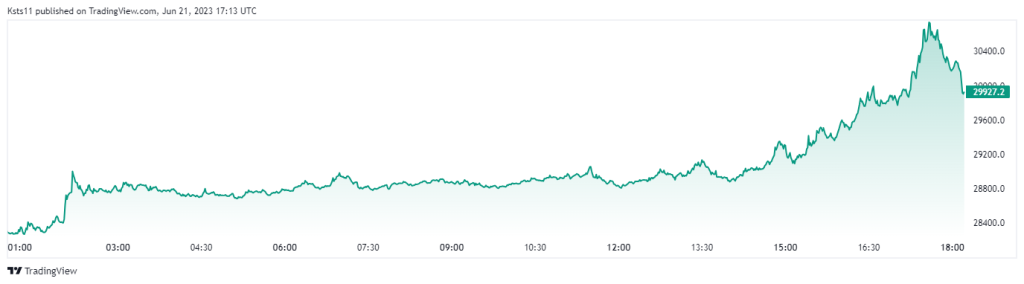

- The news that large financial institutions are making moves into Bitcoin is making the markets regain confidence and rally. In the last couple of days, the price of BTC has increased by over 18% and touched $30,737. At the moment it is hovering in the $30k range. However, if the news materialises then this rally could turn into a bull run that takes Bitcoin back to the $45k range.

- BlackRock, one of the world’s largest asset managers, recently filed for a Bitcoin ETF with the U.S. Securities and Exchange Commission. This move has been seen as a major step forward in bringing institutional investors into the crypto space.

BTC Price Chart

- The proposed ETF would track Bitcoin’s underlying market price, giving investors exposure to Bitcoin without having to purchase it directly. This news has sparked a wave of new filings from other asset managers such as WisdomTree and Invesco, who are also looking to launch their own Bitcoin ETFs. With BlackRock’s filing, institutional investor sentiment towards cryptocurrency is at an all-time high and could lead to further adoption of digital assets in the near future.

- Deutsche Bank, the largest bank in Germany, has recently applied for a license from the German financial regulator BaFin to offer custody solutions for digital assets. According to Bloomberg, Deutsche Bank filed an application to obtain a license for providing digital asset custody services on Tuesday. This move is part of the bank’s effort to push further into the crypto space and provide customers with access to digital assets. The news was also reported by other sources such as CoinDesk, Crowdfund Insider, Bitcoinist and Yahoo Finance. If approved, this would make Deutsche Bank one of the first major banks in Europe to offer crypto custody services.

- On June 20th, 2021, EDX Markets, a digital asset exchange backed by financial giants Charles Schwab (SCHW), Citadel Securities and Fidelity Digital Assets, began trading services. The platform is designed to enable safe and compliant trading of digital assets through its innovative technology and practices from traditional finance.

- EDX Markets offers a variety of order types such as market, limit and post-only orders with time-in-force options including day, FOK and GTT. It also provides resources such as market information and trade allocation for users to take advantage of. With the launch of EDX Markets, investors now have access to a secure platform for digital asset trading that has the backing of some of the world’s largest financial institutions.

Author Profile

- Lucy Walker covers finance, health and beauty since 2014. She has been writing for various online publications.

Latest entries

- June 30, 2025NewsWireBank Savings at Risk: The Dark Side of EU’s Savings Standard

- April 25, 2025Global EconomicsWhistleblowers Unmask Schwab’s Toxic WEF Secrets

- April 9, 2025Global EconomicsTariff Tensions Drive Market Volatility

- March 18, 2025Global EconomicsRed in Name Only: Labour’s War on the UK Working Class