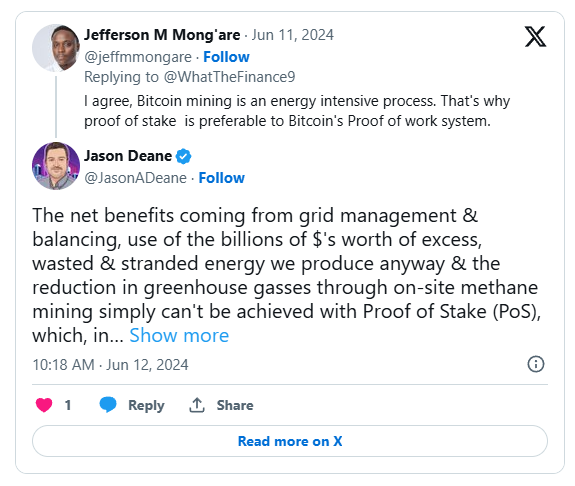

In the ongoing debate between Proof of Work (PoW) and Proof of Stake (PoS) for securing blockchain networks, England-based Jason Deane, co-CEO of Renewablox, presents a compelling argument for the superiority of PoW. His perspective emphasizes the multifaceted advantages of PoW, from effective energy utilization to unmatched network security, underscoring why PoW remains crucial for a resilient and sustainable global monetary system.

Efficient Energy Utilization

One of the most significant benefits of PoW highlighted by Deane is its ability to manage and balance power grids by utilizing excess, wasted, and stranded energy. Every year, billions of dollars’ worth of energy is produced but not consumed, leading to inefficiencies and environmental waste. PoW mining operations can harness this otherwise lost energy, effectively converting it into a productive use.

This capability is particularly crucial in the context of renewable energy sources, which often produce surplus energy that cannot be stored or used immediately. PoW mining can absorb this surplus, providing a consistent demand that stabilizes the energy grid. This integration not only improves energy efficiency but also supports the broader adoption of renewable energy by making it more economically viable.

Environmental Impact through Methane Mining

Beyond just utilizing excess energy, PoW mining operations can significantly reduce greenhouse gas emissions through on-site methane mining. Methane is a potent greenhouse gas, and capturing it to generate energy can mitigate its environmental impact. By using methane in PoW mining, these operations can transform a harmful pollutant into a valuable resource, contributing to overall reductions in greenhouse gas emissions.

Security and Decentralization

Deane’s argument extends beyond environmental and energy efficiency benefits, emphasizing the unparalleled security offered by PoW. The security of a cryptocurrency network like Bitcoin is fundamentally tied to its consensus mechanism. PoW relies on the principles of thermodynamics, where the proof of work is derived from the conversion of energy into computational power. This process is inherently secure because it requires a significant investment of resources, making it difficult and costly to manipulate the network.

In contrast, PoS systems allocate control based on the amount of cryptocurrency staked, which can lead to centralization. Those with the most substantial financial resources can exert disproportionate influence over the network, mirroring the power structures seen in traditional fiat systems. This centralization undermines the core principles of decentralization and security that cryptocurrencies aim to uphold.

PoW and Hard Money Systems

Deane argues that PoW is essential for securing a “hard money” system, one that is resilient and incorruptible. The reliance on energy conversion in PoW aligns with the laws of thermodynamics, ensuring that the network remains robust against attacks. In PoS systems, where influence can be bought, the risk of compromise is significantly higher. PoW’s energy-intensive nature makes it a more secure foundation for a global monetary system, preventing the centralization of power and ensuring the integrity of the network.

Future of PoW and Environmental Benefits

Contrary to the mainstream narrative that often criticizes PoW for its energy consumption, Deane points out that PoW is rapidly evolving towards a net positive impact on energy use and emissions. Innovations in energy efficiency and the integration of renewable energy sources are transforming PoW into a more sustainable option. As technology advances, Bitcoin mining operations are likely to become even more efficient, harnessing waste energy and reducing overall environmental impact.

Human Ingenuity and Technological Progress

Deane’s optimistic view highlights the role of human ingenuity in addressing the challenges associated with PoW. The rapid advancements in PoW technology demonstrate the potential for significant environmental benefits, challenging the perception that PoW is inherently wasteful. Instead, PoW represents a dynamic and evolving solution that leverages human creativity and technological progress to create a more sustainable and secure financial system.

Jason Deane’s perspective on PoW underscores its critical role in the future of Bitcoin. By effectively utilizing excess energy, reducing greenhouse gas emissions, and providing unparalleled security, PoW offers benefits that PoS cannot match. As PoW technology continues to evolve, it promises to deliver even greater environmental and economic advantages, reinforcing its position as the foundation of a resilient and sustainable global monetary system.

Author Profile

- Lucy Walker covers finance, health and beauty since 2014. She has been writing for various online publications.

Latest entries

- June 30, 2025NewsWireBank Savings at Risk: The Dark Side of EU’s Savings Standard

- April 25, 2025Global EconomicsWhistleblowers Unmask Schwab’s Toxic WEF Secrets

- April 9, 2025Global EconomicsTariff Tensions Drive Market Volatility

- March 18, 2025Global EconomicsRed in Name Only: Labour’s War on the UK Working Class