Unprecedented Halt Shakes Investors

Almost a year ago now, on December 9, 2022, the Financial Industry Regulatory Authority (FINRA) halted trading of Meta Materials Preferred Shares (MMTLP), sending shockwaves through the markets. The decision by FINRA to halt MMTLP trading came just as Meta Materials was on the cusp of spinning off Next Bridge Hydrocarbons, sending investors into a state of shock and confusion. The timing of this intervention was particularly critical as it preceded the transformation of MMTLP preferred shares into a different entity.

For investors, the halt not only disrupted immediate trading plans but also cast a long shadow over the future of their investments, as the preferred shares they held were slated for cancellation in the wake of the corporate restructuring. This action by FINRA, while protective in intent, was perceived by many as a decisive blow to their financial stakes in MMTLP.

A Rollercoaster of Valuation

In the tumultuous period before the trading halt, MMTLP stock experienced extreme fluctuations, indicative of the unpredictable moves that often characterize the securities market. The stock’s trajectory was marked by a dramatic ascent, surging an astonishing 700% from early October to the highs witnessed in November, fueled by speculative trading and investor enthusiasm surrounding the upcoming corporate spinoff.

However, the sharp reversal that followed was severe, with the stock’s value eroding by 58% on the eve of the halt and culminating in a 64% loss over the week. This precipitous fall in MMTLP’s value cast a harsh light on the inherent risks associated with trading such volatile instruments, sending investors into a state of heightened alarm as they grappled with the reality of a market teetering on the edge of uncertainty.

FINRA’s Stance: Protection or Precipitation?

FINRA’s invocation of the U3 halt code on MMTLP trading is a regulatory mechanism typically reserved for situations anticipating significant events that could disrupt market stability. By implementing this code, FINRA aimed to shield investors from the anticipated market turbulence due to Meta Materials’ corporate actions. However, this preventative measure was not uniformly well-received, as investors expressed their dissatisfaction, seeking greater transparency and justification for the decision that left them in limbo.

The termination of MMTLP trading with the cessation of the ticker symbol meant that these preferred shares were to vanish from the marketplace, effectively stranding shareholders and stripping them of a traditional exit strategy, thereby exacerbating the already high tensions and uncertainty within the investor community.

About MMTLP

Meta Materials Preferred Shares (MMTLP) were a notable instrument in the financial markets due to their connection with the innovative developer of functional materials, Meta Materials Inc. These shares emerged from a significant corporate event in June 2021 when Meta Materials merged with Torchlight Energy Resources. The Series A Preferred Shares were distinctive because, unlike Meta Materials’ common stock listed on Nasdaq, MMTLP shares were unlisted and traded over-the-counter (OTC).

MMTLP garnered considerable attention from investors as it was linked to Meta Materials’ spinoff plans for Next Bridge Hydrocarbons. Holders of MMTLP were poised to be central to this corporate manoeuvre, with the expectation of exchanging their preferred shares for common stock in Next Bridge following the spinoff. However, volatility and a significant drop in value preceded a trading halt initiated by FINRA, which marked a dramatic turn of events for stakeholders.

Torchlight Energy Resources

Torchlight Energy Resources, Inc. (NASDAQ: TRCH), headquartered in Plano, Texas, positions itself as a rapidly expanding oil and gas Exploration and Production (E&P) entity, with its strategic sights set on the acquisition and development of domestic oil fields with high profitability potential. Currently, Torchlight holds stakes within the state of Texas, concentrating its efforts on well-established oil-rich regions like the Permian Basin, known for its prolific production history and ongoing potential for resource extraction. Their involvement in such key areas underscores Torchlight’s commitment to leveraging established plays that promise substantial returns.

Meta Materials Inc.

Meta Materials Inc. (META) (NASDAQ: MMAT) allegedly stands at the forefront of materials science innovation, offering unprecedented performance enhancements across various applications through its pioneering work in nanotechnology. META’s expertise lies in inventing and manufacturing materials and intelligent surfaces that push the boundaries of what’s possible, emphasizing scalability and sustainability. By circumventing traditional chemical synthesis, META accelerates the development of a vast repertoire of solutions and functional prototypes, thereby reducing both time and cost. This efficiency empowers global brands across sectors, ranging from consumer electronics and 5G networks to advanced energy solutions, to launch revolutionary products. Additionally, META’s nano-optic technology plays a crucial role in security, offering sophisticated anti-counterfeiting features for government-issued documents and providing verifiable authenticity to protect brand integrity.

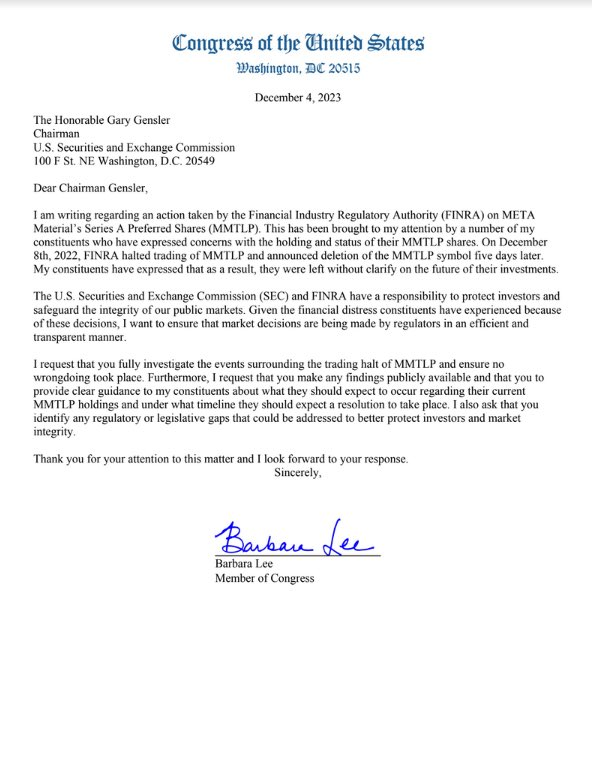

The halt of MMTLP trading by FINRA has raised significant concerns, drawing attention from Congressional figures and sparking a dialogue about the transparency and responsiveness of regulatory bodies. The markets have spoken. With a significant number of investors feeling trapped and unable to act in the face of such a halt, the incident with MMTLP has become more than a mere corporate restructuring, it’s a stark warning for the securities market and a call for better oversight and communication to protect investor interests.

Author Profile

- Lucy Walker covers finance, health and beauty since 2014. She has been writing for various online publications.

Latest entries

- June 30, 2025NewsWireBank Savings at Risk: The Dark Side of EU’s Savings Standard

- April 25, 2025Global EconomicsWhistleblowers Unmask Schwab’s Toxic WEF Secrets

- April 9, 2025Global EconomicsTariff Tensions Drive Market Volatility

- March 18, 2025Global EconomicsRed in Name Only: Labour’s War on the UK Working Class