A Trying Time for Kyber Network

Kyber Network, a decentralized exchange platform known for its on-chain liquidity protocol, has recently experienced one of the most significant challenges since its inception in 2017. On November 22, at precisely 10:54 PM UTC, KyberSwap Elastic smart contracts were the target of a sophisticated exploit. The attackers performed a series of complex on-chain actions to manipulate the smart contracts, resulting in the unauthorized withdrawal of approximately $54.7 million from user funds.

The Exploit in Detail

The attack on KyberSwap Elastic smart contracts stands out due to its complexity. Doug Colkitt noted that it required the attackers to execute a precise sequence of on-chain actions to take advantage of the system’s vulnerabilities. This level of sophistication underscores the advanced and ever-evolving threats faced by DeFi platforms.

Kyber’s Immediate Response

In the wake of the attack, Kyber Network took swift and decisive action:

- Pausing Deposits: The team immediately halted deposits to prevent further unauthorized withdrawals.

- Launching an Investigation: A thorough investigation was launched to understand the scope and mechanism of the attack.

- Contacting Relevant Parties: Kyber Network reached out to parties that could assist in the investigation and recovery process.

- Negotiating with Attackers: The team initiated negotiations with the attackers, offering a 10% bounty as an incentive to return the exploited funds to users.

Kyber Network’s team is passionately committed to helping users recover their lost funds. Recognizing the gravity of the situation, they are employing relentless efforts to negotiate and navigate the complex landscape of DeFi hacks to ensure the best possible outcome for affected users.

Proactive Security Measures

Before this incident, Kyber Network had implemented a robust security infrastructure:

- Previous Security Measures: Following a vulnerability discovery by whitehat hackers at 100proof.org in April, Kyber Network redeployed KyberSwap Elastic in May with enhanced security measures.

- Comprehensive Audits: The platform underwent audits by reputable security firms, including 100proof, ChainSecurity, and community developers through Sherlock’s audit competition.

- Bug Bounty Program: Kyber encouraged ongoing vigilance through a Bug Bounty Program with Immunefi, inviting experts to identify potential security gaps.

The Current State of KyberSwap

Despite the setback, KyberSwap’s Aggregator API continues to function efficiently, providing partners with optimized swap rates. The main website, kyberswap.com, remains operational for trading activities and insights. Only the KyberSwap Elastic liquidity pools and farms are currently affected.

The Kyber Network team expressed their gratitude for the overwhelming support from the community and offers of assistance. They also thanked users and partners for their continued belief in the platform’s mission and products.

KNC Tokenomics

Analyzing the provided metrics for Kyber Network Crystal (KNC), a variety of insights can be gleaned regarding its current market position and potential future trajectory.

Market Capitalization and Fully Diluted Market Cap

- Market Cap ($111,559,372): The current market capitalization places KNC in a moderate position within the cryptocurrency market. This figure represents the total market value of all circulating KNC tokens and is a crucial indicator of the coin’s overall market strength and investor perception.

- Fully Diluted Market Cap ($184,311,212): This higher figure represents the market cap if all KNC tokens were in circulation (considering the max supply of 252,301,550 KNC). It provides a broader perspective on KNC’s potential market value, suggesting room for growth as more tokens enter circulation.

Trading Volume

- 24-hour Trading Volume ($20,503,063): This high trading volume relative to the market cap indicates a strong investor interest and active trading. It suggests that KNC is currently experiencing substantial liquidity, which is beneficial for traders and investors looking to enter or exit positions without significantly affecting the price.

Supply Dynamics

- Circulating Supply (152,728,989 KNC): This is the number of KNC tokens currently available to the public and trading on the market.

- Max Supply (252,301,550 KNC): The maximum number of KNC tokens that will ever exist. The difference between the circulating and max supply indicates that there is still a significant number of tokens (about 40%) that are not yet in circulation, which can impact the price if released to the market.

Price Analysis

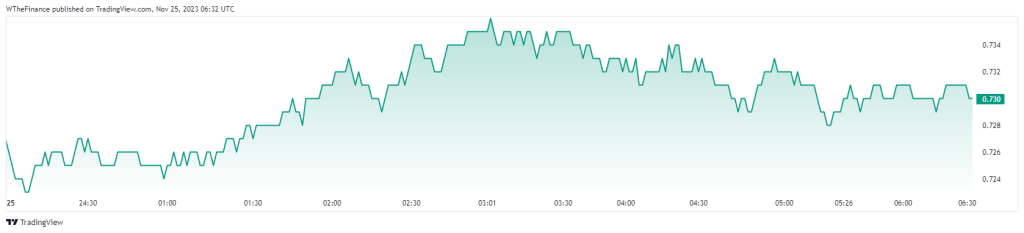

- Current Price ($0.7296): The current price is relatively modest, especially when compared to its historical performance.

- All-Time High ($5.72) & All-Time Low ($0.4455): The all-time high and low provide a range of the token’s historical price performance. The significant difference between these two figures suggests that KNC has experienced substantial volatility in its lifetime. The current price is closer to its all-time low than its high, potentially indicating a buying opportunity if investors believe the token’s value will rise again.

KNC USDT Price Chart

The analysis of KNC’s market metrics shows a cryptocurrency with a solid market cap and a very active trading volume, suggesting strong current investor interest. However, the fact that the current price is significantly lower than the all-time high indicates that KNC has not been immune to market fluctuations and volatility.

The large proportion of the max supply not yet in circulation is also a factor to consider, as it could affect the price when these tokens are released. Investors interested in KNC should monitor market trends, news around Kyber Network developments, and the release of additional tokens to make informed investment decisions.

Moving Forward

Kyber Network has promised to maintain transparency and provide regular updates as the situation evolves. This incident has not deterred their commitment to security and their mission to provide a secure and efficient DeFi environment. The Kyber team’s dedication to resolving the crisis and safeguarding their users’ interests reflects their resolve to emerge stronger and more resilient in the face of adversity.

Author Profile

- Lucy Walker covers finance, health and beauty since 2014. She has been writing for various online publications.

Latest entries

- June 30, 2025NewsWireBank Savings at Risk: The Dark Side of EU’s Savings Standard

- April 25, 2025Global EconomicsWhistleblowers Unmask Schwab’s Toxic WEF Secrets

- April 9, 2025Global EconomicsTariff Tensions Drive Market Volatility

- March 18, 2025Global EconomicsRed in Name Only: Labour’s War on the UK Working Class