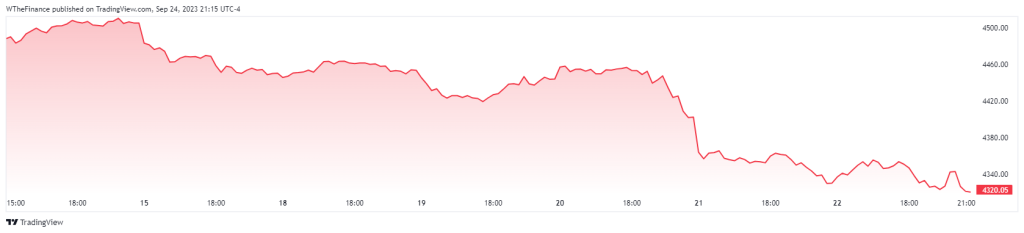

The financial markets have just endured their most turbulent week since March, marked by sharp declines in both the S&P 500 and the technology-centric Nasdaq indices. Of particular concern is the S&P 500 breaching its 100-day moving average, a pivotal support level, thereby signalling potential further downside.

Although 2023 commenced on an optimistic note for American investors, largely fueled by the burgeoning enthusiasm surrounding artificial intelligence (AI), recent developments have cast a shadow on this positivity. Notably, Nvidia, a major player in the tech sector, has seen a remarkable year-to-date increase of 190.67%. Nevertheless, the company’s stock has undergone a significant retreat, plummeting 11.69% over the past month.

So it is not surprising at all that last week’s market behavior has sounded alarms across Wall Street, as the S&P 500 exhibited multiple warning signs strongly suggesting a forthcoming selloff. At least this was the feeling across markets last week. The negative undertones have been accumulating ever since the index peaked on July 31. Subsequent price actions have traced a worrisome path, culminating in alarming technical formations that historically portend market downturns.

A Timeline of Concern

- The Rounded Top Formation: After peaking on July 31, the index commenced a rounded top in early August, a bearish pattern signalling diminished bullish sentiment.

- Breaking the 50-Day Moving Average: On August 15, the index fell below its 50-day moving average—a widely followed trend measure. Such a movement usually signifies that the bears are gaining control.

- Short-Lived Recovery: The index found its bottom on August 17-18 and attempted a rally. While it managed to cross the 50-day moving average briefly, the rebound was only halfway, raising concerns about its sustainability.

- A Slowdown in Momentum: After topping out on September 1, the index engaged in a see-saw behavior around the 50-day moving average, which itself began to decelerate, thereby highlighting a lack of conviction among bulls.

- The Double Top Configuration: Most concerning of all, the index completed its second rollover last week, forming a ‘double top’. This is a technical formation that generally signals a reversal from an uptrend. Importantly, the second top was lower than the first, adding extra weight to this bearish indicator.

SPX Weekly Chart

Double Tops and Their Significance

A double-top pattern carries greater weight than a singular move, particularly when the second peak fails to surpass the level of the first peak. This reveals that upward momentum is not only stalling but is actually reversing, as bears seize control of the market. Warning signs overall.

Implications for Market Participants

Given these critical developments, traders and investors would do well to exercise extreme caution. Defensive positioning, risk mitigation strategies, and close monitoring of subsequent market behaviour are highly recommended. The culmination of these bearish indicators, capped by the formation of a double top, suggests that a market correction is not only likely but perhaps imminent.

Author Profile

- Lucy Walker covers finance, health and beauty since 2014. She has been writing for various online publications.

Latest entries

- June 30, 2025NewsWireBank Savings at Risk: The Dark Side of EU’s Savings Standard

- April 25, 2025Global EconomicsWhistleblowers Unmask Schwab’s Toxic WEF Secrets

- April 9, 2025Global EconomicsTariff Tensions Drive Market Volatility

- March 18, 2025Global EconomicsRed in Name Only: Labour’s War on the UK Working Class

1 Comment

Peter Williamson

October 2, 2023As an investor, I find this information incredibly valuable. It's a reminder to always watch for market indicators and consider defensive strategies. Knowledge is power in the financial world! 💰💼