The latest financial data indicates a seismic shift in investor sentiment within the exchange-traded fund (ETF) landscape. A deep dive into the capital flows after four days reveals a significant exodus of funds from several major ETF providers, with Grayscale experiencing an unparalleled outflow that raises eyebrows across the market.

The Current of Capital: A Closer Look at the ETF Flows

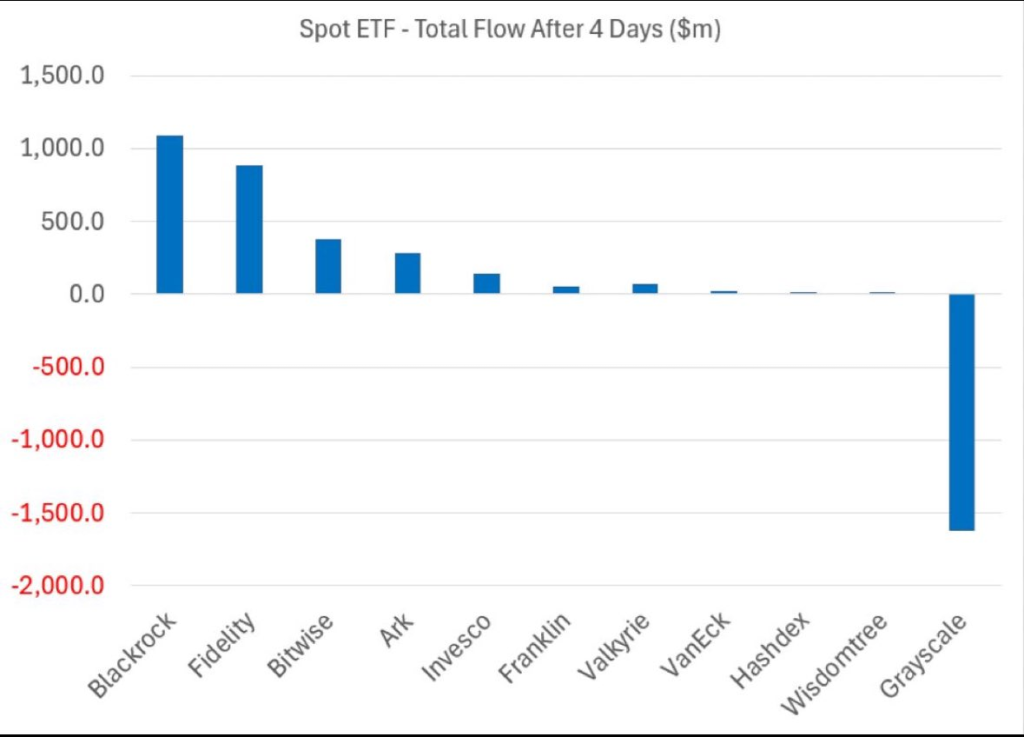

Exchange-traded funds, commonly known as ETFs, are heralded for their liquidity and ease of trading, mirroring the performance of indices, commodities, or a basket of assets. Investors often use them as temperature gauges for market sentiment. Recent data shows a polarized environment where certain firms like BlackRock and Fidelity experienced inflows, albeit the magnitude of their gains pales in comparison to the outflow that Grayscale is grappling with.

The Deep End of the Pool: Grayscale’s Outflow

Grayscale, a leading name in the digital currency asset management space, stands out with an outflow so pronounced it sends ripples through the financial community. The data paints a stark picture: a withdrawal of funds in the magnitude of $2 billion within just four days. This figure not only dwarfs the activity of its peers but also signals a potential red flag for investors and analysts alike.

Understanding the Exodus: Market Sentiments and Implications

This massive outflow from Grayscale could be symptomatic of a larger trend in investor behavior. The cryptocurrency market, where Grayscale is heavily invested, has seen its fair share of volatility, potentially spooking investors. The surge in outflows could reflect a shift towards a more risk-averse stance, especially in the face of regulatory uncertainties and the maturation of the crypto market.

Moreover, the scale of the outflow could suggest a strategic reallocation of assets by institutional investors. This raises questions about the future of investment in crypto-related assets and the possible reassessment of digital currencies’ role in diversified portfolios.

The Ripple Effect: Broader Market Implications

The significance of Grayscale’s situation extends beyond the company itself. It serves as a barometer for the tech and crypto sectors at large. As institutional investors potentially retreat, we might witness a cooling effect on the overheated segments of these markets. Other firms, like Bitwise, ARK, and Valkyrie, show more modest changes in fund flows, indicating that the current is not sector-wide but may be more reflective of company-specific factors.

Calm After the Storm or a Bigger Wave on the Horizon?

Investors and market spectators are now left to ponder whether this outflow is a temporary setback for Grayscale or a harbinger of a more systemic shift away from crypto-focused investments. Will Grayscale and its counterparts navigate through these choppy waters to find calmer seas, or is this the beginning of a more significant market correction?

The Analyst’s Perspective: A Tactical Maneuver or a Strategic Retreat?

Financial analysts are keenly observing whether these outflows represent knee-jerk reactions to short-term market movements or a more deliberate strategic withdrawal from riskier asset classes. The answers will unfold in the coming weeks and months as the market digests this activity and its repercussions.

Monitoring the Financial Barometer

The ETF flow data after four days is more than just numbers; it’s a narrative of market sentiment, a story of investor confidence, and a script of strategic financial planning. Grayscale’s substantial outflow is a chapter that will be studied for its impact on the future of ETFs and the investment landscape. As the market continues to evolve, keeping a pulse on these flows will be crucial for understanding the direction in which the financial winds are blowing.

Author Profile

- Lucy Walker covers finance, health and beauty since 2014. She has been writing for various online publications.

Latest entries

- June 30, 2025NewsWireBank Savings at Risk: The Dark Side of EU’s Savings Standard

- April 25, 2025Global EconomicsWhistleblowers Unmask Schwab’s Toxic WEF Secrets

- April 9, 2025Global EconomicsTariff Tensions Drive Market Volatility

- March 18, 2025Global EconomicsRed in Name Only: Labour’s War on the UK Working Class