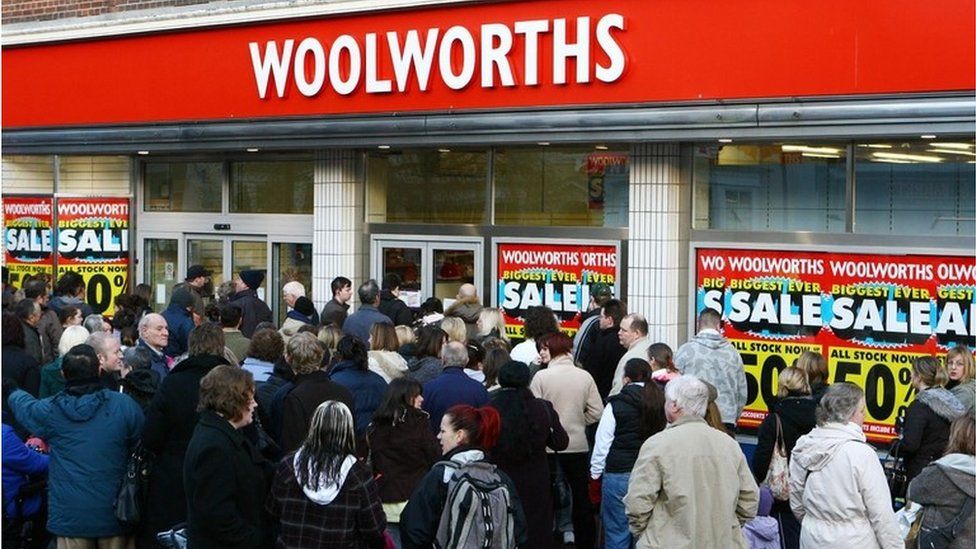

Woolworth’s was about to celebrate its 100th birthday this year, but instead of appointing party organizers to celebrate its century long history of success it had to appoint administrators after a vain last minute attempt to sell stores to raise cash.

Woolworth’s has more than 800 stores across the UK and employs around 25,000 people according to a company’s statement.

Woolworth’s is expected to be sold at the nominal price of £1, but if you own it dont think you can sell it as the stock was yesterday suspended for the second time this week. The stock has lost more than 90% of its value since the beginning of the year. It had already fallen by 62 percent in 2007.

Although its true the consumer economy got bad enough, fast enough, Woolworth’s executives should have no excuse. Robert James McDonald, Chief Financial Officer, has made no comments so far and the questions remains if he will do so as analysts find it hard to explain the strategy of doing-nothing-until-there-is-nothing-left-to-do.

Why?

While 25,000 are agonising for their jobs, lets have a look at the facts behind Woolworth’s bankruptcy.

– Credit market freeze. Banks ability to lend has been restricted massively, but more importantly their willing to lend is close to zero. This is basically still the case, despite global government efforts to revive the economies by injecting cash, providing all sorts of guarantees, printing new money, etc.

– Spending drop-off. Consumers squeezed to the penny by rising living costs, are holding tight to their money postponing any cash outflows until they feel safer. Consumer confidence reached record lows in Europe, US, and Asia and so sales have plunged

– Debt. More Debt. Too Much Debt. Of course any economically viable company should be flexible enough to cope with lower levels of demand and be able to finance its way out of an economic downturn. But not a company that is already carrying debt 16 times more than its current worth in the market. Woolworth’s current market capitalization is not even enough to pay the (debt) interest costs which amount to £18.6 million.

The market outlook is pretty gloomy at the moment and will remain such for the rest of 2009 and possibly for the first half of 2010. Companies such as Woolworth’s that have taken on too much debt are inevitably going to find it difficult to refinance themselves. This is not a prediction, but a fact.

Author Profile

- I am a financial services writer with experience in forex trading and stock market analysis.

Latest entries

- August 14, 2013Investment IdeasStockmarket Shares: Tips for Beginners

- August 7, 2013NewsWireNew consumer protection laws target pressure sellers

- July 25, 2013Best DealsPrice rises spell trouble for UK’s crowded housing market

- July 1, 2013NewsWireMoney lenders welcomed into temple as Church of England plans credit union

10 Comments

noprob

April 21, 2010like a neutron star.

bankruptcy in greenville sc

June 6, 2010Have you thought about adding some social bookmarking buttons to these blog posts. At least for google.

The What Girl

June 8, 2010Hi mate, the social bookmarking buttons are on the top right hand corner of the website! So no excuses mate ;) just start bookmarking and sharing whatever you read and you like! Thanks again for reading.

Brenton Hutchings

June 23, 2012Unquestionably believe that which you stated. Your favorite reason seemed to be on the internet the simplest thing to be aware of. I say to you, I certainly get annoyed while people think about worries that they plainly do not know about. You managed to hit the nail upon the top as well as defined out the whole thing without having side effect , people could take a signal. Will probably be back to get more. Thanks

Ben

May 2, 2013My family members always say that I am killing my time here at web, but I know I am getting experience daily by reading thes pleasant posts.

Earnestine

May 13, 2014It's really a nice and useful piece of information. I'm glad that you simply shared this helpful information with us. Please keep us informed like this. Thank you for sharing.

Charley Amerson

July 6, 2014You really make it seem so easy with your presentation but I find this topic to be really something which I think I would never understand. It seems too complicated and very broad for me. I'm looking forward for your next post, I will try to get the hang of it!

Regina

July 18, 2014Hello, I enjoy reading through your article.

Davis

October 7, 2014Highly energetic post, I loved that a lot. Will there be a part 2?

Loren Learmonth

October 7, 2014Pretty nice post. I just stumbled upon your blog and wanted to say that I've truly enjoyed surfing around your blog posts. After all I will be subscribing to your rss feed and I hope you write again very soon!