As the Bitcoin network inches closer to its next halving event, anticipated in approximately 33 days, the cryptocurrency’s price has surged to $68,782.99, showcasing remarkable resilience and a bullish trend in the face of a dynamic financial landscape.

The most recent block, 835,179, indicates a healthy transaction count of 2,380, reflecting Bitcoin’s robust network activity. Notably, the average transaction fee has maintained at 6,704 Satoshis per transaction, with the average fee rate being relatively low at 15 Satoshis per byte, making Bitcoin transactions both secure and affordable for users.

Mining pools like Braiins Pool and Foundry USA continue to dominate block discovery, hinting at a well-distributed network hashing power. Speaking of hashing power, the network’s total hash rate has been on a steady climb over the past year, now standing at around 639 EH/s. This growth indicates increasing security and competition among miners, as well as the network’s enhanced computational prowess.

However, the ‘Fees vs. Reward’ chart showcases that a significant majority of the miners’ revenue—96.7%—is still predominantly from the block subsidy, rather than transaction fees. This could change post-halving, as the block reward halves and transaction fees become a more significant portion of miners’ revenue.

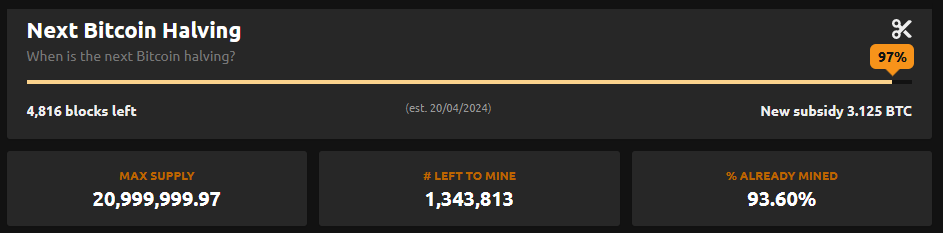

The imminent halving is poised to slash the current subsidy of 625 Satoshis per block by half, a deflationary mechanism built into Bitcoin’s protocol to control inflation and mimic the scarcity-induced value retention similar to precious metals like gold. Historically, such events have led to price rallies, although past performance is not indicative of future results.

Investors and enthusiasts are keenly watching the market, as previous halving events have been pivotal moments for Bitcoin, often marking the beginning of substantial bullish runs. With the halving on the horizon, the market is abuzz with speculation: Will the price continue to soar, or will it correct in response to the reduced pace at which new Bitcoins are minted?

The coming weeks will be critical for the cryptocurrency market. As always, participants are advised to do their research and consider their investment horizon and risk appetite before participating in the market.

The integrity and the security of the Bitcoin network are often measured by its difficulty adjustments— a self-governing mechanism designed to maintain block discovery times close to ten minutes. As the latest data from the Bitcoin blockchain indicates, we are approaching a difficulty adjustment, projected at a decrease of 2.573%, suggesting the network is responding to recent fluctuations in mining power.

The intricacy of mining, however, does not deter the estimated 19.66 million BTC already in circulation, inching ever closer to the hard cap of 21 million. This finite supply underscores the scarcity that makes Bitcoin akin to digital gold, with 93.60% of the total possible BTC already mined. The countdown to the next halving event, projected to occur in about 4,817 blocks, also emphasizes the deflationary nature of this pioneering cryptocurrency. This event will see the block reward subsidy cut down to 3.125 BTC, further limiting the new supply and potentially impacting the miners’ economics significantly.

In the global markets, Bitcoin continues to command an impressive stance against various fiat currencies. With valuations ranging from 58,367,019 Argentine Pesos to 68,614 US Dollars, the price of Bitcoin mirrors the diverse economic landscapes and inflationary pressures within different countries, asserting its place as a borderless and decentralized currency.

This moment offers an opportunity to reflect on Bitcoin’s founding principles as outlined by its pseudonymous creator, Satoshi Nakamoto. Bitcoin was engineered as a peer-to-peer electronic cash system, enabling transactions without the need for a centralized authority. This vision for a simplified payment verification process remains a core feature that contributes to Bitcoin’s resilience and appeal.

With each difficulty adjustment and halving, Bitcoin reinforces its protocol’s innovation and continues to shape discussions around monetary policy, economic freedom, and the future of finance. As the network adjusts, so does the global community’s perception of value, trust, and autonomy in the digital age.

Author Profile

- Lucy Walker covers finance, health and beauty since 2014. She has been writing for various online publications.

Latest entries

- April 25, 2025Global EconomicsWhistleblowers Unmask Schwab’s Toxic WEF Secrets

- April 9, 2025Global EconomicsTariff Tensions Drive Market Volatility

- March 18, 2025Global EconomicsRed in Name Only: Labour’s War on the UK Working Class

- March 7, 2025SatoshiCraig Wright Banned from UK Courts with Civil Restraint Order