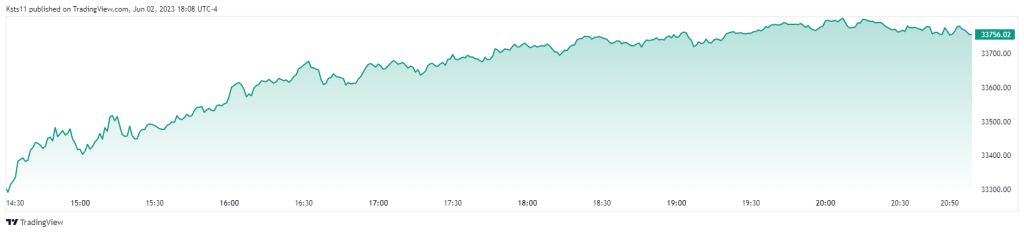

- Easing debt ceiling worries led to stock market gains on Thursday. Then on Friday the Dow Jones Industrial Average had its best day since January. The Dow’s Friday advance pushed it into positive territory for the week, finishing up 2%.

- The S&P 500 climbed 1.45%, and the Nasdaq Composite advanced 1.07%. The S&P 500 and Nasdaq finished the holiday-shortened trading week about 1.8% and 2% higher, respectively.

- The US economy added 339k non-farm payroll jobs last month. Nonfarm payrolls grew much more than expected in May but the unemployment rate still rose to 3.7%. That was not enough to dampen the spirits in the markets. Economists had expected payrolls to rise by 195k. This is the 14th straight month of job creation exceeding expectations

- The Fed could pause its interest rate hike campaign at the policy meeting later this month. Senate approved a bill to raise the US debt ceiling for two more years. Easing concerns around the U.S. debt ceiling also helped sentiment.

- The Russell 2000 index of small-cap stocks jumped 3.56%, the best one-day rally since Nov. 10, 2022.

Dow Jones Index Day Chart

Author Profile

- Lucy Walker covers finance, health and beauty since 2014. She has been writing for various online publications.

Latest entries

- April 25, 2025Global EconomicsWhistleblowers Unmask Schwab’s Toxic WEF Secrets

- April 9, 2025Global EconomicsTariff Tensions Drive Market Volatility

- March 18, 2025Global EconomicsRed in Name Only: Labour’s War on the UK Working Class

- March 7, 2025SatoshiCraig Wright Banned from UK Courts with Civil Restraint Order