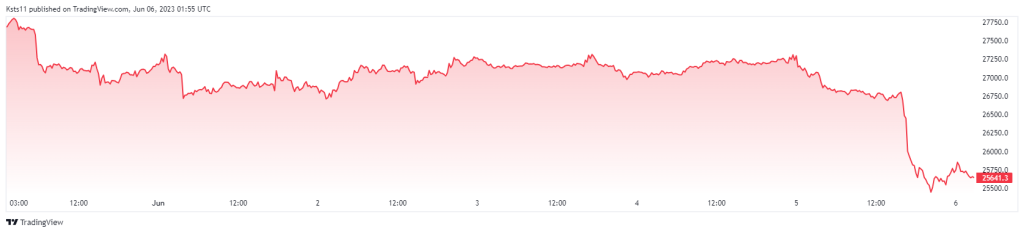

Bitcoin’s value experienced a sudden 5% drop in just one hour following the United States Securities and Exchange Commission (SEC) filing a lawsuit against Binance for its alleged violation of federal securities laws. While Bitcoin’s support at $25,500 held strong, investors are still processing the implications of the regulatory action and its involvement with Binance’s CEO Changpeng “CZ” Zhao. Although an eventual shutdown of Binance’s US operations may have little direct impact, negative market sentiment is expected despite the crypto community uniting in supporting Binance and CZ.

Adding to the uncertainty is DCG, whose subsidiary Genesis Capital filed for Chapter 11 bankruptcy on January 19. The recent personal withdrawal of $1 billion from CEO Barry Silbert’s holdings, coupled with cryptocurrency hedge fund Three Arrows Capital’s default, has raised further questions surrounding the intercompany deals and loans within DCG.

The news of Binance’s legal battle and DCG’s troubles prompted a sell-off, but rumours of forthcoming SEC action against Binance had been circulating for some time. While traders do not anticipate a repeat of the mass liquidations seen in 2022, they do wonder if Bitcoin will test the $25,000 resistance level, which hasn’t been seen since March 17. With the US debt ceiling crisis averted, a surprise Bitcoin price rally in the short term seems unlikely.

Traders should keep an eye on Bitcoin futures contracts and options markets to understand market sentiment and gauge whether the recent correction has made investors more optimistic. When anticipating a Bitcoin price drop, traders should look for a rise in the skew metric above 7%, while phases of excitement tend to have a negative 7% skew.

Bitcoin Price Chart

Other cryptocurrencies, such as Ether, BNB, SOL, ADA, MATIC, DOGE, and Litecoin, have also experienced significant declines in market value following the SEC suit. Although Bitcoin’s support level is held, investors remain cautious and uncertain about the future of cryptocurrency.

Binance Response Statement

“We are disappointed that the U.S. Securities and Exchange Commission chose to file a complaint today against Binance seeking, among other remedies, purported emergency relief. From the start, we have actively cooperated with the SEC’s investigations and have worked hard to answer their questions and address their concerns. Most recently, we have engaged in extensive good-faith discussions to reach a negotiated settlement to resolve their investigations. But despite our efforts, with its complaint today the SEC abandoned that process and instead chose to act unilaterally and litigate. We are disheartened by that choice.” Continues.

Author Profile

- Lucy Walker covers finance, health and beauty since 2014. She has been writing for various online publications.

Latest entries

- April 25, 2025Global EconomicsWhistleblowers Unmask Schwab’s Toxic WEF Secrets

- April 9, 2025Global EconomicsTariff Tensions Drive Market Volatility

- March 18, 2025Global EconomicsRed in Name Only: Labour’s War on the UK Working Class

- March 7, 2025SatoshiCraig Wright Banned from UK Courts with Civil Restraint Order