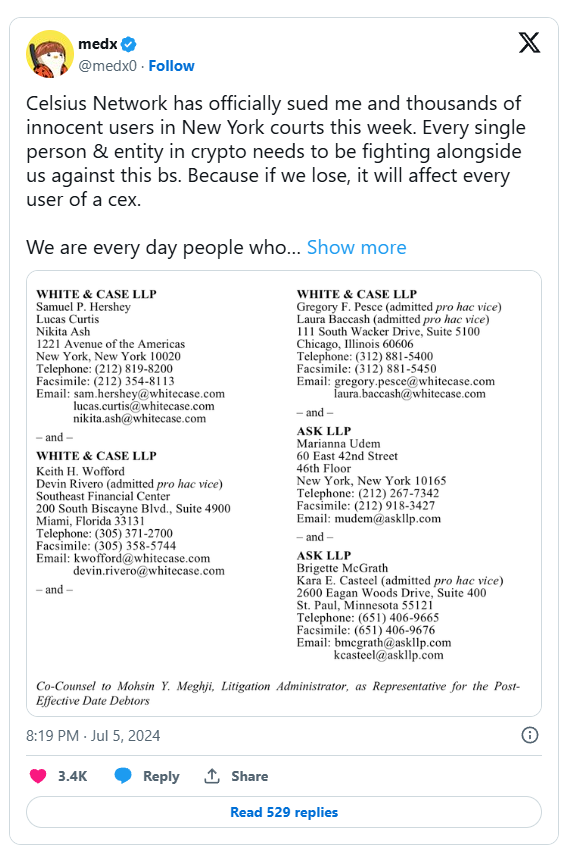

In a shocking move that has caused outrage, the bankrupt crypto lender, Celsius Network has initiated lawsuits against numerous users in New York courts. The suits target individuals who withdrew funds from the platform within the 90-day window preceding Celsius’ bankruptcy declaration. This aggressive legal strategy has raised alarm across the crypto industry, prompting calls for collective action to combat what many see as an unjust attack on ordinary users.

The lawsuits demand the return of funds withdrawn before the bankruptcy, citing market rates as of June 14, 2024, rather than the values at the time of withdrawal in 2022. This adjustment significantly increases the amounts being claimed, putting immense financial strain on the defendants. One affected user expressed the frustration and disbelief felt by many: “They are asking for outrageous sums of money, basically my entire net worth is what I’m being sued for, for doing absolutely nothing wrong.”

The Legal Battle: A Nightmare for Users

The move by Celsius has been widely condemned as a draconian measure that punishes everyday users rather than addressing issues with insiders or bad actors. Many of the targeted individuals are now facing the daunting prospect of substantial legal fees to defend themselves. “At first I thought this was a scam and then some shakedown, but now that the suit is actually filed, I have to spend thousands to retain an attorney,” one user lamented.

Adding to the outrage is the claim that the recovered funds are intended to be redistributed to other users of the platform. Critics argue that the majority of the money will ultimately go to lawyers rather than providing meaningful compensation to those who lost funds in the Celsius collapse. “The lawyers say they are going to give the money to other users of the platform and spread it around, but that’s a joke. Those folks will get fractions of a penny on the dollar,” the same user noted.

Industry Reactions: Solidarity and Strategy

The response from the broader crypto community has been swift and vocal. Industry leaders and influencers have rallied in support of the affected users, emphasizing the potential repercussions for the entire sector if Celsius’ actions set a precedent. David “JoelKatz” Schwartz highlighted a critical concern in his tweet: “Are they seeking only the return of non-existent profits? Or are they seeking a return of withdrawn principal as well?”

medx0, who has been allegedly sued, voiced frustration with the settlement terms: “The only reasonable settlement in my view would’ve been to ask for the ‘earn profits’ from the 90-day lookback period. Instead, they started off asking for 27% of all principal as a settlement, which came across as a giant scam.”

Legal and Financial Implications

The legal complexities of the case have left many feeling overwhelmed and uncertain about their future. Justin Taylor shared his experience of consulting with an attorney and ultimately settling, despite his belief that he had little chance of success in court. “I consulted with an attorney and settled. It’s insane and so upsetting, but my understanding was I didn’t have much of a case.”

Call to Action: Uniting Against Celsius’ Legal Strategy

As the lawsuits proceed, there is a growing call for unity and action within the crypto community. Users and advocates are urging prominent figures in the industry to help fund a robust legal defense and push for the case to be dismissed. The overarching message is clear: this fight goes beyond the individuals involved and touches on the principles of fairness and justice within the cryptocurrency ecosystem.

One user’s plea encapsulated the collective sentiment: “Everyone in the industry needs to unite against this. We need to get this case tossed. These are the lawyers making everyone’s life hell. Along with Cam Crews of the Celsius LOC. Thank you everyone for spreading the word. We need to fight this together as a united front.”

Alex Mashinsky Trial Date

The trial date for Alex Mashinsky, the former CEO of the bankrupt crypto lender Celsius Network, has been set for September 17, 2024. This decision was made during a hearing in the U.S. District Court for the Southern District of New York. During the hearing, Mashinsky’s defense lawyers hinted that they might question whether cryptocurrency can be considered a security, citing the fluidity of current securities law.

Celsius Network filed for Chapter 11 bankruptcy in July 2022, and Mashinsky subsequently resigned. In July 2023, Mashinsky was arrested and charged with wire fraud, conspiracy to manipulate the value of Celsius’s native token (CEL), among other crimes. He has denied all charges. Multiple U.S. agencies, including the SEC, DOJ, and FTC, have filed suits against him.

Recently, Roni Cohen-Pavon, a former Celsius executive, pleaded guilty to criminal charges and agreed to cooperate with ongoing investigations.

On the business front, Celsius has sought court approval for its final restructuring plan, which aims to distribute $2 billion worth of Ethereum (ETH) and Bitcoin (BTC) to creditors by the end of the year.

The Path Forward: Decentralization and Resilience

The unfolding drama underscores the importance of decentralization and resilience in the cryptocurrency space. As Celsius’ legal tactics come under scrutiny, the community is reminded of the critical need to build systems that protect users and uphold the foundational values of the crypto movement. The ongoing support and advocacy efforts will be crucial in determining the outcome of this pivotal moment for Celsius users and the broader crypto landscape.

In summary, Celsius Network’s legal action against its users has galvanized the cryptocurrency community, leading to widespread condemnation and calls for unified resistance. The outcome of this battle could have far-reaching implications for centralized exchanges and their accountability to users.

Author Profile

- Lucy Walker covers finance, health and beauty since 2014. She has been writing for various online publications.

Latest entries

- April 25, 2025Global EconomicsWhistleblowers Unmask Schwab’s Toxic WEF Secrets

- April 9, 2025Global EconomicsTariff Tensions Drive Market Volatility

- March 18, 2025Global EconomicsRed in Name Only: Labour’s War on the UK Working Class

- March 7, 2025SatoshiCraig Wright Banned from UK Courts with Civil Restraint Order