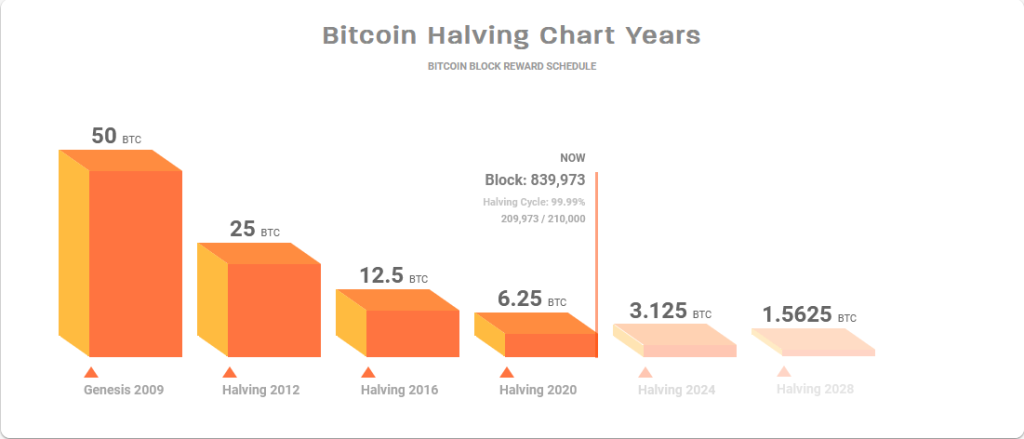

The phenomenon of Bitcoin’s halving is a significant event that occurs approximately every four years, an interval that marks a reduction in the block rewards for miners by half. It is not just a technical recalibration but an event with profound market implications. As we can see from historical data, each halving has been a precursor to a remarkable change in Bitcoin’s price.

Senator Cynthia Lummis, an avid advocate for Bitcoin and its underlying technology, recently shared her excitement about the cryptocurrency’s latest halving event. In her enthusiastic message, “Happy Halving!”, she illuminates the unique mechanism that not only promotes scarcity but also underpins the value of Bitcoin, drawing an apt parallel with gold.

For those unfamiliar, the ‘Halving’ is a foundational element of the Bitcoin protocol. Roughly every four years, the reward granted to Bitcoin miners for verifying transactions and protecting the network is slashed by 50%. This reduction mimics the extraction process of gold, where immense energy is expended to unearth the precious metal. Similarly, Bitcoin miners invest substantial energy in securing the network and, in turn, minting new coins.

Happy Halving! The ‘Halving’ is one of Bitcoin’s ingenious features that creates scarcity and value, in the same way that scarcity in gold creates value.

Senator Cynthia Lummis

The halving is a deliberate design choice that ensures the new supply of Bitcoin doesn’t outpace its existing quantity too quickly. By limiting the rate at which new bitcoins are created, the network enshrines a form of digital scarcity that is reminiscent of the physical scarcity of gold.

Today, according to Senator Lummis, the halving has taken an extra special turn. With the latest event, Bitcoin’s rate of new supply will, for the first time, dip below that of gold’s, marking a historic moment in the landscape of store-of-value assets. This shift fortifies Bitcoin’s proposition as a digital store of value—a narrative that’s been steadily gaining traction over the years.

Senator Lummis‘s team celebrated this milestone with a ‘lunch and learn’ event, signaling a growing interest and validation of Bitcoin within political spheres. The event featured tools like the mempool block explorer, which provides a real-time window into the workings of the Bitcoin network—a marvel of transparency and ingenuity that continues to captivate enthusiasts and newcomers alike.

Let’s delve into the historical context. In 2012, when the first halving occurred, the price of a single Bitcoin was a mere $10. Fast forward to 2016, and we see the impact of the second halving with the price escalating to $650. The pattern continued in 2020 when the price surged to $8,800 at the time of the third halving.

Layah Heilpern, a prominent figure in the cryptocurrency commentary sphere, points out an intriguing pattern in the wake of past halvings. Each event has not only been followed by a bullish uptrend, but the gains realized one year later paint a picture of staggering growth.

Let’s take a retrospective glance, with a lens focused on the trajectory post-halving:

- In 2012, Bitcoin sat modestly at $12 during its halving. Fast forward a year, and the price leaped to $964, marking an incredible growth rate that catalyzed interest and investment in the then-nascent cryptocurrency market.

