When it comes to economic theories, the Austrian school has long stood out for its unwavering belief in the inherent principles governing economic life and monetary systems. Proponents such as Saifedean Ammous have been vocal in their assertion that they offer a window into the universal, immutable truths of economics, free from the biases of philosophical dogma and social constructs.

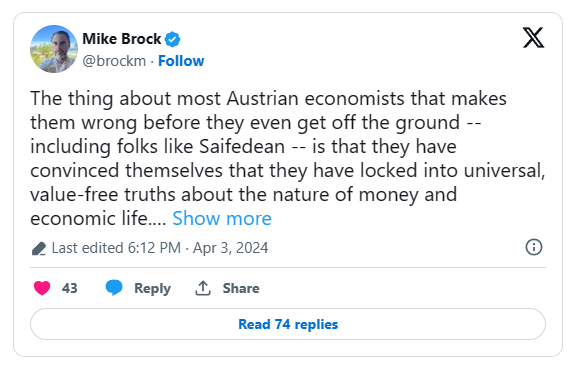

However, critics like Mike Brock challenge this view, arguing that the foundation of Austrian economics is not as objective as it claims to be, but deeply entrenched in a quagmire of ethical considerations and subjective judgments.

The Illusion of Objectivity

The central tenet of Austrian economics: that there exist universal, value-neutral principles underpinning economic reality, faces scrutiny for oversimplifying the complex, multifaceted nature of money and economic interactions. According to critics, the claim of objectivity overlooks the inevitable influence of philosophical assumptions, value commitments, and the contexts within which these ideas emerge and evolve. This oversight, they argue, undermines the validity of Austrian economics right from its inception, as it fails to account for the inherent subjectivity of economic phenomena.

The Ethical Dimension of Economic Assertions

One of the more contested assertions within Austrian economics is the idea that “good money is money that retains values across time and space.” At face value, this statement appears to be a straightforward assessment of monetary stability. However, upon closer examination, it reveals itself to be rooted in ethical judgments. The classification of anything as “good” inherently involves a value judgment, making it impossible to divorce the statement from the realm of ethics.

The determination of what constitutes “good” is inherently subjective, contingent upon individual values and societal norms. Thus, the assertion about good money veers away from an objective description of economic reality and ventures into ethical prescription.

The Praxeological Approach & Limitations

Austrian economists like Hans-Hermann Hoppe have attempted to bridge the gap between normative and descriptive statements through the lens of praxeology, aiming to provide a metaphysical grounding for their claims. Despite these efforts, critics assert that such approaches fall short of their objectives, veering into the territory of virtue ethics without successfully eliminating the subjective underpinnings of their arguments.

This, they argue, is indicative of a broader tendency within Austrian economics to disregard empirical insights in favor of theoretical purity, thereby neglecting the complex interplay between ethical values and economic realities.

Austrian Economics and Bitcoin

Austrian economics, known for its rigorous defense of free markets and skepticism towards government intervention in monetary policy, aligns closely with the fundamental principles of Bitcoin. The cryptocurrency’s decentralized nature and fixed supply cap echo the Austrian school’s emphasis on sound money as a hedge against inflation and government mismanagement. Proponents of Austrian economics, such as Saifedean Ammous, author of “The Bitcoin Standard,” argue that Bitcoin embodies many of the school’s key tenets.

Ammous and like-minded economists posit that Bitcoin’s mathematical scarcity and decentralized issuance make it an exemplary form of money that can potentially restore financial sovereignty to individuals, reducing reliance on centralized financial systems and fiat currencies.

The relationship between Austrian economics and Bitcoin extends beyond theoretical alignments; it influences practical discussions about the future of finance. Bitcoin’s architecture, which limits interference and promotes a predictable monetary policy, offers a practical application of Austrian theories about the dangers of monetary expansion and centralized control.

This perspective has fueled a growing dialogue within the Austrian economics community about the potential for cryptocurrencies to replace traditional banking systems, echoing earlier Austrian economists critiques of central banking systems like the Federal Reserve. As Bitcoin continues to gain mainstream acceptance, its principles and mechanics increasingly serve as a real-world test of Austrian economic theories in action.

Reconciling Economic Thought

The critique leveled against Austrian economics calls for a reassessment of the relationship between ethical values and objective economic analysis. By acknowledging the role of ethical judgments in shaping economic theories, economists can foster a more holistic understanding of monetary phenomena. This does not necessarily diminish the contributions of Austrian economics but highlights the need for greater reflexivity in its claims of objectivity.

In recognizing the inherent subjectivity of economic life, economists can navigate the intricate landscape of monetary theory with a more nuanced and comprehensive approach.

Author Profile

- Lucy Walker covers finance, health and beauty since 2014. She has been writing for various online publications.

Latest entries

- June 30, 2025NewsWireBank Savings at Risk: The Dark Side of EU’s Savings Standard

- April 25, 2025Global EconomicsWhistleblowers Unmask Schwab’s Toxic WEF Secrets

- April 9, 2025Global EconomicsTariff Tensions Drive Market Volatility

- March 18, 2025Global EconomicsRed in Name Only: Labour’s War on the UK Working Class