financial Turmoil

The situation quickly devolved into a blame game. Synapse accused Evolve Bank & Trust of being responsible for $50 million in missing depositor funds. Evolve, in turn, asserted its stability and criticized Synapse for cutting off system access over a weekend, exacerbating the crisis. Synapse CEO Sankaet Pathak countered, suggesting that Evolve’s public statements omitted crucial details about the situation.

As a result, potentially 200,000 or more people across 20 banks found themselves entangled in a web of IOUs and legal ambiguities, unsure if and how they could access their money. This confusion starkly contrasts with the clarity offered by Bitcoin.

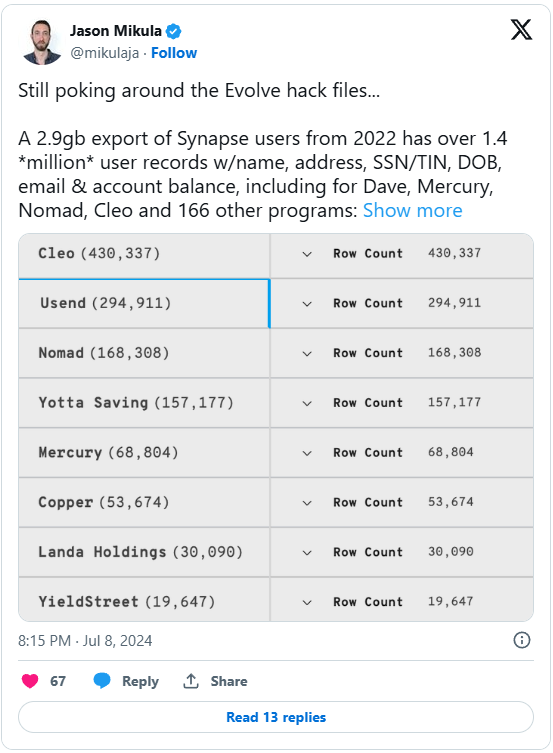

In addition to these developments, a data breach has further complicated matters. According to a tweet by Jason Mikula, an export of Synapse user data from 2022 revealed over 1.4 million user records, including sensitive information such as names, addresses, SSNs/TINs, DOBs, emails, and account balances. This breach affects multiple programs, including Dave, Mercury, Nomad, and Cleo, among others, highlighting the extensive reach and impact of Synapse’s failure.

Allegations of Fraud

A series of tweets and leaked communications have shed light on deeper issues. Former Synapse employees, including ex-CEO Sankaet Pathak, allegedly retained access to key systems, such as MongoDB, even after the company filed for bankruptcy. This administrative access, combined with alleged manipulation of data, suggests a deliberate attempt to conceal fraudulent activities.

Chris Slaughter, a vocal critic and industry insider, highlighted the systemic failures in a series of tweets and emails. He accused Evolve Bank of complicity, stating that the bank used its knowledge of Synapse’s fraudulent activities to safeguard its corporate customers while offloading losses onto direct deposit account (DDA) holders. This maneuver has intensified scrutiny on Evolve’s role and its responsibility in overseeing Synapse’s operations.

The email exchange between Chris Slaughter and Cecilia Russell from Evolve underscores the frustration and complexity of the situation. Slaughter pointed out that Evolve’s repeated failures to address complaints and coordinate effectively with regulators were indicative of a broader issue. He emphasized that Evolve’s lack of oversight for Synapse’s actions might render it unfit to continue offering neobanking services in the U.S.

MongoDB

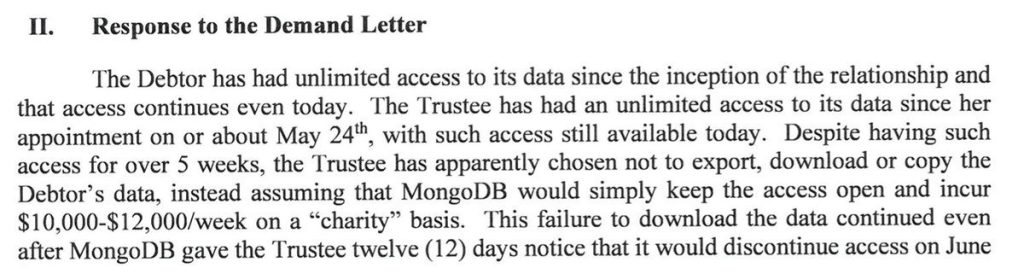

The Synapse bankruptcy case has revealed significant friction between the Synapse Financial Technologies Inc. trustee and MongoDB. According to the supplemental status report, MongoDB contends that Synapse had unlimited access to its data from the beginning of their relationship, continuing even today. The trustee, appointed on or about May 24th, also had unlimited access to this data. However, despite over five weeks of access, the trustee did not export, download, or copy the debtor’s data.

MongoDB noted that this inaction persisted even after it provided a 12-day notice that access would be discontinued on June 24th. The letter from MongoDB highlighted the assumption by the trustee that MongoDB would maintain access on a “charity” basis, incurring costs of $10,000 to $12,000 per week. This assumption, along with the failure to secure the data, has contributed to the complexity and challenges of the ongoing bankruptcy proceedings.

The report underscores the need for clear communication and decisive action in managing data access and preservation during bankruptcy cases, particularly when involving multiple stakeholders and significant financial implications.

Bitcoin’s Solution: Self-Custody and Transparency

Bitcoin presents a radically different approach to financial management. As an independent cryptographic system with a public ledger, Bitcoin eliminates the confusion and risk associated with intermediaries. Ownership is clear and verifiable, and those who hold their own keys can move their Bitcoin without needing permission from any third party.

Nick Neuman, co-founder of Casa, a Bitcoin storage solution, emphasizes the importance of self-custody in avoiding the systemic risks highlighted by the Synapse crisis. Casa is dedicated to providing simple and secure self-custody solutions, allowing users to hold their own keys and manage their Bitcoin independently of traditional banking systems. This model ensures that users retain full control over their assets, mitigating the risks posed by intermediary failures and regulatory uncertainties.

Fintech Meltdown

The Synapse bankruptcy and ensuing fintech meltdown underscore the vulnerabilities inherent in modern financial ecosystems reliant on complex webs of intermediaries. In contrast, Bitcoin’s transparent and decentralized nature offers a compelling alternative, emphasizing the importance of self-custody and independent asset control. As fintech continues to evolve, the principles of Bitcoin and self-custody could play a crucial role in shaping a more resilient and user-centric financial future.

Author Profile

- Lucy Walker covers finance, health and beauty since 2014. She has been writing for various online publications.

Latest entries

- June 30, 2025NewsWireBank Savings at Risk: The Dark Side of EU’s Savings Standard

- April 25, 2025Global EconomicsWhistleblowers Unmask Schwab’s Toxic WEF Secrets

- April 9, 2025Global EconomicsTariff Tensions Drive Market Volatility

- March 18, 2025Global EconomicsRed in Name Only: Labour’s War on the UK Working Class