The courtroom on the 16th day of the COPA vs. Wright trial was charged with palpable tension, as Mr. Madden, a forensics expert witness for COPA, took the stand. The proceedings, as led by Jonathan Hough KC and Craig Orr KC, delved into the complex world of digital forensics, the authenticity of documents, and the intricate computing environments allegedly used by Craig Wright (CSW).

Madden’s qualifications and expertise in digital forensics were the initial focus, revealing he obtained his qualification through a 12-week course, a detail that set the stage for the rigorous examination to follow. Madden’s scrutiny of over 500 documents provided by Wright laid bare a critical perspective, suggesting all “I am Satoshi” evidence submitted by Wright had been manipulated or forged, a view surprisingly echoed by Wright’s own expert.

The cross-examination by Wright’s counsel, Orr KC, meticulously navigated through Madden’s reports, highlighting the forensic approach to analyzing the authenticity of digital documents. A particular emphasis was placed on the environment in which these documents were created and stored, underscoring the importance of metadata and timestamps in digital forensics. Madden admitted, “Depending on the timestamps, yes,” acknowledging the complexity and potential for different interpretations of this data.

The discourse extended into the technical specifics of Wright’s claimed computing environment, touching upon the use of Linux, virtual machines, Citrix, and SAN systems, among others. Madden’s responses, peppered with cautious acknowledgements such as “I’ve no reason to doubt it” and “Yes, technically possible,” reflected a careful consideration of the possibilities these environments presented for document creation and management.

The conversation further delved into the implications of group policies, remote server access, and the functionality of Microsoft Word templates, revealing layers of complexity in how documents could be edited, saved, and potentially manipulated. Madden’s expertise was put to the test with detailed inquiries into Grammarly’s functionality, the potential for font substitutions in Word documents, and the specificities of file management through Xcopy and symbolic linking.

One of the more compelling moments came when discussing a scanned document purportedly from 2007, which COPA argued couldn’t be authentic due to the notepad manufacturer’s timeline. This led to a broader debate on the reliability of digital scans and the forensic analysis of handwritten documents. The trial also ventured into the realm of email authenticity, DNS records, and DKIM authentication, with Madden’s analysis suggesting some emails might not have originated from the claimed sources.

Damning Evidence

Several pieces of evidence came to light this week that put Craig Wright in an even harder spot in this legal saga of the last 4 weeks in the High Court.

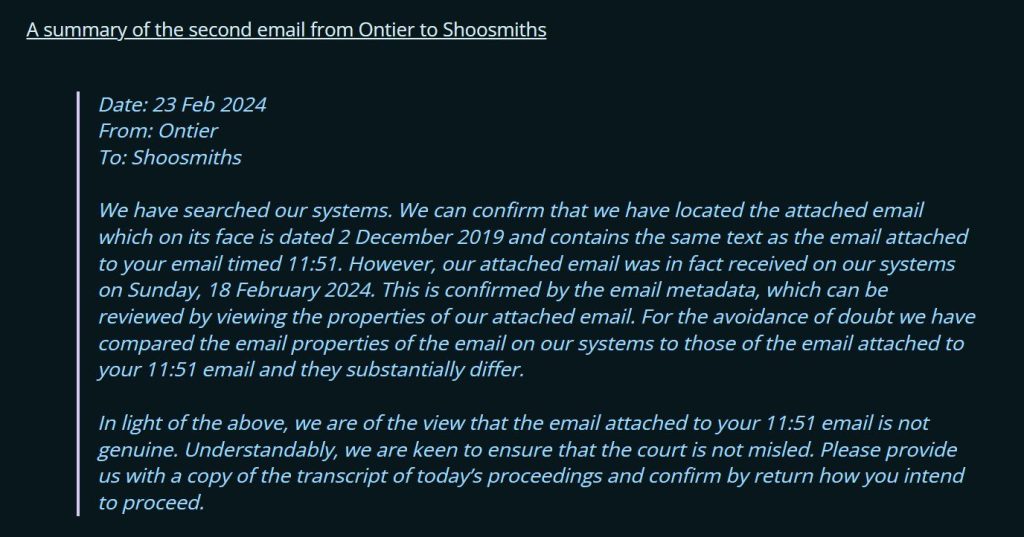

The trial took another astonishing turn on Monday (26/2/2024) when Lord Grabiner, the barrister representing Craig Wright, was compelled to present evidence that appeared to undermine his client’s position. In what has been a series of challenging developments for Wright, this instance stood out because it involved his current legal team highlighting potential discrepancies that could discredit their client’s claims. The evidence in question was a letter from Wright’s former legal firm, Ontier LLP, addressed to his new solicitors, Shoosmiths. This letter stated unequivocally that an email, allegedly provided by Craig Wright’s wife, Ramona Watts, and containing MYOB login details, was “not genuine.” The letter pointed out discrepancies in the email metadata, which did not match the properties of the original email dated 2 December 2019.

