In what some speculate a significant move, Russian President Vladimir Putin has signed a law legalizing Bitcoin and cryptocurrency mining within the country, according to a press release by Russian news agency TASS. This landmark legislation is poised to reshape the digital currency landscape in Russia, providing a formal framework for an activity that has operated in a grey area for years.

New Legal Definitions Framework

The newly signed law introduces several key concepts to the Russian legal lexicon, including digital currency mining, mining pool, mining infrastructure operator, address identifier, and the individual who organizes mining pool activities. This comprehensive approach underscores the government’s intent to regulate and integrate cryptocurrency mining into the broader economic system. Notably, mining is recognized not as the issuance of digital currency but as a component of its turnover, delineating its role within the financial ecosystem.

Mining Rights and Regulations

The legislation stipulates that only Russian legal entities and individual entrepreneurs included in a specific register will have the right to mine cryptocurrencies. This registry is likely aimed at ensuring compliance with national standards and regulations, fostering a transparent and controlled environment for mining operations.

However, the law also makes provisions for individuals, allowing them to mine digital currencies without registration, provided they do not exceed government-set energy consumption limits. This clause appears to balance regulatory oversight with individual freedoms, encouraging wider participation in cryptocurrency mining while maintaining control over resource consumption.

Foreign Digital Financial Assets & the Bank of Russia

In a bid to integrate Russia into the global cryptocurrency market, the law permits the trading of foreign digital financial assets on Russian blockchain platforms. This inclusion signals Russia’s ambition to become a significant player in the international cryptocurrency arena. The Bank of Russia is granted the authority to ban the placement of individual digital financial issues if deemed a threat to the nation’s financial stability, ensuring that the new regulatory framework does not compromise economic security.

Strategic Economic Discussions

The legalization of cryptocurrency mining follows recent discussions between President Putin and government officials on the potential of digital currencies. During a meeting on economic issues, Putin emphasized the importance of seizing the moment to create a robust legal framework and regulatory environment. He highlighted the promise of digital currencies as a burgeoning economic sector and the necessity of prompt action to develop the required infrastructure and circulation conditions for digital assets.

This legislative move aligns with Putin’s broader vision of economic modernization and diversification. By embracing digital currencies, Russia aims to position itself at the forefront of financial innovation, potentially mitigating the economic impacts of international sanctions and fostering technological advancements.

Implementation Timeline

The law is set to enter into force ten days after its official publication, with certain provisions potentially taking effect at different times. This phased approach allows for a smooth transition and gives stakeholders time to adapt to the new regulatory landscape.

Implications

The legalization of Bitcoin mining in Russia is expected to have profound implications. For the cryptocurrency community, it offers a new, regulated environment that could attract significant investment and technological development. For Russia, it represents a strategic move to leverage digital assets for economic growth, technological innovation, and financial sovereignty.

However, the success of this initiative will depend on the effective implementation and enforcement of the new regulations. The balance between fostering innovation and ensuring financial stability will be crucial in determining the long-term impact of this legislation.

Community Reaction

Overall the reaction on Twitter has been positive with many hailing these news as another milestone for Bitcoin and other crypto. The news saw the price of Bitcoin increase to the mid $59,000 range, at the time of posting.

Ki Young Ju, the Founder and CEO of CryptoQuant, has offered insightful commentary on the potential global impact of this legislative shift. According to Ju, Russia’s move seems driven by a desire to keep pace with the United States, highlighting a growing trend of nation-level fear of missing out (FOMO) in the Bitcoin space.

Ju believes that Russia’s formal entry into the cryptocurrency mining sector will significantly boost the Bitcoin network’s hashrate. The hashrate is a critical measure of the computational power used to mine and process transactions on the Bitcoin network. An increase in hashrate not only enhances the network’s security but also underscores its robustness and decentralization. By adding Russian mining power to the global pool, the network’s fundamentals are expected to strengthen, making it more resilient against potential attacks and further cementing Bitcoin’s position as a secure digital asset.

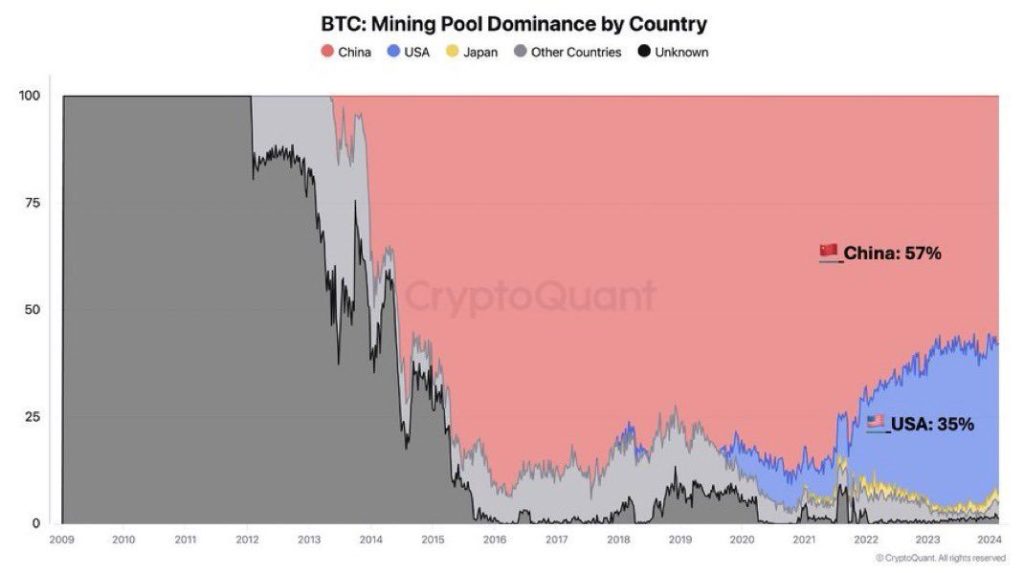

One of the notable points raised by Ju is the diversification of miner politics. Currently, Chinese mining pools control a significant 57% of the Bitcoin hash rate, with the United States holding around 35%. Russia’s entry into this landscape could introduce a new dynamic, potentially reducing the concentration of mining power in any single region. This diversification is crucial for the decentralized ethos of Bitcoin, as it mitigates the risk of a single point of failure and ensures that no single country can exert disproportionate influence over the network.

Ju’s analysis suggests that Russia’s move is a strategic response to global trends in cryptocurrency adoption and regulation. As countries like the United States advance their regulatory frameworks and infrastructure for digital currencies, other nations are prompted to follow suit to remain competitive. Russia’s legalization of cryptocurrency mining can be seen as a step towards integrating itself into the rapidly evolving global digital economy.

A Bold Move

President Putin’s decision to legalize cryptocurrency mining marks a pivotal moment in Russia’s economic policy. By formalizing the status of cryptocurrency mining and creating a regulated environment for its operation, Russia is making a bold statement about its commitment to embracing digital innovation. As the law takes effect, the eyes of the global financial and technological communities will be on Russia, watching closely to see how this new chapter in the country’s economic development unfolds.

Author Profile

- I have been writing articles about finance, the stock market and wealth management since 2008. I have worked as an analyst, fund manager and as a junior trader in 7 different institutions.

Latest entries

- June 4, 2025NewsWireHow Webmasters Are Paying the Price for the AI Boom

- April 24, 2025NewsWireCapital One-Discover Merger Reshaping the Credit Card Industry

- April 15, 2025NewsWireMichael Saylor’s Strategy New $286 Million Bitcoin Purchase

- February 14, 2025NewsWireBreaking Down the U.S. Budget