The forex market in 2023 has been a theatre of dramatic shifts and significant trends, painting a complex picture of the global economic landscape. Delve deeper into these developments, for a more nuanced understanding of the current forex market dynamics.

- Emerging Market Currencies and the U.S. Dollar: Emerging market currencies, after enduring a challenging 2023, are showing signs of modest recovery against the U.S. dollar. Analysts suggest that this trend may continue, with the U.S. dollar expected to trade lower by the year’s end, despite the Federal Reserve holding interest rates steady. This weakening of the dollar could be a temporary phase, as most emerging market central banks are anticipated to cut rates next year, following the Fed’s lead. The Russian rouble and Turkish lira, however, have seen significant devaluation this year, with the latter down by 52%.

- Asian Market Stability Amid Dollar Rebound: Asian currencies, particularly the Indian rupee, Thai baht, and South Korean won, are projected to recoup their losses by late 2024, despite the recent rebound of the U.S. dollar. China’s economic performance, post-COVID reopening, has been underwhelming, with the yuan expected to regain only slightly more than half of its 2023 losses.

- Performance of Specific Forex Pairs:

- GBP/JPY: This pair saw the most appreciation in 2023, reaching highs not seen since 2015

- EUR/JPY: The euro reached a new high against the yen since 2008.

- USD/JPY: The U.S. dollar gained significantly on the yen, trading above the 150.00 mark.

- GBP/USD: The pound made modest gains against the dollar.

- USD/CAD: The U.S. dollar appreciated slightly against the Canadian dollar

- EUR/USD: The euro remained relatively unchanged against the dollar

GBP JPY Chart

- Latin American Currencies: The Brazilian real and Mexican peso have shown resilience, gaining around 8% and 11%, respectively, since the year began. However, forecasts indicate a slight depreciation for both currencies in the coming year.

- South Korea’s Forex Market Opening: South Korea’s decision to open its currency market to global traders and extend trading hours is a significant step towards globalizing currency trade, potentially impacting the global forex landscape.

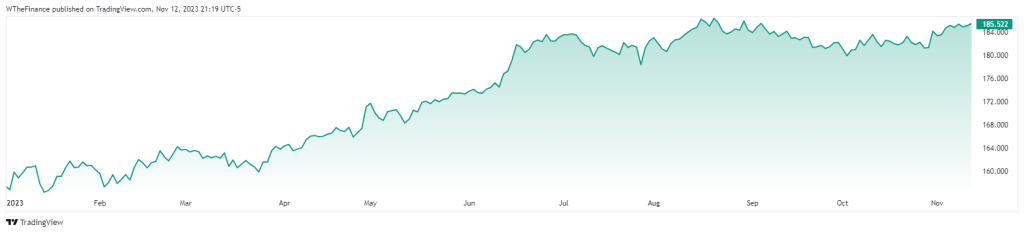

EUR USD Chart

The forex market in 2023 has been marked by a blend of stability and volatility, influenced by a myriad of factors ranging from central bank policies to global economic performances. While some currencies have shown signs of recovery, others continue to struggle, reflecting the diverse and interconnected nature of the global economy.

Author Profile

- Lucy Walker covers finance, health and beauty since 2014. She has been writing for various online publications.

Latest entries

- June 30, 2025NewsWireBank Savings at Risk: The Dark Side of EU’s Savings Standard

- April 25, 2025Global EconomicsWhistleblowers Unmask Schwab’s Toxic WEF Secrets

- April 9, 2025Global EconomicsTariff Tensions Drive Market Volatility

- March 18, 2025Global EconomicsRed in Name Only: Labour’s War on the UK Working Class