- The 2016 halving witnessed Bitcoin at $663, only to surge to $2,550 the following year. This continued the precedent of exponential post-halving increases, reaffirming the event’s bullish undertones.

- Come 2020, the pattern upholds its momentum. Bitcoin, priced at $8,740 at the time of the halving, skyrocketed to $55,801 a year later, underscoring the largest dollar-price leap post-halving to date.

As we stand in the aftermath of the 2024 halving, with Bitcoin at a noteworthy $63,300, anticipation builds. Heilpern suggests that this event could be the most bullish yet. Her advice is steadfast: do not be swayed by the market maneuvers of ‘whales’—the term for holders with the ability to significantly influence market prices.

The downward price pressures occasionally exerted by these entities may be strategic attempts to secure more favorable entry points. This tactic, while impacting short-term valuations, should not deter individual investors who are eyeing the long-term horizon.

Heilpern’s message is clear: looking at the historical precedence, the period following a halving has been overwhelmingly positive for Bitcoin‘s value. Hence, for those considering an entry into the Bitcoin market or holding onto their assets, the period now could be pivotal. The sentiment is optimistic, suggesting that the coming year could yield reasons for gratitude for those who remain resolute in their Bitcoin positions.

“The Bitcoin halving is the first holiday everyone in the world celebrates at the same time”

Dan Webb

Currently, in 2024, as we stand on the precipice of the next halving, the community buzzes with speculation. The pattern of adding a zero to the end of the last halving price suggests an expectation of the price reaching into the tens of thousands, an optimistic forecast that taps into Bitcoin’s historical performance and its perceived scarcity over time.

The Shifting Impact of Halving Events

Bitcoin’s economic landscape is set to undergo subtle yet significant shifts with each successive halving. These events, which slash the mining subsidy by half, have traditionally spurred discussions around Bitcoin’s deflationary nature. However, a new dynamic is emerging as transaction fees become a more substantial part of the miners’ rewards.

Under the current protocol, Bitcoin miners receive two types of incentives: the subsidy for new bitcoins created with each block, and transaction fees from users sending transactions. As the halving cuts down the subsidy, the relative importance of transaction fees is spotlighted. Should miners collect a steady stream of 1 BTC per block in fees, the economics of the mining industry adjust intriguingly.

Let’s break down the numbers. With the anticipated 2024 halving, if miners are indeed earning 1 BTC from fees per block, the total reduction in block rewards would equate to a 43% drop, not the expected 50%. This dilution in the halving’s effect would continue into future cycles. By the 2028 event, the reduction in total block rewards would be 38%, gradually lessening to a mere 4% by 2048.

This trend suggests a gradual weakening of the halving’s impact over time, assuming a constant 1 BTC in fee revenue:

- 2024 Halving: A 43% reduction

- 2028 Halving: A 38% reduction

- 2032 Halving: A 30% reduction

- 2036 Halving: A 22% reduction

- 2040 Halving: A 14% reduction

- 2044 Halving: An 8% reduction

- 2048 Halving: A 4% reduction

These figures mark a significant shift from the pure halving narrative. They represent a transition from an era where block subsidies dominated miners’ rewards to one where transaction fees play a pivotal role. This evolution has critical implications for Bitcoin’s security model, miner incentives, and the overall supply dynamics.

However, it’s crucial to tread this predictive model with caution. The digital finance market is known for its volatility, and while historical data can provide insights, it is not a foolproof indicator of future performance. Various external factors such as regulatory shifts, technological advancements, and changes in investor sentiment can significantly influence the trajectory of Bitcoin’s value.

Investors and enthusiasts eagerly await to see if the pattern holds true and if Bitcoin will continue its trend of exponential growth post-halving. Yet, one must remember that the market is as speculative as it is exciting, and past performance is not indicative of future results.

For those keeping an eye on this digital asset, the 2024 halving stands as a testament to Bitcoin’s enduring allure and the ever-present question: What’s next for the world’s first digital currency?

Author Profile

- Lucy Walker covers finance, health and beauty since 2014. She has been writing for various online publications.

Latest entries

- June 30, 2025NewsWireBank Savings at Risk: The Dark Side of EU’s Savings Standard

- April 25, 2025Global EconomicsWhistleblowers Unmask Schwab’s Toxic WEF Secrets

- April 9, 2025Global EconomicsTariff Tensions Drive Market Volatility

- March 18, 2025Global EconomicsRed in Name Only: Labour’s War on the UK Working Class