After a long and protracted legal battle to disprove that Craig Wright is the creator of Bitcoin, new alleged “revelations” are coming to light, this time on USA cable TV. An HBO documentary about to air has claimed to change the course of markets with it’s revelation of the true Satoshi.

In stark contrast to Craig Wright, Peter Todd has already issued an internet denial on the findings of the latest HBO documentary about the hunt for the real creator of Bitcoin, Satoshi Nakamoto. HBO and documentary creator Cullen Holback have sensationally advertised this event as earth-shattering and that is it going to change the course of the financial markets, but if the reaction of Twitter is anything to go by, that is not going to happen.

If Peter is already publicly refusing this attribution it is either because he is not Satoshi or does not want to be. In any case, many are anticipating the release of the documentary, for entertainment reasons only.

HBO is expected to base the documentary on the following points:

- A 2001 post by Peter Todd in a thread with Hal Finney and Adam Back where he describes Bitcoin without the Hashcash POW, where he mentions the double spending problem as the missing piece of the puzzle. Twitter commentators have placed Todd being 15 years old when he made that comment.

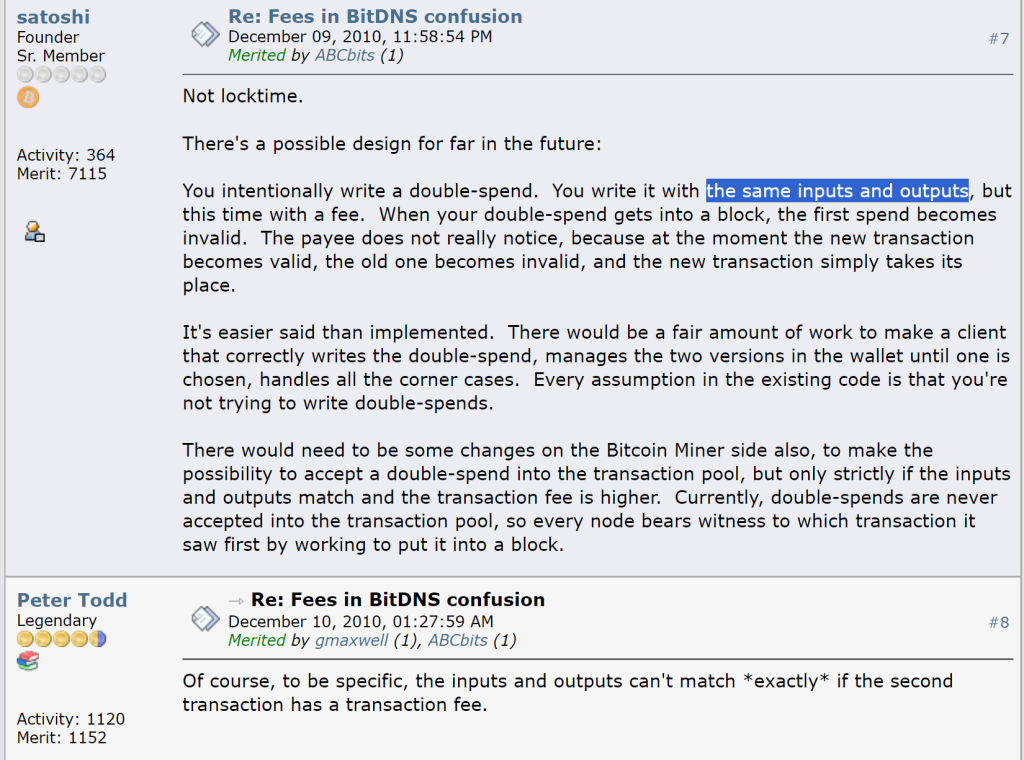

- A post from 2010 titled “Fees in BitDNS confusion”, that the documentary creator believes to be proof that Satoshi accidentally posted as Peter Todd on the Bitcointalk forum.

- That Peter Todd is also John Dillon, an alleged spy who was “invented”, according to this theory, so Peter Todd can introduce the replace-by-fee concept which he allegedly conceived years earlier.

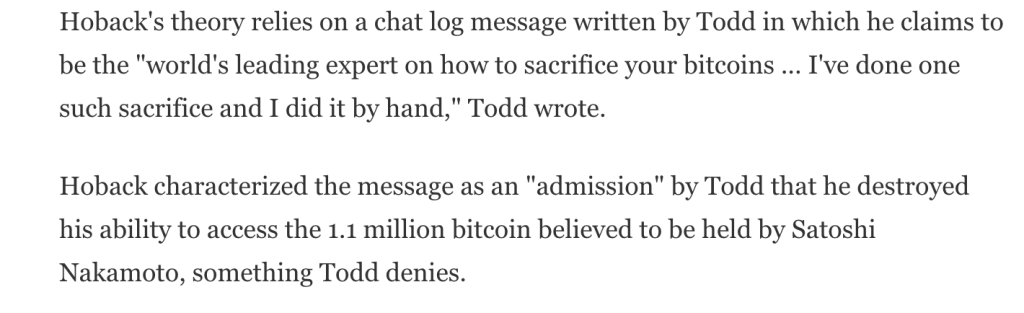

- An alleged “admission” by Peter Todd that he destroyed coins, which HBO believes to be the 1.1 million coins that are known to be under Satoshi’s control from the early days of Bitcoin mining.

