Europe, with its rich history of industrial might and economic power, seems to be facing a period of stagnation, particularly in the realm of finance and technology. The decline of the industrial sector has been one of the most significant challenges, with many factories and businesses failing to integrate modern automation technologies, resulting in a loss of competitive edge in the global market.

The internet policies in Europe have often been seen as a barrier rather than a facilitator for innovation. Regulations are perceived to be overly restrictive, and while they aim to protect consumers, they have also been criticized for stifling the growth and adaptation of new and emerging business models within the digital space.

This cautious approach extends to the adoption of new technologies. While blockchain technology holds immense potential for transforming various sectors, including finance, trade, and public administration, Europe appears hesitant in its embrace.

Deloitte Insights suggests that blockchain and DLT platforms have indeed crossed the disillusionment trough and are now driving productivity and fundamental changes in business operations. Technical advancements and regulatory standards, especially in private networks, are aiding adoption beyond financial services.

Recent legislative developments in the European Union have sparked significant discussion and concern regarding financial privacy and the autonomy of cryptocurrency users. The European Parliament has approved measures that essentially outlaw anonymous transactions made through self-custody crypto wallets within the region. This is part of a broader Anti-Money Laundering (AML) and Counter-Terrorist Financing push that also includes restrictions on cash transactions, prohibiting anonymous cash payments over €3,000 and completely banning cash payments over €10,000 in business transactions.

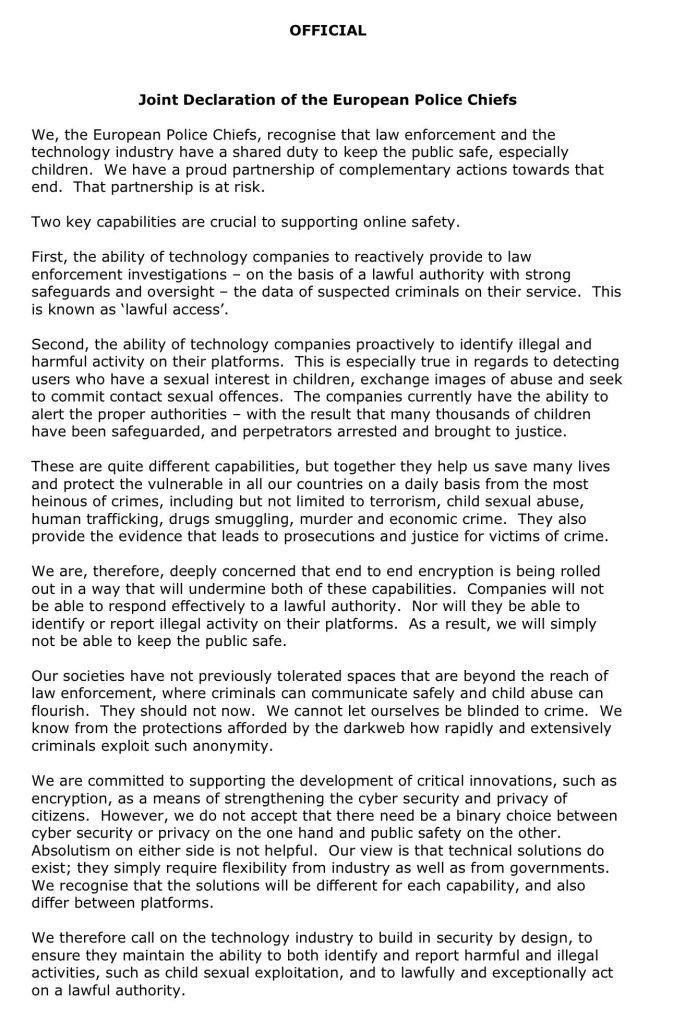

European Police Chiefs Declaration Against Encryption

These regulatory changes have raised substantial concerns among European citizens and lawmakers who value financial privacy. Patrick Breyer, Member of the European Parliament, has been vocal in his opposition to these measures, emphasizing the importance of anonymous payments as a fundamental human right necessary for individual financial freedom. Breyer and others worry that the prohibition on anonymous payments will not effectively combat crime but will instead encroach upon the financial freedom of law-abiding citizens.

In the face of these restrictions, European citizens and members of the crypto community have expressed resistance, referencing past instances where a strong majority opposed similar limitations on cash payments. These developments have raised questions about the impact these regulations will have on the innovative spirit of the cryptocurrency sector and whether the EU Parliament can sustain political support for such a restrictive approach moving forward.

While these laws are set to become fully operational within three years from their entry into force, there are expectations that they may be implemented even before the usual enforcement timeline. The crypto community is now closely watching the situation, debating the potential impacts and seeking ways to navigate this new regulatory landscape.

Author Profile

- Lucy Walker covers finance, health and beauty since 2014. She has been writing for various online publications.

Latest entries

- April 25, 2025Global EconomicsWhistleblowers Unmask Schwab’s Toxic WEF Secrets

- April 9, 2025Global EconomicsTariff Tensions Drive Market Volatility

- March 18, 2025Global EconomicsRed in Name Only: Labour’s War on the UK Working Class

- March 7, 2025SatoshiCraig Wright Banned from UK Courts with Civil Restraint Order