This revelation was particularly damaging as it came from Wright’s own barrister, who, in a twist that seemed to blur the adversarial lines of the courtroom, appeared to be aiding the efforts of COPA’s barrister, Jonathan Hough KC. The situation was so striking that Hough had almost nothing to add, given that the opposing counsel had laid bare the problematic evidence. The email in question was part of a chain where the first email showed Wright sending login details to Ontier, and the second had Simon Cohen of Ontier acknowledging receipt with a “Thanks Craig.” What made this part of the trial even more remarkable was the fact that the scrutiny and questioning of the document’s authenticity were being driven by Wright’s own legal representation.

The court was shown two versions of the emails side by side, exposing the inconsistencies and casting doubt on their authenticity. This act of presenting the evidence was not just a procedural necessity as prompted by Ontier’s letter, which demanded its disclosure in court, but also a strategic move that seemed to align with COPA’s objective of questioning Wright’s credibility. Moreover, the content of the original 2019 email pertained to information about the BlackNet system, adding another layer to the unfolding narrative of Wright’s alleged “nefarious shenanigans.”

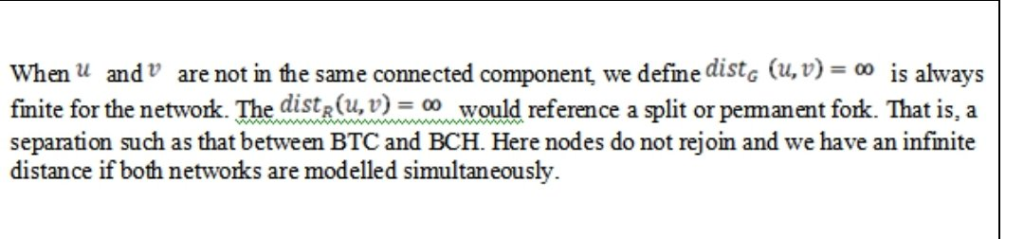

Wright submitted a document titled ‘Maths.doc’ purportedly dated December 2008, which he has used to support his claim to the identity of Satoshi Nakamoto, the enigmatic creator of Bitcoin. However, scrutiny of the document has revealed references to Bitcoin Cash (BCH), a cryptocurrency that did not come into existence until 2017, following a hard fork from the original Bitcoin blockchain. The presence of such an anachronism casts doubt on the document’s authenticity and, by extension, Wright’s assertions based on it.

The snippet provided from the document discusses the concept of “infinite distance” in network models, specifically mentioning the separation between Bitcoin (BTC) and Bitcoin Cash (BCH). The reference to BCH is particularly jarring, given that Bitcoin Cash’s genesis was nearly a decade after the document’s alleged creation date. This revelation potentially adds to the pile of contentious evidence that has marked the trial, raising questions about the veracity of the documents Wright has submitted in his favor.