The Replace-by-Fee (RBF) feature in Bitcoin sparked controversy mainly because it touches on a delicate balance in Bitcoin’s design: ensuring secure, reliable transactions while giving users flexibility in transaction fees. The controversy largely centers around concerns of double-spending and trust. However it is also worth noting that this solution was one of the last things the real Satoshi was working on before his abrupt departure from the scene.

1. Double-Spending Fears

The biggest criticism of RBF is its potential to facilitate double-spending attacks. In Bitcoin, a double-spend happens when someone spends the same set of bitcoins twice by broadcasting two conflicting transactions.

- Without RBF: Once a transaction is broadcasted to the network, it’s assumed to be final, even if it’s unconfirmed. Merchants and service providers often accept “zero-confirmation” transactions (i.e., transactions that haven’t yet been confirmed in a block) because they assume the transaction is unlikely to be replaced or reversed.

- With RBF: A user could send a zero-confirmation transaction with a low fee to pay for something (say, buying a cup of coffee), and while the merchant is accepting the transaction, the user could quickly issue a replacement transaction with a higher fee, but with different outputs (like sending the funds back to themselves). This creates the potential for fraud against merchants who rely on zero-confirmation transactions.

This concern leads to a trade-off: Bitcoin users gain flexibility with RBF, but at the potential cost of eroding trust in zero-confirmation transactions.

2. Impact on Zero-Confirmation Transactions

Many businesses and users were using zero-confirmation transactions as a way to speed up commerce, especially for small or low-value purchases. These transactions are broadcasted and generally accepted by merchants before they’re included in a block, assuming they’ll be confirmed shortly.

- Pre-RBF: Zero-confirmation transactions were somewhat safe because users couldn’t easily replace them.

- Post-RBF: RBF introduces the possibility that even an unconfirmed transaction can be replaced, which undermines the trust merchants had in zero-confirmation transactions.

As a result, businesses that relied on fast transaction approvals had to reconsider their strategies or wait for at least one confirmation to feel secure in a transaction. This adds latency to transactions, which hurts user experience, particularly in retail and online services.

3. Philosophical Divide in the Bitcoin Community

The debate also highlighted a broader philosophical divide in the Bitcoin community:

- Supporters of RBF argue that users need flexibility, especially in congested network conditions, to adjust their fees and ensure timely confirmations. This feature provides an important mechanism for dealing with Bitcoin’s sometimes unpredictable fee market.

- Critics argue that Bitcoin was designed as “digital cash”, and a core aspect of cash is instant finality. They believe RBF undermines the trust that comes with zero-confirmation transactions, which some considered an essential feature for Bitcoin’s utility in day-to-day transactions.

4. Economic Incentives

Proponents of RBF argue that in the long term, miners are economically incentivized to prefer transactions with higher fees. In other words, the RBF mechanism reflects a more honest market for transaction fees. However, this shifts some of the risks to users and merchants, creating a more competitive fee environment where everyone must pay more for faster confirmation, potentially leading to higher transaction costs.

Reactions

Many have condemned the effort to find the creator of Bitcoin, they claim that if he is dead it does not matter and if he is alive we should all respect his privacy, if he does not want to be found. But human nature does not work like that unfortunately. Some saw the Craig Wright case as a test to “out” Satoshi. They speculated that the real Satoshi had to come forward, if someone was fraudulently claiming to be him. And even succeeding at that, which of course never happened. But now, we have a new challenge.

Critics of the HBO move say it is completely speculative and without foundation. Largely because many of the points raised are highly circumstantial and can be interpreted in multiple ways.

Whether Holback’s theory is true or false it has so far been categorically denied by Peter Todd, who refuses to accept being named Satoshi in a leaked video of the documentary a few hours before the show was about to air. This was followed by a Coindesk and then Forbes article which both name Peter Todd as the person identified in the HBO documentary. HBO claims that the creator of Bitcoin is still alive and they are convinced that it is who they say it is.

One thing is certain, the saga for the hunt of Bitcoin’s true creator is not going to end any time soon.

Author Profile

- Lucy Walker covers finance, health and beauty since 2014. She has been writing for various online publications.

Latest entries

- June 30, 2025NewsWireBank Savings at Risk: The Dark Side of EU’s Savings Standard

- April 25, 2025Global EconomicsWhistleblowers Unmask Schwab’s Toxic WEF Secrets

- April 9, 2025Global EconomicsTariff Tensions Drive Market Volatility

- March 18, 2025Global EconomicsRed in Name Only: Labour’s War on the UK Working Class