The realm of cryptocurrencies, particularly Bitcoin, offers a fascinating lens through which we can examine the health of fiat currencies worldwide claims Rip VanWinkle. Often, Bitcoin is heralded as a digital safe haven, a bulwark against the devaluation of traditional money. The assertion that Bitcoin acts as an index of fiat weakness gains credence when we witness its valuation against various struggling currencies. These local BTC/fiat exchange rates provide a relentless and transparent appraisal of fiat currency stability, or more pointedly, their instability, across the globe.

Let’s navigate through the waters of global economic turmoil to understand how certain fiat currencies are faring against the steadfast Bitcoin.

The Argentine Peso (ARS)

Argentina has been wrestling with high inflation for years, a waltz that has quickened to a frenetic tempo. The country’s economic policies have spurred inflation, leading to a devaluation of the peso. Bitcoin’s staggering price in ARS reflects not only the cryptocurrency’s strength but also the peso’s precipitous fall.

The Egyptian Pound (EGP)

The land of the Nile is no stranger to economic fluctuations. The Egyptian pound has historically suffered due to political instability and policy missteps. Bitcoin’s valuation in EGP is a clear indicator of the currency’s volatility and the public’s search for financial shelter.

The Lebanese Pound (LBP)

Lebanon’s financial crisis is a textbook example of hyperinflation, with the Lebanese pound losing a vast portion of its value. The stratospheric BTC price in LBP underscores the severity of the domestic monetary collapse.

The Sri Lankan Rupee (LKR)

Sri Lanka’s recent economic woes have seen the rupee tumble dramatically. Rising debt and deficits, coupled with a loss of tourism revenue, have battered the currency, making Bitcoin an attractive alternative for wealth preservation.

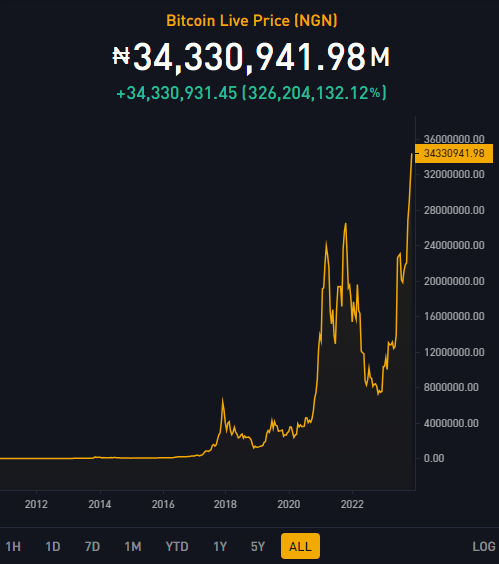

The Nigerian Naira (NGN)

Nigeria’s economy, although rich in resources, faces substantial fiscal challenges. The naira has experienced significant devaluation, in part due to oil price volatility and economic mismanagement. Here too, Bitcoin’s valuation paints a stark picture of the naira’s decline.

The Turkish Lira (TRY)

Turkey’s lira has been in a freefall, attributed to unorthodox economic theories applied by its leadership. The TRY’s plummet has been mirrored by soaring Bitcoin prices, as Turks seek to hedge against their currency’s rapid depreciation.

The Pakistani Rupee (PKR)

Pakistan’s economic challenges are manifold, with the rupee’s devaluation being a symptom of larger fiscal and trade deficits. Bitcoin’s valuation in PKR reflects the increasing mistrust in traditional financial systems within the country.

In each of these cases, Bitcoin’s comparative strength not only highlights the weaknesses of the respective fiat currencies but also the public’s response to economic mismanagement and inflation. It stands as a beacon for those billion individuals living in regions where fiat currencies are experiencing hyperinflation. The local government’s monetary inflation, often hidden from the daily lives of citizens, is ruthlessly exposed by the BTC exchange rates.

The narrative that every fiat currency is on a path to collapse might sound extreme. However, the examples provided do offer compelling evidence that Bitcoin can act as a refuge in times of fiat turbulence. In the event of a fiat collapse, as seen in these regions, Bitcoin’s value could indeed exhibit the kind of parabolic ascent depicted in these charts.

#Bitcoin is an index of fiat weakness. The shittiness of your local fiat currency (let's face it, they're all shitty) is being reflected in the local BTC/Fiat exchange rate 24/7/365.

— Rip VanWinkle ⚡️ (@danieleripoll) December 14, 2023

Which fiat currencies are getting REKT the most against the hardest of Bitcoin?

A 🧵👇

Bitcoin’s role as a safe haven asset grows increasingly prominent as more people seek a hedge against the devaluation of their local currencies. The question for many is not if, but when they should turn to cryptocurrencies as an economic life raft. The financial landscapes in Argentina, Egypt, Lebanon, Sri Lanka, Nigeria, Turkey, and Pakistan serve as a clarion call, a signal that perhaps the era of traditional fiat dominance is waning, giving way to the cryptographic certainty of Bitcoin.

Author Profile

- Lucy Walker covers finance, health and beauty since 2014. She has been writing for various online publications.

Latest entries

- April 25, 2025Global EconomicsWhistleblowers Unmask Schwab’s Toxic WEF Secrets

- April 9, 2025Global EconomicsTariff Tensions Drive Market Volatility

- March 18, 2025Global EconomicsRed in Name Only: Labour’s War on the UK Working Class

- March 7, 2025SatoshiCraig Wright Banned from UK Courts with Civil Restraint Order