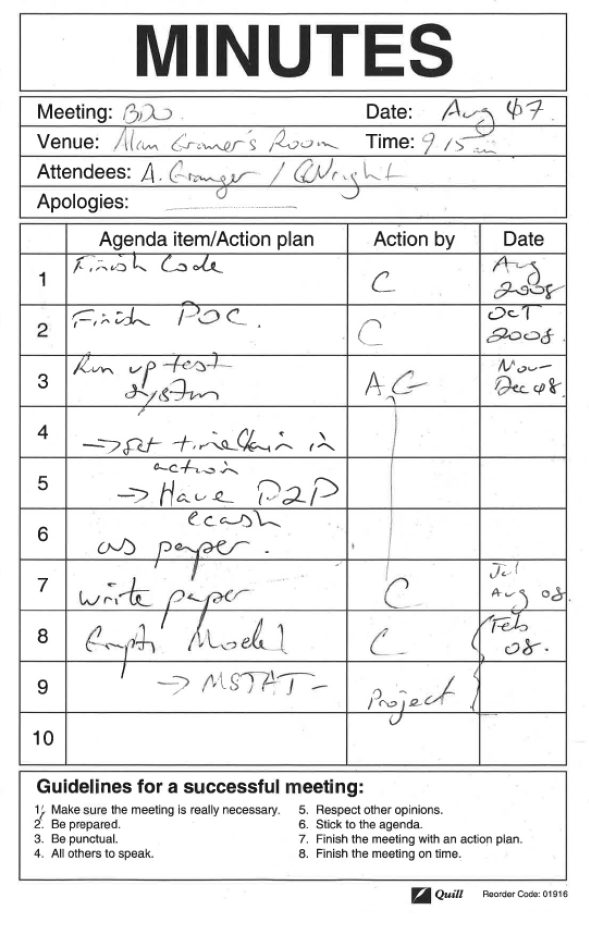

Craig Wright (CSW) submitted a notepaper dated August 2007 into evidence, which outlines various plans related to Bitcoin. If authentic, this document could be a strong support for Wright’s claim to being Satoshi Nakamoto, the pseudonymous creator of Bitcoin. The notepaper, branded by Quill, contains several entries with actions and dates stretching from August to February of the following year. It mentions tasks such as “finish code” and “write paper,” which could be interpreted as steps toward creating Bitcoin. However, the validity of this document is under serious scrutiny.

COPA has challenged the authenticity of this notepaper by contacting the manufacturer. The manufacturer confirmed that the particular type of notepaper presented by CSW was not in production until around 2012. This discrepancy indicates that the document could have been backdated, undermining CSW’s evidence and, consequently, his claim. Craig Wright has countered this claim by asserting that he has superior knowledge about the notepaper due to his previous employment at Staples. He suggests that his insight into the stationery’s availability predates the manufacturer’s stated production timeline.

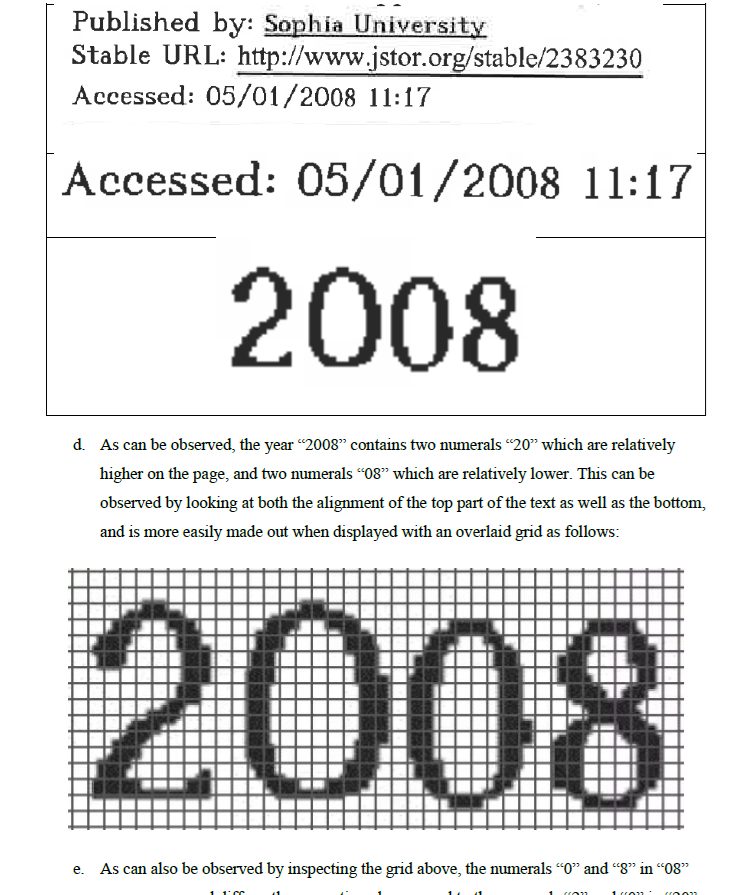

Another piece of evidence that has come under intense scrutiny is a document purportedly from 2008. Wright has used this document to support his claim, pointing out that it refers to “Nakamoto as the Japanese Adam Smith,” implying an early link to the pseudonym he would later use for Bitcoin’s creation. However, the document’s authenticity is in question due to inconsistencies in the typography. Observations have been made that in the year “2008” mentioned within the document, the numerals “08” are slightly smaller than the numerals “20.” Such discrepancies in font size and alignment could be indicative of alteration or manipulation, casting doubt on the document’s origin and, by extension, on Wright’s claim.

This kind of typographic analysis is often used in forensic examinations to determine the authenticity of a document. Discrepancies in the size, font, or alignment of characters can reveal whether a document has been tampered with. If the document in question was genuinely created in 2008, one would expect consistency in the typography, especially within a single-date format. Wright’s opponents argue that this evidence suggests the document has been altered at a later date, which undermines its credibility as proof of Wright’s involvement in the early stages of Bitcoin’s development.

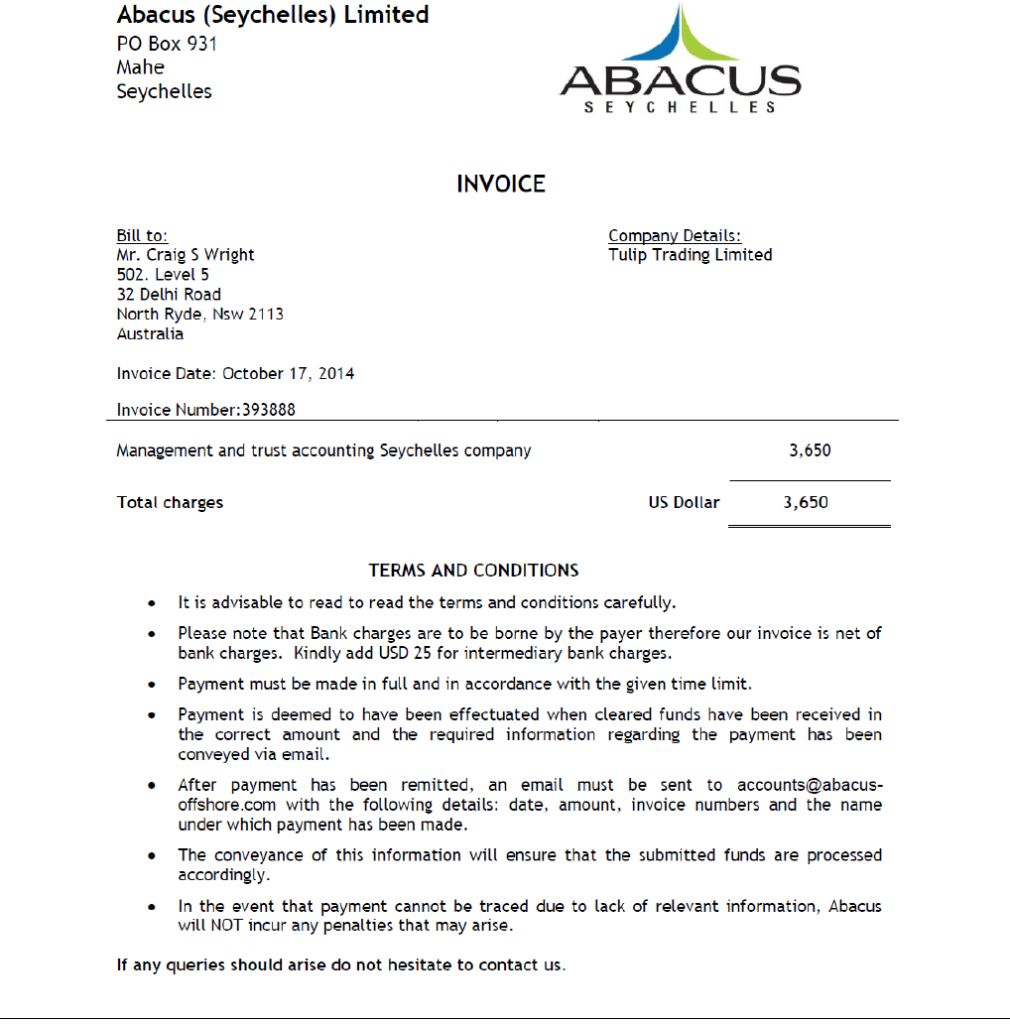

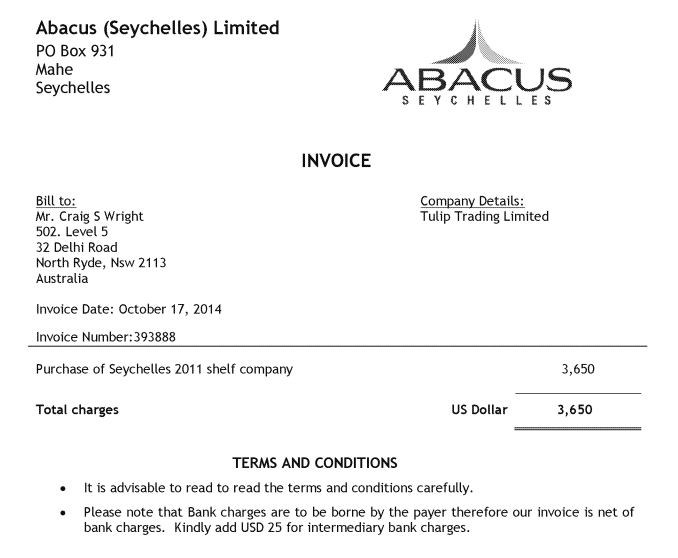

Two versions of an invoice from Abacus (Seychelles) Limited have been presented, both bearing the same invoice number and date, related to the purchase of Tulip Trading Limited in 2014. The issue at hand is a notable discrepancy in the description of the services rendered. In one version, the invoice states the “Purchase of Seychelles 2011 shelf company,” while the other reads “Management and trust accounting Seychelles company.” Allegations have arisen suggesting that Craig Wright may have altered the invoice description, possibly using Adobe’s text-editing features, to retroactively adjust the nature of the service provided.

This alteration is significant because it seemingly attempts to backdate the establishment of Tulip Trading to 2011, thereby obscuring the actual purchase date in 2014. This could potentially mislead regarding the timeline of Wright’s involvement and actions concerning Tulip Trading, which is relevant to the claims and counterclaims in the trial regarding Wright’s identity as Satoshi Nakamoto and the origins of his Bitcoin-related activities.

The culmination of the three-day forensic battle in the COPA vs. CSW trial left the courtroom in a state of heightened anticipation. Each piece of evidence scrutinized, whether it be the questionable “Maths.doc,” the controversial Quill notepaper, or the altered Abacus invoices, has only added layers of complexity to the case.

The final days were marked by a meticulous dissection of digital artefacts that called into question the integrity of documents that CSW presented to substantiate his claim as Bitcoin’s creator. From typographical inconsistencies to the debate over the manufacturing date of a notepad, the veracity of CSW’s narrative has faced formidable challenges.

The anachronistic mention of Bitcoin Cash in a supposedly 2008 document, the suspicious alteration of a key invoice’s description, and the debunked timeline of a notepad’s availability, all have cast shadows of doubt over CSW’s assertions. The digital forensic evidence presented, while not conclusive on its own, has certainly influenced the atmosphere of the trial, potentially swaying the judgment about CSW’s identity as Satoshi Nakamoto.

As the trial continues, the court must now navigate through the technical testimonies and the sea of documents to discern truth from fabrication. The outcome rests on the delicate balance of expert analysis and legal interpretation of what has become a landmark case for digital authenticity and the legacy of Bitcoin.

The veracity of CSW’s claims hangs in the balance, with the crypto community eagerly awaiting the final verdict, with some also expecting a custodial sentence. The implications of this decision will reverberate far beyond the courtroom, potentially reshaping the narrative of Bitcoin’s enigmatic beginnings and exposing Craig Wright to a point of no return.

Author Profile

- Lucy Walker covers finance, health and beauty since 2014. She has been writing for various online publications.

Latest entries

- June 30, 2025NewsWireBank Savings at Risk: The Dark Side of EU’s Savings Standard

- April 25, 2025Global EconomicsWhistleblowers Unmask Schwab’s Toxic WEF Secrets

- April 9, 2025Global EconomicsTariff Tensions Drive Market Volatility

- March 18, 2025Global EconomicsRed in Name Only: Labour’s War on the UK Working Class